Institutions Move 14,600 BTC as Miners Start Bitcoin Accumulation

Yesterday, bitcoin miners reported that almost 15K BTC were bought and withdrawn by financial institutions from the Coinbase exchange platform. As of this writing, that amount of bitcoin is worth about $807 million. Also, Glassnode is convinced that bitcoin miners are not selling their crypto again and are also buying in anticipation of a rally.

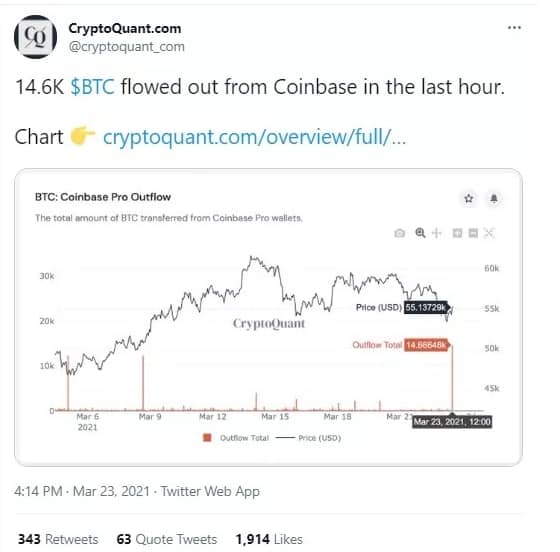

Coinbase moves $807 million worth of BTC

On Monday, BTC declined briefly to hit the $53K zone before rising by about $500 today. That decline has been its most for the past month but by yesterday, it had stabilized to trade around the $55K mark. Before these price movements, crypto enthusiasts observed that the Coinbase exchange moved a significant amount of BTC (almost 15K BTC). CryptoQuant, a crypto analytics company was the first to share the details involved. That’s almost $807 million of the king coin.

Ki-Young Ju, CryptoQuant’s CEO reported that “the outflow was divided into various wallets which might represent their hot wallets, an indication of custodian wallets or internal transfer popularly used by corporate firms.” There has always been a direct integration between Coinbase’s cold wallets and the exchange’s over-the-counter (OTC) desk.

Typically, firms and high-volume traders don’t trade outside over-the-counter desks so as not to have a significant influence on the coin’s market price. Thus, when there are outflows from Coinbase Pro, it is generally assumed that it is the large traders’ code for BTC purchase. Ju further remarked, “I guess that it is a custodian wallet and an indication that corporate investors continue to buy the dip.” In previous times, BTC price pull-backs have always resulted in massive movements from Coinbase Pro. So, is history repeating itself or about to repeat itself?

Recall that there have been previous withdrawals of massive BTC amounts using this exchange. That was when traditional firms bought BTC during its slight decline on February 27 and March 5. On each of these days, BTC was trading below $50K.

CryptoQuant Tweet. Source: Twitter

Miners Hoarding BTC: Are We About to Have A BTC Rally?

Analysis by Glassnode shared by Moskovski capital’s CEO showed that miners (whose official name is cryptocurrency verifiers) no longer sell BTC and have even started buying it. Lex is convinced that the miners are doing this in anticipation of an imminent BTC rally. As of this writing, the leading crypto asset is trading at about $55K after recovering from a decline of about $53K earlier in the day.

But BTC is yet to reach the $60K price range or rise above it. It would be recalled that about 11 days ago, bitcoin attained a new peak price of $61.8K precisely one year after ‘black Thursday – a day when plunged below $4K level within a day after losing more than 50 percent of its value during that period. Even though the global pandemic affected the oil and stock markets, the latter was hit the most. Oil only went negative for short period. It remains to be seen what the actions of the miners would mean on the king coin’s price.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.