Liquid Review

The cryptocurrency market is crammed with vast opportunities and many investors, just like yourself, look to choose a credible and legitimate exchange platform like the Liquid cryptocurrency exchange to help guide and assist them in making the best use of the available opportunities. We are writing this Liquid cryptocurrency exchange review to provide a reliable and honest insight into the entire workings and operations of the exchange platform.

One of the things intending investors have to understand is that succeeding in the crypto market isn’t solely dependent on the financial knowledge acquired but is also dependent on the exchange platform employed. Hence, taking the risk of signing up or registering with a mediocre exchange platform that lacks the proper features and technology to offer decent trading services, will only get investors in trouble.

Aside from mediocre exchange, the crypto market is also filled with fraudulent and scam exchanges whose goal is to prey on novice and unsuspecting investors ripping them off their investments. This is why investors need to be very careful and choose decent exchanges like the Liquid cryptocurrency exchange who are well recognized for providing top-quality features and benefits.

The Liquid cryptocurrency exchange platform is well recognized among investors for its decent and incredible services and features it offers its clients across the world. However, to assure new investors who are just kick-starting their trading career in the crypto market about the legitimacy of the Liquid cryptocurrency exchange, we’ll be discussing expressly its features, benefits, and services that make it one of the decent exchanges in the market.

| Exchange Platform | Liquid |

| Website | https://www.liquid.com/ |

| Language | Japanese and English |

| Support | Live Chat, FAQ section, Email |

| Trading Fee | 0.30% |

| Withdrawal Fee | 0.0007 BTC |

| Security | Two-factor authentication (2FA), Know Your Customer, Cold Wallets, and lots more |

| Trading Platform | Web-based and Mobile app |

| Payment Method | Wire transfer, Credit and Debit Card, and Cryptocurrency transfer |

| Trading assets | Bitcoin, Monacoin, Ethereum, Litecoin, and lots more |

The Liquid cryptocurrency exchange is a crypto digital marketplace where investors and traders buy, sell, store and trade a wide variety of crypto/crypto and fiat/cryptocurrency pairs. The Liquid exchange platform is owned and managed by its parent company Quione which has its headquarters based in Tokyo, Japan.

Quoine was established in 2014 under the authority and legislation of the Japanese Financial Services Agency. Immediately after its establishment, Quoine launched the Quoinex exchange platform which specializes in fiat-to-crypto trading. In the year 2017, Quoine further established the Qryptos exchange platform which specializes in crypto-to-crypto trading.

By the year 2018, both the Quoinex and Qryptos exchange platforms have recorded a total of $50 billion in transactions. In September 2018, Quoine decided to merge both the Quoinex and Qryptos exchange platforms birthing the Liquid cryptocurrency exchange that we have today.

The Liquid exchange platform is recognized for developing its specialized order book known as World Book which incorporates a decent price matching and a universal network of various sources of liquidity to give its clients access to an elevated degree of liquidity

The exchange platform also provides Liquid Margin, which allows investors and traders to trade with a maximum leverage of X25. The Liquid exchange platform also established its utility token called Liquid Coin (LQC). The Liquid token can be used to make payments for various services and fees on the Liquid exchange platform.

To fully understand why the Liquid exchange platform is acknowledged as one of the leading crypto exchanges in the cryptocurrency market, let’s have a closer look at the primary features and services it offers.

Security Procedure

Security of funds and sensitive personal data has become a primary concern for most investors in the crypto market because cyberattacks and fraudulent activities have become a widespread menace.

As a result of this, traders (both experienced and newbies) duly consider the security measures and protocols put in place by exchange platforms. This is done by investors, to ascertain the safety of their funds and personal data.

As regards the Liquid exchange platform, the security of clients’ personal sensitive information and funds is of topmost priority. The security protocols and measures put in place are adequate enough to stave off various cyberattacks and third parties access to their database.

The liquid is a registered and licensed exchange platform under the authority of the Japanese Financial Services Agency complies with the Anti-Money Laundering (AML) and Know Your Customer (KYC) policies to curb various criminal activities such as identity theft, terrorist funding, money laundering, and so on.

The security measures established by the Liquid exchange platform include;

- KYC verification

Upon registration, all clients are required to submit proof of address, passport photograph, and proof of identification like a driver’s license, an international passport to verify and put a face to each trading account.

- Cold wallet

Liquid stores and safeguard its entire digital assets in an offline cold wallet to ensure proper protection of clients’ investments.

- Compulsory Two-factor authentication (2FA) for every client

- No API withdrawals

- Crypto withdrawal address whitelist

Trading Option

The Liquid exchange platform operates as both a fiat-to-crypto and crypto-to-crypto exchange platform, however, most of its trading activities are recorded to be carried out on its don’t currencies with its JPY and USD dominating the market. Asides from JPY and USD, the exchange platform offers a wide variety of fiat currency trading pairs and including cryptocurrency trading pairs, listing over 100 tokens and coins on its trading platform.

Liquid offers various types of trading to its clients so they can adequately take advantage of the opportunities that present themselves in the crypto market. The trading offered by Liquid include; Margin trading, Spot trading, Futures, and CDs

- Margin trading

Liquid offers its clients the opportunity to make use of the margin trading services to trade various fiat-based trading pairs with a maximum leverage of 25X. However, clients cannot make use of margin trading when trading cryptocurrency pairs. Clients of the Liquid exchange platform are also allowed to lend out their assets to various margin traders for a specified interest rate fee.

- Perpetual Futures

The Liquid exchange platform recently rolled out perpetual futures as one of its latest features. The perpetual futures contract offered by Liquid is aimed at the Bitcoin-USD market and is called the P-BTC.

These perpetual futures contracts work differently from other contracts offered by various exchanges. The major difference between the P-BTC contracts and others is that it is priced at about Bitcoin instead of US Dollar value. For clients looking to trade the P-BTC contracts, they can trade up to maximum leverage of 100X

- Infinity (CFD trading)

The Liquid exchange platform offers an incredible feature known as Infinity trading. Infinity trading allows clients to trade various contracts for difference (CFD) which is quite related to futures trading. This is because investors and traders through infinity trading bet on the price of assets instead of buying them.

On the BTC-JPY and BTC-USD trading pair, the Liquid exchange platform offers a maximum leverage of 100x.

Liquidity

In terms of liquidity, the Liquid exchange platform is one of the top crypto exchanges on the list of top exchange platforms in terms of the daily trading volume. Liquid ranks 22nd on the Coinmarketcap’s list on the 20th of December 2018 having a daily trading volume of $277 million.

Taking a look at the one-month trading volume, the Liquid exchange platform ranks even better holding the 20th position having a trading volume of $4 billion in that same month of December 2018.

On the 23rd of March 2020, at the center of the COVID pandemic, Liquid recorded a daily trading volume of $162 million ranking 67th which is considerably lower compared to that of December 2018. However, looking at the bigger picture, the exchange recorded a trading volume of $5.7 billion for the month of March 2020 which is higher than that of December 2018.

Commission and Fees

It is expected of traders and investors to pay various commissions and fees to exchange platforms on trading activities carried out via the exchange. However, traders should always be wary of exchanges that charge very high fees as it is difficult to make considerable profits when using such exchanges.

For new investors, it is important they understand how the trading fee is structured by crypto exchanges. Generally, every trade executed transpires between two individuals; the taker and maker, and as such the trading fee is grouped into the takers fee and makers fee.

The maker is an individual whose order stands in the order book before trades are executed and the taker is an individual who takes the order that conforms to the maker’s order. The name “maker” was derived because the marker’s order generates the market’s liquidity while Takers remove the market’s liquidity.

- Liquid’s Trading fees

The Liquid exchange platform charges a flat rate for both its takers fee and makers fee. The exchange platform charges a maximum of 0.3% for both takers and makers fees. However, with an increase in monthly trading volume, clients get to enjoy a decrease in both takers and makers’ fees.

For clients whose monthly trading volume is considerably low (less than $10,000 monthly) Liquid waves off their makers fees making it totally free. Furthermore, commissions and fees are halved when clients pay their fees using the Liquid Coin.

- Liquid’s Futures fees

The trading fees charged by Liquid on its perpetual futures are quite different. The exchange platform charges a taker fee of 0.12% and a maker fee of 0.00% on perpetual futures markets. Liquid still went further to drop the makers fee to a negative value for clients trading larger volumes. Clients who pay the perpetual futures trading fees using the Liquid Coin also enjoy a discount on the taker fees.

- Liquid’s Withdrawal and Deposit fees

The Liquid exchange platform offers free deposits of both cryptocurrencies and fiat currencies, however, the typical network fees charged on deposits are expected to be paid by its clients.

For withdrawals, the exchange platform charges a withdrawal fee of 0.10% on every fiat withdrawal, charging a minimum fee of $15.

For crypto withdrawals, the fees are decent, covering all network fees as it pertains to crypto withdrawal. The exchange platform charges a withdrawal fee of 0.0007 BTC for every Bitcoin withdrawal and 0.01ETH for every Ethereum withdrawal.

Trading Platform

One of the vital features traders and investors need to consider before choosing a crypto exchange platform is the trading platform provided. The trading platform is vital because it primarily oversees and governs the overall trading activities performed by traders in the crypto market. As a result, for investors to make sure they enjoy a remarkable trading experience, they must choose an exchange platform that offers a trading platform that is of top-quality.

It is expected that the trading platform offered by one exchange platform to the next differs and these differences are usually in terms of design, user interface, customization, ease of navigation, and lots more. These differences among exchange platforms are a result of exchanges placing more priority on different parameters.

However, regardless of the differences, it is expected of a decent trading platform to be simple, easy to navigate, user-friendly, and incorporated with essential trading tools.

The Liquid exchange platform offers a simple and nice trading interface integrated with the TradingView Charts. The exchange platform ensures that the dashboard is not crowded with figures and display options so that the trading platform is not intimidating to new traders and investors.

Looking at the Web-based trading platform, the trading view consists of sell and buy-boxes, price charts of different cryptocurrency pairs, an order history, and an order book. In general, the trading platform is very effective in trade analysis, user-friendly, and simple to navigate.

The Liquid exchange platform also went further to develop its mobile application known as Liquid Pro. The mobile app offers similar trading services and features to clients while also promoting on-the-go trading. The mobile app can be installed and downloaded on both iOS and Android devices.

Withdrawal and Deposit

The Liquid exchange platform allows its clients to make deposits and withdrawals using both cryptocurrencies and fiat currencies. For the withdrawal and deposit of fiat currencies, clients can make use of wire transfers and credit or debit cards. The fiat currencies accepted by the Liquid exchange platform include;

- Japanese yen (JPY)

- Euros (EUR)

- US dollars (USD)

- Australian dollars (AUD)

- Hong Kong dollars (HKD)

- Singapore dollars (SGD)

- Philippine Peso (PHP)

To make withdrawals and deposit of fiat currencies, clients are expected to link their bank account directly to their Liquid account. It is also important to know that depending on the fiat currency being deposited, the payment processor that oversees and handles the deposit differs.

The deposit of the US dollars (USD), Australian dollars (AUD), Singapore dollars (SGD), and Euros (EUR) is handled by Swapforex. Deposit of the Japanese yen (JPY) is handled by SBI Japan and the deposit of Euro (EUR) for deposits using SEPA is handled by UAB Mistertango.

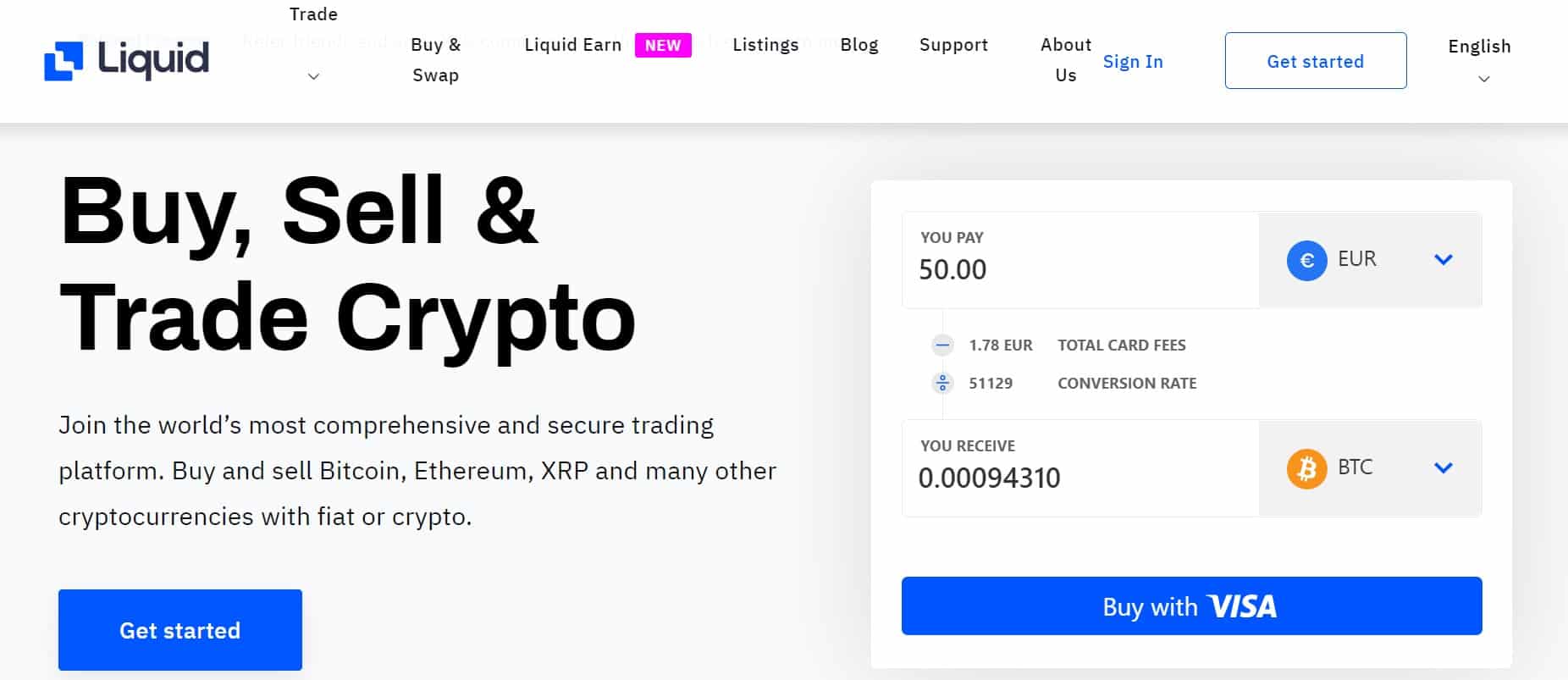

For the deposit and withdrawal of cryptocurrencies, clients can transfer their digital coins from their external wallets into their Liquid trading account and vice versa whenever needed. The Liquid exchange platform just like many exchange platforms also offers its clients the instant but option using the Visa debit or credit cards and this service is made available to its clients across the globe.

However, higher fees do accompany the use of credit and debit cards. A conversion rate and credit card fee applies on every purchase, but this is easily calculated and shown to clients before the purchase is made.

Customer Support

Support is critical feature traders and investors look out for when choosing a crypto exchange platform. Unexpected situations do come up and the demand to contact and reach out to your exchange becomes essential. Failure by an exchange platform to provide the required assistance and support defeats the entire purpose of choosing that exchange platform.

The Liquid exchange platform offers a very simple and straightforward online FAQ section that gives answers to commonly asked questions primarily asked by newbie clients. In case that doesn’t offer the needed assistance, the email support option is also made available.

Clients can send in their requests and complaints via email and get the appropriate reply within a couple of hours. Liquid also makes available a Live Chart Window which allows clients to real-time conversations with a customer representative.

Final Thoughts

The Liquid exchange platform is one of the top-performing and reliable exchange platforms present in the crypto market. The exchange platform is known to be very compliant with the regulations and laws laid down by the Japanese Financial Services Agency and went as far as delisting up to 30 digital coins to remain compliant with the new regulations.

Considering the overall features and services offered by the Liquid exchange platform, it can be said that its offerings are very attractive providing the needed comfort, flexibility, and trust investors need to achieve their financial goals in the crypto market.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.