The entire virtual asset industry need to be thankful for the Covid-19 pandemic. It was during that period that the industry experienced the highest growth to date. Now, it seems payment service providers are also willing to expand their services. Their stance may have been jolted by a combination of factors including a rise in acceptance of virtual currencies by the authorities in most nations and the Covid-19 pandemic.

The Virtual Asset Industry Is Growing, Thanks To Investors

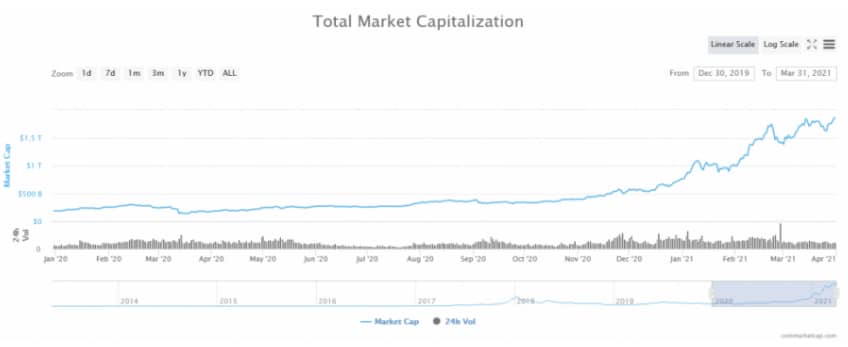

As of this writing, the market capitalization of the global digital asset industry stands at about $1.818 trillion. While that figure shows that it has dropped by about 2.5% in the last few hours, the market cap was about $194 billion before the pandemic. Hence, that represents an almost 90% growth prior to the pandemic to date.

Total market capitalization. Source: coinmarketcap

In the past day, the entire crypto asset market volume has grown to about $135 billion – about a 2.4% growth rate. When this figure is compared to the $77 billion market volume before the pandemic, it represents an almost 44% growth. Also, the Defi growth represents about 9% growth of the entire crypto asset market volume within the last 24 hours.

The market cap for this sub-industry is almost $88 billion which indicates a gain of more than 6.3% in the last few hours. Per data from coinmarketcap, the top five Defi projects based on the market cap are Aave ($5 billion), terra ($7 billion), wrapped bitcoin ($8 billion), chainlink (about $11 billion), and Uniswap (about $14 billion).

Right now, the total volume of all stablecoins is close to $98 billion – a figure that represents 72.3% of the whole digital asset market over the past 24 hours. Using the market cap as the yardstick, the five leading stablecoins would be trueUSD ($335 million), Paxos Standard ($961 million), Binance USD ($4 billion), USD coin ($11 billion), and tether (about $41 billion).

Paypal Launches a New Feature

Paypal has inaugurated a new payment feature which it labeled checkout with crypto service. This move by PayPal is proof of more digital currencies acceptance by the traditional finance industry. Through this service, PayPal clients residing in America can make payments successfully at any global business using their digital wallets. It would be recalled that PayPal’s previous crypto-related service (called buy and sell) for its American account holders led to a bullish run for leading virtual assets.

Mastercard Following the Footsteps Of PayPal

Last month, MasterCard disclosed that before the year runs out, it will start allowing virtual currency transfers on its network. The payment processor giants are also planning to launch another investment project that will help unbanked Americans (mostly the black ecosystem) to be financially inclusive.

Not long ago, visa allowed over 60 million of its customers to hold and make payments through its native coin known as USD coin (USDC). This new information raised the USDC’s trading volume by over 43%.

Also, the firm allowed crypto-supported visa payments for its account holders. Visa even initiated a program for FinTech startups. This program called fast track is beneficial to these startups because it aids their growth, while it is also beneficial to the card payment giants because it helps them expand their FinTech services.

The company has also put in place a research team whose sole aim is to study how the lightning network and blockchain can be combined to develop a platform that makes immediate payments possible. As these leading financial service providers adopt virtual currencies, it increases the interest, and adoption of these digital assets massively.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.