As MATIC’s 150% value flood triggers an exemplary bullish example, Polygon is nearly at a record high.

MATIC request from examiners was driven up by the positive break basics, bringing about the new value rise. A normal bullish arrangement has likewise been enacted by the transition to the potential gain, which may drive MATIC costs to another record high. MATIC, Polygon’s local resource is trying its June opposition level at $1.51 in anticipation of a bullish breakout situation.

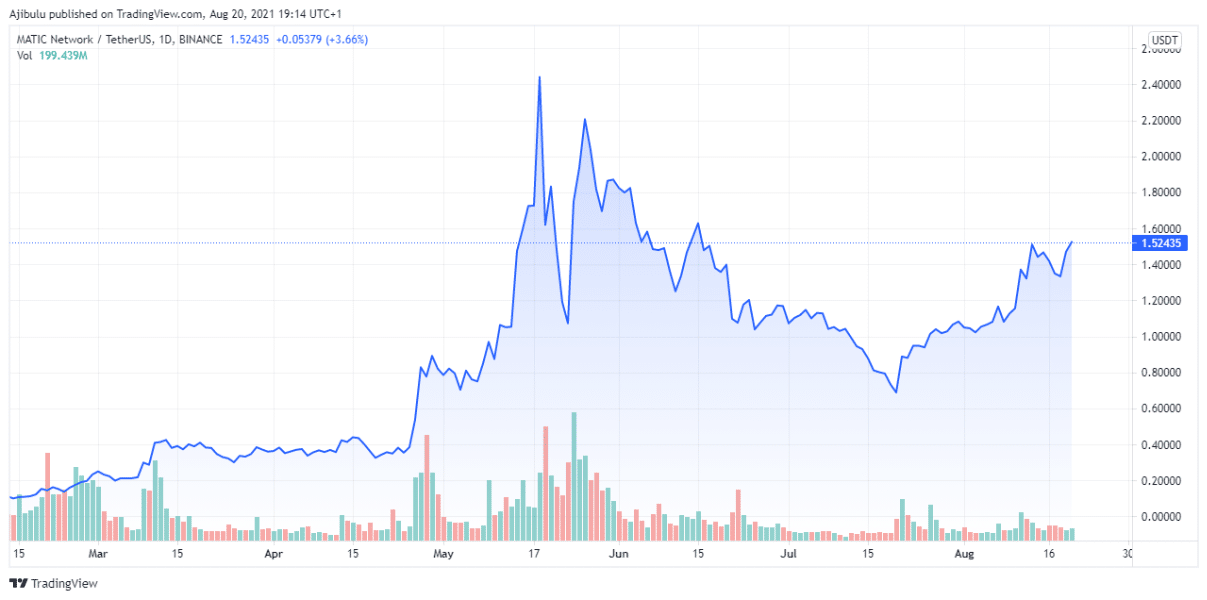

Another worth meeting in the Polygon (MATIC) market pushed its expenses above $1.56 unprecedented for more than two months. Comprehensively, the MATIC/USDT change scale rose 20.65% in just two days to recuperate the June 17 high. Vendors raised their proposals for the pair after Polygon pronounced that it would make a decentralized self-administering affiliation (DAO) for its neighborhood while focusing expressly on the thundering decentralized cash (DeFi) space.

For the DAO, Polygon, which gives layer2 scaling answers for Ethereum applications, put away $100 million. Furthermore, the organization has expressed that it would airdrop extra DAO administration tokens on top of current Polygon clients, which implies that holders of MATIC will get free tokens.

A Breakthrough is on the Horizon

The MATIC/USDT three-day outline shows a reversed head-and-shoulder design when utilizing course reading measures. Unbeknownst to numerous brokers as backwards head and shoulders, this example is utilized to flag a bullshi pattern change when the market hits three continuous lows beneath what is by all accounts opposition. Due to its profundity (head), the center box (shoulders) is by all accounts further than the other two.

MATIC/USDT Chart Source: TradingView.com

On the off chance that a cost goes over the neck area, specialized chartists by and large take a long situation with the most extreme tallness in addition to the breakout level as their definitive benefit objective. Their stop misfortune is generally situated around the depressed spot of the right shoulder, which is a common area.

As of Aug. 20, the Polygon token had risen 150% from its low of $0.62 on June 18 to a cost of $1.51. (head). Since the greatest stature of an altered head and shoulders design is $0.89, the most extreme tallness of the example is $0.79. Along these lines, if an ascent in exchanging volume happens alongside a break more than $1.51, the pair’s odds of expanding by $0.89 will improve. Its backwards head and shoulders benefit objective would be $2.40, which is only $0.30 underneath its present record high.

Negative Game Plan

It is conceivable that Polygon’s costs will fall back to $1.35 in case bulls can’t recover opposition at the 1.51 level as a help level Another drop would uncover MATIC/USDT to $1.09, which has been a strong help level as of late.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.