Meitu Invests $50 Million in BTC And ETH

After investing another $51 million into Bitcoin and ETHer, the Hong-Kong and China-listed company, Meitu’s crypto investment is now about $91 million. Yesterday, the photo and video editor app company bought 16K ETH for almost $29 million and about 387 BTC for roughly $22 million. This new disclosure is an update to its previous crypto-asset purchases thirteen days ago when the Chinese tech giants purchased 15K ETH and 380 BTC for roughly $22.5 million and $18 million respectively.

The firm remarked in their press release statement that cryptocurrency might still be in its infant stage, it is highly likely that the blockchain technology will disrupt the current FinTech structure: “The company executive is convinced that the blockchain market is still young, similar to the mobile internet market sixteen years ago. Based on this perspective, the company is convinced that crypto-assets can still expand more than it is right now.”

The firm also referred to tesla, MicroStrategy and other traditional investors’ accumulation of Bitcoin and the rising adoption of cryptocurrency to pay products and services in the general populace as its viewpoint for buying more of these crypto assets.

Meitu was officially launched in 2008 but became publicly listed on the Chinese and Hong Kong exchange in 2016. One of their tech products is the MeituPic app, it allows users to modify photos and videos to their satisfaction.

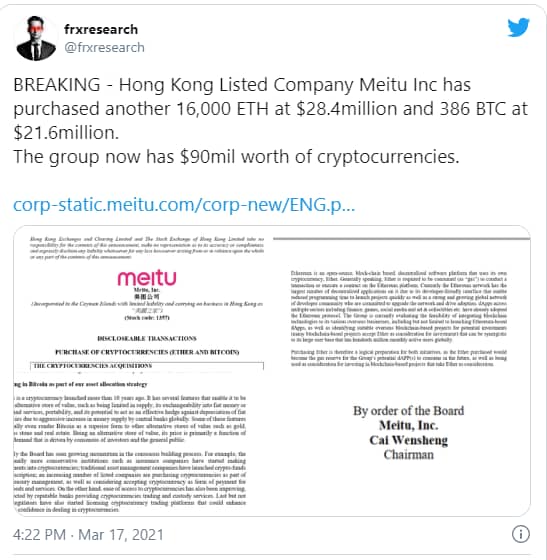

The app has continued to grow in popularity among the Taiwanese, Chinese and Hong Kongese with over 100K downloads recorded daily. A respected crypto analyst who goes by the username frxresearch on Twitter revealed Meitu’s statement of the crypto asset purchases through its official Twitter handle.

Frxresearch Tweet. Source: Twitter

After announcing its previous purchase almost two weeks ago, Wu blockchain, a Chinese analyst said “Meitu is the first publicly-listed company in China to purchase significant quantities of Bitcoin.” Sadly, the crypto regulations in China is unpredictable. Thus, most other Chinese-listed company may not be able to invest in cryptocurrency. As of this writing, Chinese authorities consider Bitcoin as a digital commodity but disallows exchanges from receiving virtual currencies or tokens in exchange for physical currency.

Apart from exceeding 800 million user database, Meitu users are spread across almost twenty countries such as Brazil, Bangladesh, Canada, Malaysia, Mexico, Nigeria, Pakistan, The Philippines, South Korea, Turkey, The United States and Vietnam. Earlier this year, one of Meitu’s subsidiary, Meitueve announced that it had allied with Effectim, a skincare product by Shiseido – a top skincare company in Asia.

Meitu is well known for its range of smartphones, smartphone devices and selfie apps. It is the most recent corporate giant to invest in the king coin. After the lockdown and a massive price decline in march 2020, BTC is yet to fall back to its pre-lockdown price. At its current trading price, Bitcoin has risen by more than 1,000% from March last year till date.

Most analysts believe that Bitcoin’s price bounce was a result of institutional investments in the currency. For example, Microstrategy owns over $5 billion worth of BTC, while tesla’s known worth is over $1.5 billion and there are other traditional investors with similar investments in the currency financial analysts now call the new digital gold.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.