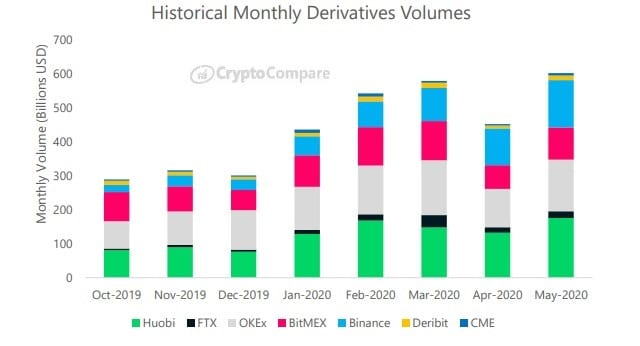

The crypto data firm CryptoCompare in its new report finds out that the crypto derivatives volumes on all cryptocurrency trading platforms are increasing more than ever. Crypto derivatives volumes touched an all-time high rising by 32% in May. After surging by 32% in a single month, derivatives volumes reached to $602 billion.

The report reads:

“What’s more, crypto derivatives are gaining market share. Total spot volumes increased only 5% to $1.27 tn in May, which meant that derivatives represented 32% of the market, compared with 27% in April.”

Huobi, OKEx, and Binance make the largest portion of total volume: Huobi tops the list with $176 billion in volume while OKEx and Binance come with $156 billion and $139 billion respectively.

Institutional Options Volume

Institutional options also saw a clear bullish momentum and witnessed a clear growth on institutional exchange CME as compared to April. In May, Bitcoin derivatives on CME surged by 59% and reached $7.2 billion. “Options are one area seeing particularly impressive growth. CME total options volumes reached an all-time monthly high of 5986 contracts traded in May. This figure represents 16 times that of April’s volumes. CME futures volumes have also recovered since April, increasing 36% (number of contracts) to reach 166,000 in May,” the report added.

Another prominent derivative platform Deribit saw a record daily volume. On May 10, the options volume rose to $196 million which was the peak value witnessed till date. In May, Deribit’s volume in options surged to its ATH as users traded $3.06 billion in a single month.

On May 10, the total daily traded volume reached $64.7 billion which was much closer to $66.2bn seen on April 30 and to $75.9 billion witnessed on March 13. Out of total $64.7 billion, $49.88 billion came from Lower Tier Exchanges while Top Tier exchanges represented $14.86 billion.

“In May, Top Tier volumes increased 12.6% to $275bn, while Lower Tier volumes only increased 0.2% to $858bn,” CryptoCompare noted. “Exchanges that charge traditional taker fees represented 77% of total exchange volume in May, while those that implement Trans-Fee Mining (TFM) represented less than 23%. Last month, fee charging exchanges represented 78% of total spot volume.”

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.