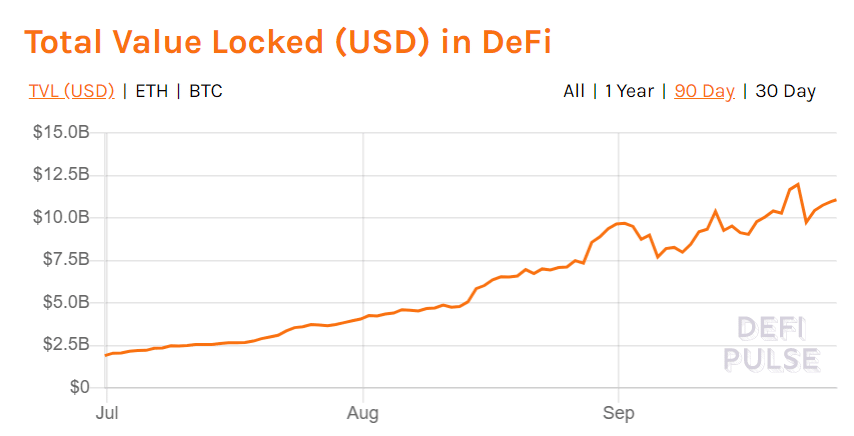

Amid the rising decentralized finance (DeFi) industry boom, the total value locked across different DeFi protocols has crossed the $11 billion figure. The total value locked in decentralized finance is now on its way to hit $12 billion. According to the recent data shared by DeFi Pulse, most of the value is locked on Uniswap and Maker protocols.

The DeFi Pulse Index shows that now more than $11 billion in assets is locked in the decentralized finance protocols. Out of the total value locked in DeFi, $1.99 billion is locked in the Uniswap protocol, $1.96 billion is locked in Maker, and $1.51 billion is locked in the Aave protocol.

While on the other hand, the other major protocols with the most value locked in them are Curve Finance ($1.33B), WBTC ($930.5M), Compound ($880.8), yearn.finance ($813.7M), Synthetix ($623.4M), and Balancer ($472.7M).

The decentralized finance industry took more than two years to reach the $1 billion figure in the total value of assets locked in it. However, the DeFi market has now reached $11 billion within the duration of just one year. The ongoing growth in the decentralized finance market indicates to the fact that it is soon going to hit $12 billion in total value locked.

The hype around DeFi is just starting

Meanwhile, the founder of Neo Da Hongfei has said in a recent live stream on China’s Hub that the hype around decentralized finance has not finished yet, it has just begun. He said that all kinds of derivatives, decentralized exchanges, as well as lending or borrowing protocols are continuously growing in the DeFi sector. He stated:

“Lending and borrowing, decentralized exchanges, insurance and all kinds of derivatives are on the rise in DeFi. The initial stage DeFi infrastructure has a solid good start, and now it is time to see more and more applications to be built and innovated on DeFi.”

Furthermore, Da believes that the decentralized finance industry is going to have a positive impact on economic life in the future.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.