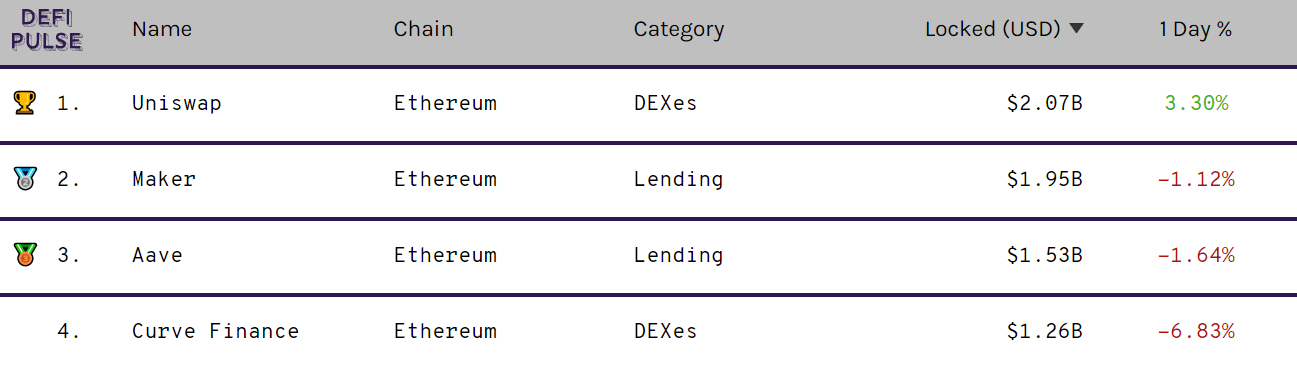

According to the data from DeFi Pulse, the decentralized finance (DeFi) protocol Uniswap has reached the $2 billion figure in total value locked (TVL). The decentralized exchange Uniswap has now become the first DeFi protocol to hit $2 billion in total value locked. Moreover, the dominance of Uniswap is also more than the other decentralized finance protocols.

Currently, according to DeFi Pulse, the total value of assets locked in the Uniswap protocol is standing above the $2 billion mark at the moment. The top three digital assets by liquidity available on the Uniswap protocol include the second-ranked digital currency Ethereum (ETH), the USD-pegged stablecoin Tether (USDT), and Wrapped Bitcoin (WBTC).

Source: DeFi Pulse

Maker, the second-ranked decentralized finance protocol, is also on the verge of reaching $2 billion in total value locked in it. Currently, Maker’s TVL is standing at $1.95 billion at the time of writing. By reaching $2 billion in TVL, Maker will become the second DeFi protocol to achieve this milestone following Uniswap. While on the other hand, Aave and Curve Finance are standing on the third and fourth positions respectively with $1.53 billion and $1.26 billion in total value locked.

Not only the number one DeFi protocol Uniswap has more TVL than the other protocols, but the dominance of Uniswap is also high in the decentralized finance market. According to DeFi Pulse, the dominance of Uniswap is 18.58% at the time of writing.

Uniswap became the top DeFi protocol after it launched its governance token known as UNI. Uniswap’s native token gained a great deal of popularity in the community within no time after its launch. Various major digital currency exchanges in the cryptocurrency sector such as Binance, Coinbase, etc, listed UNI token immediately on their trading platforms.

Due to UNI, Uniswap was able to become one of the most valuable projects in the decentralized finance sector. Moreover, UNI’s popularity fueled the ongoing boom of the DeFi market and it witnessed a significant increase in the institutional interest after that.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.