Even though Bitcoin price decline beneath the $35K mark, a few privacy coins such as XMR, DASH, and ZEC were unaffected. Instead, these privacy coins achieved a price increase. In the last 24 hours, the leading cryptocurrency has fallen to a new 5-day low in price. Its increased volatility saw bitcoin decline below $35,000. Consequently, most other altcoins followed suit, which caused an increase in bitcoin’s dominance of the market by over 44%.

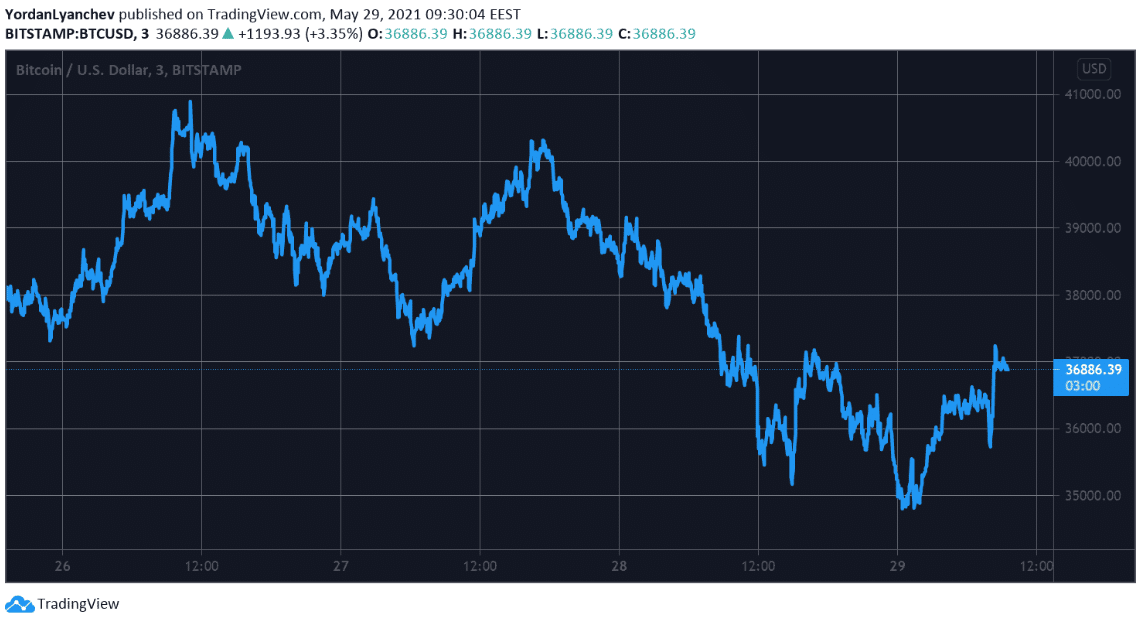

Bitcoin Price Declined Below $35K

The leading digital currency was on a price rally for a few successive days after it experienced its most violent decline in recent times to dip below $30K. Finally, it tested the $40K mark and even scaled above it briefly. But the bears rejected any of its further attempts to increase beyond that point. Rather, it experienced a rapid fall shedding a few thousand dollars in the process. In the hours that followed, bitcoin kept losing its USD value, signaling a worsening situation. Hence, its price decline to a new low in five days to below $35,000 (as recorded on Bitstamp). However, the bulls resisted further declines, which caused bitcoin to experience an upward price rally to its current price of about $38,000. Its market cap hasn’t risen above $700 billion yet, but it’s still leading the market by more than 43%.

BTC/USD. Source: TradingView

Privacy Coins Post Impressive Gains

Most altcoins performed like their leader by also experiencing a slump within the last 24 hours. Ethereum dipped below $2,300, but it has recovered to now trade around $2,500. Binance coin also dipped a little above $300 but now trades around $350. Other large-cap altcoins performed in likewise manner, but most of them have become a little green over the last 24 hours. Some of those that turned slightly green and their percentage increment include LTC (3.5%), LINK (1.5%), BCH (4%), uni (5%), XRP (2.7%) and ADA (!%).

Crypto market overview. Source: QuantifyCrypto

Funny enough, the alleged private coins have posted more impressive gains within the same period in review. Horizen (ZEN) rose by over 20% to $116, dash (14%) to over $201, zCash (ZEC by 29% to about $185, and Monero (XMR) by 24% to almost $301.

However, these market fluctuations haven’t affected the cumulative market cap of all crypto assets, as it is still approaching $1.65 trillion. It is a known fact that the privacy coins’ uptrend didn’t just start. Monero has increased by over 200% in the last three months zCash, Horizen, and Verge has posted impressive increases within the same period too.

Even though the regulatory climate has made it a little harder for these privacy coins on exchanges, most of them keep performing well. One reason attributed to Monero’s price spike is that it protects its users’ identities by obscuring the origin of their transactions. Hence, most crypto enthusiasts flocked to it after the U.S. Treasury revealed that all crypto transactions over $10K would be subjected to tax with the IRS beginning from 2023.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.