QuickSwap Review

Generally, there are two methods used in transactions with cryptocurrencies. It is either you send them directly or use a centralized system. The former requires trusting your trading partner, because there is no middle man. The centralized system requires some form of trust as well, because the system will be in charge of your tokens and the exchange will serve as the middle man. Quickswap Exchange is a decentralized exchange platform, and this is a review of its services.

Though the centralized system is quite safe, it also comes with some risks. Because the exchange will be in charge of your tokens, there will be a restriction placed on the tokens. There is also the possibility that your funds get missing in the exchange. This often happens due to failures in the login mechanism or the administrative tools used to ensure hackers are kept at bay. Some centralized exchanges might also present a pathetic excuse of shutting the platform to steal users’ tokens.

Every centralized system requires a user to liquefy their assets. Some decentralized exchanges such as QuickSwap evade this problem by giving a minimum target for every user to liquefy every day. With this opportunity, a user gets to earn more money by getting rewarded through liquidity provide (LP) fees, that grow into significant income over time. Most users use this system as an easy way to make income.

This system works efficiently, unlike the traditional banking system. In the banking system, you have to go through a queue and fill many forms, all to still get a low interest which is a significant issue for the account owner. But it is different when trading in a decentralized exchange, as the DEX system serves as the middle man and is transparent in every way. QuickSwap uses a balanced system called Polygon. The Polygon is a combination of the Ethereum blockchain and layer 2 (L2).

Ethereum is run on different computers, which are decentralized networks. Each computer is responsible for keeping a copy of its transactions and, at the same time, protecting every transaction that is stored in the system. The software used on these systems is known as dApps. The purpose of Polygon software is to mitigate transaction fees and boost the speed of dApps having Ethereum. QuickSwap is a member of these dApps.

| Exchange platform | QuickSwap |

| Website | quickswap.exchange |

| Variety crypto | 8 |

| Account needed | No |

| Verification | Mandatory |

| Verification levels | 2 |

| Trading Platform | Web-based |

| Payment Method | Bank account, Matic wallet, Debit/Credit card, Email wallet, Wire transfer, Crypto Conversion |

| Customer Support | Email, Twitter, Phone |

What is QuickSwap?

Quickswap was founded last year as part of the Uniswap project. Quickswap is the latest decentralized exchange with Etheriem and the 4th most considerable existing decentralized finance (Defi) dApp using Ethereum. This information is extracted from the Total Value Locked (TVL) written by Defi plus.

In QuickSwap, you can make exchanges through the set of intelligent contracts running on the platform. You can quickly do the exchange through your browser; no signup is needed so you don’t have to provide any personal information. This set of smart contracts are sent out by the Ethereum Virtual Machine (EVM). The tokens are held in smart agreements giving them the ability to swap. This system doesn’t require a person or cooperation.

QuickSwap only tends many exchanges with the tokens in the Polygon Network. This system has been approved by many. Keep in mind that there are other tokens represented with ‘W’ as the initial. These tokens are called Wrapped tokens, such as WETH (Wrapped ETH) and WBTC (Wrapped BTC). Stablecoins also have USDC and DIA withdrawn in fiat currencies, such as the US dollar and others.

You can easily make a trade using QuickSwap, through a browser-based wallet like MetaMask. Use the wallet to send tokens you are ready to trade. The system will fill out your order through the QuickSwap smart contract. If someone needs the tokens, the system will exchange and return your token to your wallet. The exact process used in sending the tokens will be utilized.

However, it would be best to have sufficient liquidity to run this transaction, or the system will return an error message saying insufficient liquidity for this trade.

QuickSwap Trading services

During the creation of the QuickSwap system, the team focused on lowering transaction fees while increasing the speed involved in confirming a transaction on Layer 2 technology on Polygon.

The existing program, called Uniswap, is an open-source code and a member of the dApp used on Polygon. This new invention is QuickSwap. Aside from the recent improvements, an intriguing feature is the QUICK feature. You can buy this feature at QuickSwap using Ethereum and other accepted cryptocurrencies. This feature can also be a reward for liquidating.

QuickSwap Fee

The centralized exchange made a profit by imposing a charge on trades from the makers-maker fees and the takers-taker fees. Makers are users that have tokens they are willing to sell as orders, while the takers are those ready to buy these tokens from the order book.

Since the takers are liquefying the tokens, a fiat fee is a tax on the tokens. So, the system taxes both the makers and the takers during the transaction. Many decentralized exchanges don’t impose any fee on trading with their system. This is the cause of the long argument by DEX supporters that decentralized exchanges will soon fold up.

However, QuickSwap imposes fees on each transaction. A trading fee of 0.30% on the maker and taker involved in the transaction. These fees are given to the liquidity provider as a protocol compensation for using their services. The communist government also taxes these fees.

Withdrawal and Deposit Fees

As at the time of writing this article, the QuickSwap Exchange, unlike other decentralized systems, has no imposed fee on deposit, transfer, or withdrawal. The only fee charged is the network fee. The communist government also taxes these transactions. Still, these fees are not profitable to the system, rather they impose an incentive by miners (owners of the used crypto/blockchain). Network fees increase or decrease based on the number of people using the network.

In October 2020, the exchange, in their FAQ, posted a claim that they can survive without fees because the system runs at a light speed with a high possibility of using no gas fees. On 18 May 2020, the platform also claimed that the costs are 0.01% through Ethereum.

For a system to charge only network fees on transactions, it is considered a non-profit making platform. Fee levels in decentralized systems are set on crypto withdrawal; even DEX and CEXs are members.

Like almost every DEX system, there are no fees levied on deposits, except in the form of fiat currency. This platform has made it easy for crypto traders to make transactions with their crypto assets. But in fiat currency, you need to pay a fee to purchase an entry-level exchange. This exchange is responsible for accepting fiat currency.

QuickSwap API

DEX is fond of spreading their server all around the world. This is unlike centralized exchanges whose servers are concentrated in a specified location. The idea behind spreading the servers is to make it hack proof since there exists no downtime. This makes the system immune to attack; because even a server being attacked has a mute effect on other servers, unlike a centralized exchange where a single attack can cause a lot of damage.

When using DEX to trade, the exchanges are not responsible for your tokens. So even if a hack infiltrates the exchange, none of your tokens will be touched. But in a centralized exchange, your funds can go missing when hacked because the exchange holds the funds for the transaction. QuickSwap is a decentralized system, which means your funds are safer.

QuickSwap Limits and Liquidity

Presently, QuickSwap is worth $540 million in liquidity and, on different occasions, they have amassed $200 million in daily transactions. This system has become a money-making wizard of the Polygon network. This system has shone more light on Ethereum and makes existing dApps like Aave and Curve easier to navigate. In addition, the system has introduced yield farming as a way to spread projects. You can invest as much liquidity as you wish and withdraw as much as you have in your wallet.

QuickSwap Portfolios

Having different trading options makes a user happier and the system easier to use. This makes the design user-friendly as it provides knowledge of what the trade is about. It is also a strategy to get more users.

With such a simple, user-friendly interface, a user can experience more trading and activities, providing a knowledge of alternative trade that can be performed. QuickSwap is one of those exchanges with different options of coins. You can also make transactions in other cryptocurrencies based on your plan, investment, and returns.

This simple portfolio makes it easy for experts as well as novices in the trading world. The system provides total censorship to the user who can do whatever they want with their funds. As earlier stated, this system has zero risks attached.

Cryptocurrencies Available QuickSwap

You cannot directly use fiat money to purchase QUICK compared to other popular cryptocurrencies. But you can use another method in which you’ll be required to buy Ethereum from a fiat-to-crypto site. After this, you can move the funds and start trading.

The site accepts many cryptocurrencies such as WETH, Wrapped Mtics, USD coin, Pancake Bunny Polygon, UniLend Finance, Quickswap, and Aavegotchi.

You can purchase these coins using your credit/debit card or through a bank transfer. However, both ways come with a transaction fee. A higher transaction fee is charged on cards, although it’s faster and provides instant payment. The bank transfer is a bit cheaper. Some countries charge lower fees on cash deposits than others.

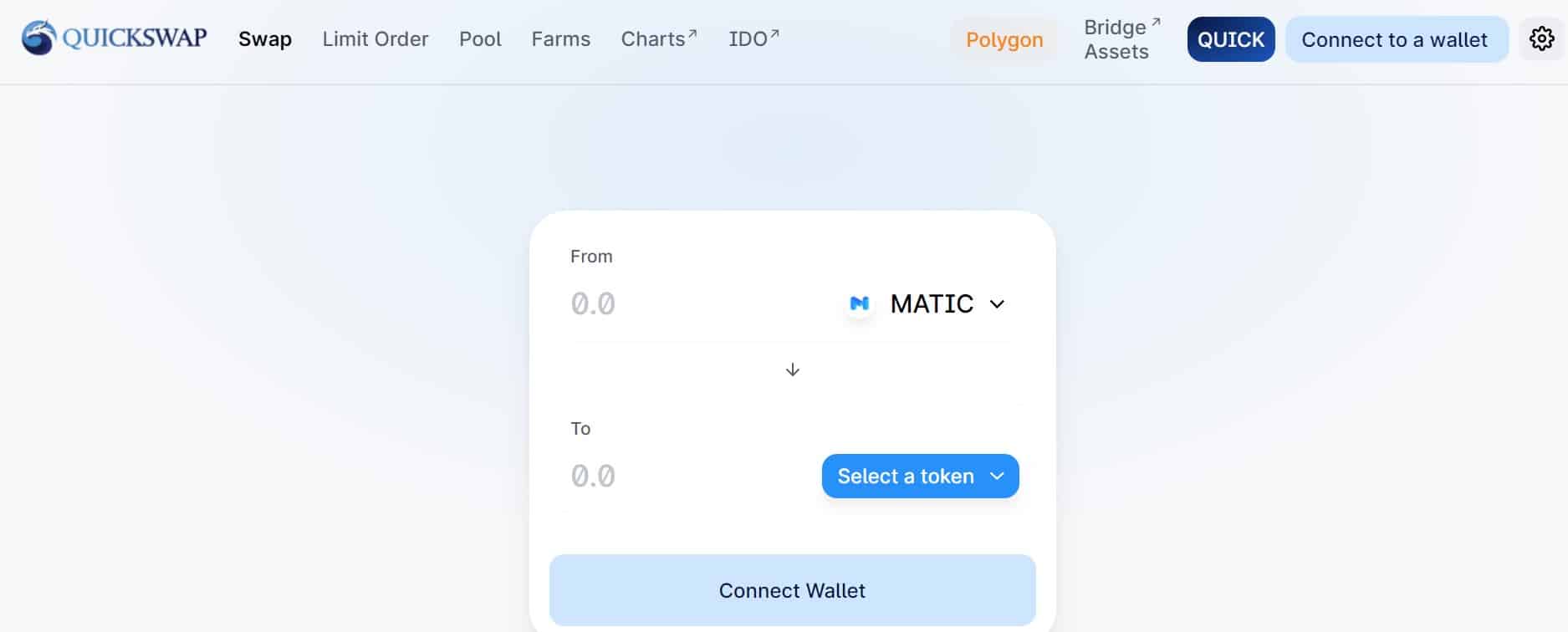

QuickSwap Interface

All trading platforms have a trading interface. The trading interface is an integral part of the exchange website. This interface presents a picture that displays the prices of accepted cryptocurrencies and what they are worth. This interface also has the buy and sell slots. The interface also has where you can place your order with your crypto; like any other platform, you can also view the history bar here. The history displays all past transactions that have been done using crypto. The interface also has the reward, pool, and IDO actions.

The interface also introduced yield farming in the early stages. However, a user with low assets like $100-1000 crypto is expected to make losses during trading because of the high fees imposed on transactions. But the QuickSwap interface runs a program known as the Matic Network. This network charges little on transaction fees.

Comparing the QuickSwap interface to other cryptosystem interfaces, other systems using Ethereum charge $4.23 in-network fees. Uniswap charges $40.28 as network fees. However, QuickSwap, which runs on Polygon, charges roughly $0.00001 for network fees with a faster confirmation time.

How amazing! It is left for you to decide if this trading interface is suitable for you or not. However, you can still adjust the settings to fit your trading preference.

How secure is QuickSwap?

Like every Automated Market Maker (AMM) platform, the risks are slightly different from QuickSwap’s. These networks of Defi systems face many risks, but the three significant risks are impermanent loss, smart contract bug, and rug pulls.

As earlier stated, QuickSwap is formed from UniSwap. It is identical to UniSwap, with a few modifications like the UI. It also runs on the Matic network, and this is responsible for its flash speed and cheaper transaction rates. Currently, there has been no report of hack attacks on the UniSwap platform so the risk is at its minimum.

Impermanent loss is when there is a fluctuation in a pool where you invested your assets for liquidity. However, this loss is minor, due to the ability to earn rewards from yield farming and fees. This is because of the LP available in yield farming. The reward from LP depends on the timing, market condition, and other possibilities.

Rug pulls when a coin suddenly disappears from a pool as the price skyrockets. This happens unnaturally or through hype manipulation. Be careful when you see those circumstances and stay away from starting them.

It is advisable to do comprehensive research and understand yield farming before you initiate your registration. Study all the risks involved, the risk tolerance, and be ready to accept the losses. You can start with a low amount of crypto while preserving the rest from optimistic investment.

You can also store your assets on a hardware wallet. The system has a USB-enabled option with a fortress of security, making it more durable. This security is constantly updated by the manufacturers, which makes it safe. Some devices you can use are Ledger Nano S and Ledger Nano X. These wallets are priced in the range of $50 to $100, depending on the features.

QuickSwap Customer support

Like every other platform, QuickSwap has a high number of intelligent and expert workers. These workers are paid to provide satisfactory services to the users. You can contact them any time you wish; however, it must be online. You can also drop your complaint through their chat icon on the displace interface.

Asides trading, QuickSwap provides alternative ideas for trading with cryptocurrencies. The interface also allows the installation and usage of this system on phones, apps, and browsers. Since you have your account on the phone, you can easily detect any suspicious activities going on in your account.

Keep in mind that QuickSwap can never call a user to request their password or any confidential information. In case of such an incident, you can report to customer services through an email.

Modern technology on this platform makes it easy for you to place a complaint and receive feedback immediately. There are many ways you can contact QuickSwap customer service. These ways are:

You can send your complaint through an email, with a linked account, for easy identification. Make sure your issue is thoroughly explained.

QuickSwap also has a Twitter handle where all FAQs are answered. This handle also posts their new updates and information.

- Phone

QuickSwap has no phone support so you can’t reach them by phone call. But you can still reach out to them if you wish to deactivate your account due to fraudulent activities or personal reasons. This process will require correctly answering all the required questions. You can also reactivate your account at a later time if you wish. All these can be done through email.

Conclusion

QuickSwap is the new cutting edge exchange platform in decentralized exchange. Most problems faced when using the Ethereum network have been mitigated. This network allows users to trade with minor cryptocurrencies in a fast transaction that takes only a few seconds to be completed. This system also protects your assets and increases trust in the Ethereum mainchain. This is possible due to the available Polygon layer-2 program.

Many users have moved to this new system, and many users have made the massive amount of liquidity possible. This rushing in of users is due to the free transaction fee, fast transaction time, and lower risk involved. This network has been accepted by many and has gained more popularity than other decentralized exchanges.

The availability of massive amounts of liquidity will still attract more investors in due time. The liquidity pools have been expanded by introducing new ones. This has given the system a competing edge over others. The QUICK feature is also getting more relevant attention since it launches in a few months. This has also increased the level of liquidity in the platform.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.