Ripple’s cross-border payment ODL sets All time high record of liquidity in Philippine and Mexico

Ripple’s newly-named cross-border payment solution known as On-Demand Liquidity has achieved a new all-time high record of volume liquidity in Philippine and Mexico.

XRP transaction volume has set a new record on two crypto exchanges in Philippine and Mexico. XRP volume recorded the all-time high against Philippine peso and Mexico peso. These two crypto exchanges are Coins.ph and Bitso that have partnered with Ripple and are utilizing XRP-powered cross-border payment solution On-Demand Liquidity (ODL) of Ripple.

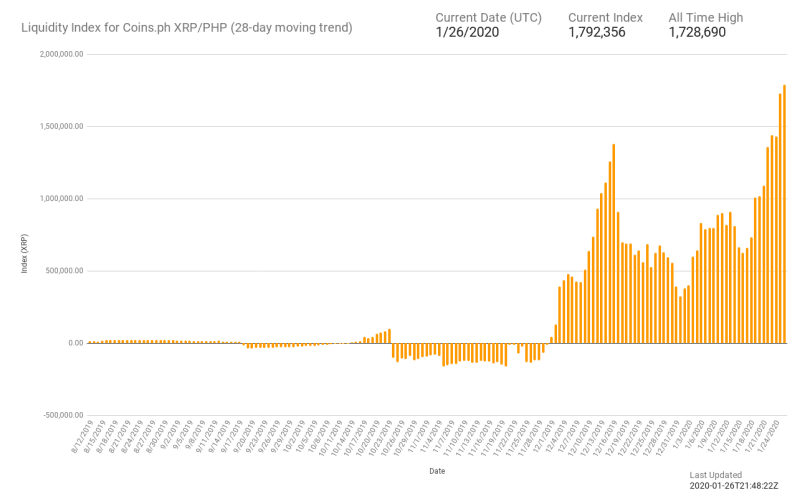

Coins.ph transaction volume of the XRP/PHP pair

Coins.ph is a Manila-based crypto exchange. According to the report of Liquidity Index Bot, on Sunday, the transaction volume of Coins.ph on the XRP/PHP trading pair has recorded a new all-time high. The transaction volume of the XRP/PHP pair reached 1,728,690.

Back in October 2018, Ripple launched the liquidity solution since that time the transaction volume on this pair has been increasing.

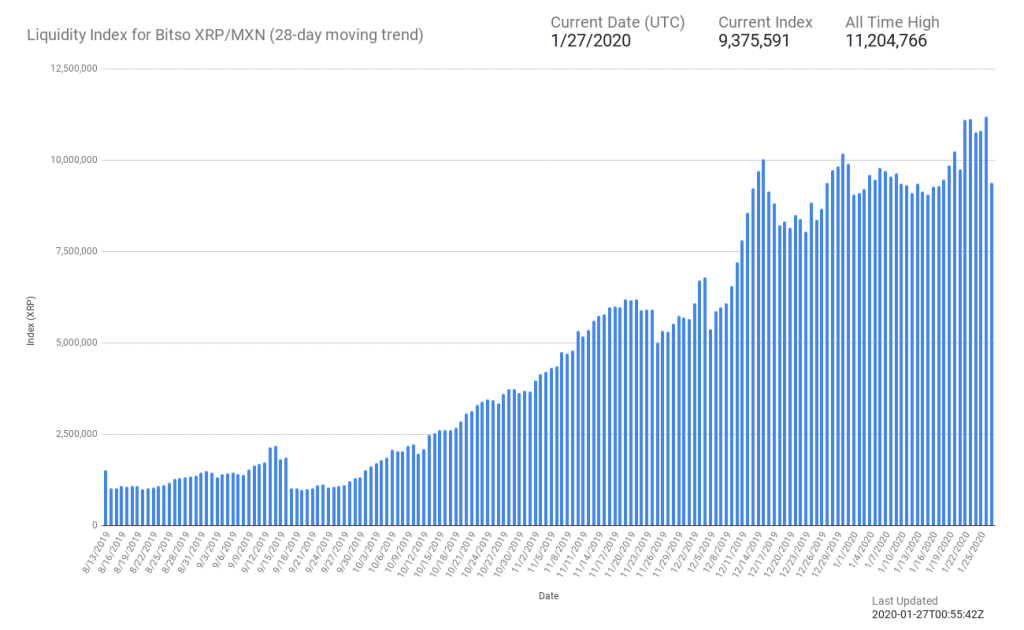

Liquidity Index for Bitso XRP/MXN trading pair

Bitso is another crypto exchange that is using Ripple’s On-Demand Liquidity payment tech. The transaction volume of Bitso exchange for the XRP/MXN trading pair also sets a new Liquidity index record. According to the report from Liquidity index Bot, the transaction volume of Bitso XRP/MXN trading pair reached an all-time high of 11,204,766.

Rising volume in Mexico is linked with MoneyGram

The money transfer giant MoneyGram claims that the crypto exchange Bitso is transferring around 10% of its daily transaction volume between the US and Mexico.

The CEO of Ripple Brad Garlinghouse said on FintechBeat podcast’s recent episode that the rising volume of XRP in Mexico is somehow linked to the money transfer giant MoneyGram. As he said:

It’s a public ledger. You can see where volumes are growing, contracting, and we’ve talked publicly about it – partly because of MoneyGram as well as some other customers who are using what we call On-Demand Liquidity. The product is moving [capital] so that you don’t have to pre-fund.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.