The Largest Crypto Asset Manager “Grayscale” is Now Holding 277,000 BTC Worth $2.866B

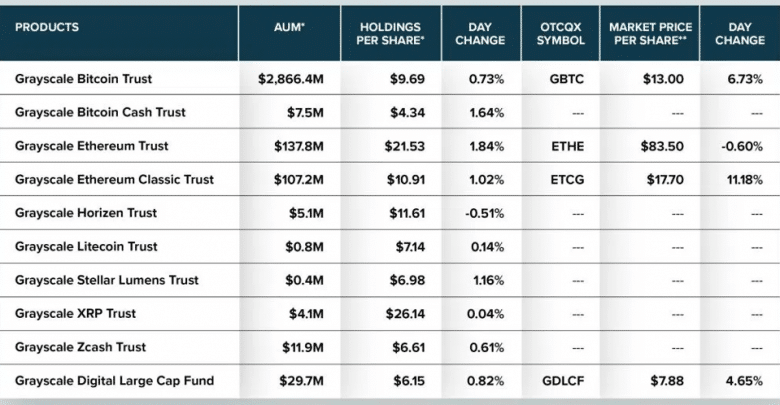

The Grayscale firm has recently presented the latest overview of its crypto assets that are currently under its management.

The crypto asset manager Grayscale is known as the leader in digital currency investing. This largest institutional crypto asset manager has its own Bitcoin-backed flagship product known as the Grayscale Bitcoin Trust (GBTC).

With the help of its GBTC, Grayscale provides crypto exposure. Along with the Grayscale Bitcoin Trust, the firm also offers altcoin trusts such as Ethereum, XRP, Bitcoin Cash, Litecoin, Stellar, Zcash, Ethereum Classic, and Horizen.

The Latest overview of Grayscale’s Crypto assets

The Grayscale firm has recently presented the latest overview of its crypto assets that are currently under its management.

According to this new overview, after bitcoin, the second and third most famous crypto assets among investors are Ethereum and Ethereum Classic.

2019 was the year of Popularity for Grayscale Bitcoin trust

According to the firm, the Grayscale Bitcoin trust became popular in the year 2019 because, this year, the total investment across all of its products reached $607.7 million. This amount is more than the total investments from 2013-2018.

Apart from this, the company claims that it received almost 71% of the 2019 investment from institutional investors. The client base of Grayscale firm is expanded by 24% with existing customers accounting for more than 75% of raised capital. Also, almost 35% of the Grayscale customers have multiple product allocations within the range of Grayscale products.

Institutional money in the crypto world has arrived

Recently, a crypto conference held in Switzerland. At this conference, the managing director at Grayscale Michael Sonnenshein stated that the institutional money in the crypto world has come. He also said that the leading digital asset Bitcoin is already taking the share of the gold market. As he said:

“I think one of the areas that’s already underway is taking share of the gold market – or Bitcoin or other digital assets emerging as this digital store of value. Perhaps gold and other things may have been that type of investment that had a place in a portfolio when the world was much more physical. For better or for worse – I would argue for better – the world has gone quite digital. And so, it’s time to start thinking about what constitutes a digital store of value, and so we start looking at things like Bitcoin.”

Millennials and younger generations are likely to play their role in the adoption of the crypto assets as Sonnenshein says:

“I think the analogue that’s not being discussed as much, which we find to be exceedingly important, is in the United States, over the 25 years, we’re looking at about $68 trillion that’s going to pass down from older generations, baby boomers, down to Millennials and younger generations. So we’re certainly not going to go out and say that we think $68 trillion is moving into digital currency. What we do think, however, is investors today need to be positioning their portfolios and looking at skating towards where the puck is going.”

The managing director then says that the younger generation does not have the same investment preferences. The importance of digital currency can only be known if you are living in the age of Apple, Venmo, and Bitcoin.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.