The Federal Reserve is busy printing more and more money, and investors are not happy at all. The US debt has increased to an unprecedented limit in June 2020.

Dan Morehead, the CEO of Pantera Capital, explained the money printing by the Fed and its effects on the US economy in an open letter to investors published on July 29. The US has broken all previous records of the two centuries in terms of cash print. Morehead said,” The United States printed more money in June than in the first two centuries after its founding”

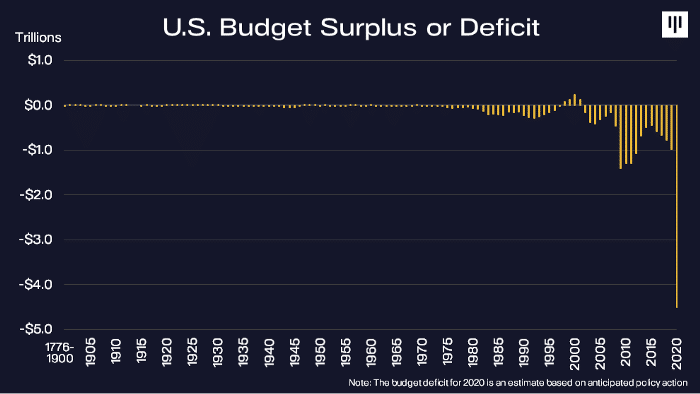

The US Budget Deficit

The increasing US debt will have long term effects on the economy, and investors will have to suffer from this act of government. “Last month the U.S. budget deficit — $864 billion — was larger than the total debt incurred from 1776 through the end of 1979,” Pantera Capital CEO claims.

For Pantera Capital, Bitcoin is a perfect alternative for investors to hedge their capital. The equivalent amount to printed money in recent months had performed many great things in the past.

“With that first trillion [USD printed] we defeated British imperialists, bought Alaska and the Louisiana Purchase, defeated fascism, ended the Great Depression, built the Interstate Highway System, and went to the Moon.”

According to Morehead, “there is no need for inflation-adjusted numbers [with Bitcoin] because there is no inflation/hyper-inflation.”

Greatest Inflationary Period in World History

Peter Schiff also shared his concern for the negative consequences as a result of surplus money printing by the Fed. He said in a tweet:

“The U.S. is about to experience one of the greatest inflationary periods in world history…any credibility the Fed has left will be lost. Federal Reserve Notes soon won’t be worth a Continental.”

Investors believe that high inflation is waiting for the US if the Fed continues to print money. Pantera Capital concluded:

“Stay long crypto until schools/daycare open. Until then the economy won’t function and money will be continuously printed.”

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.