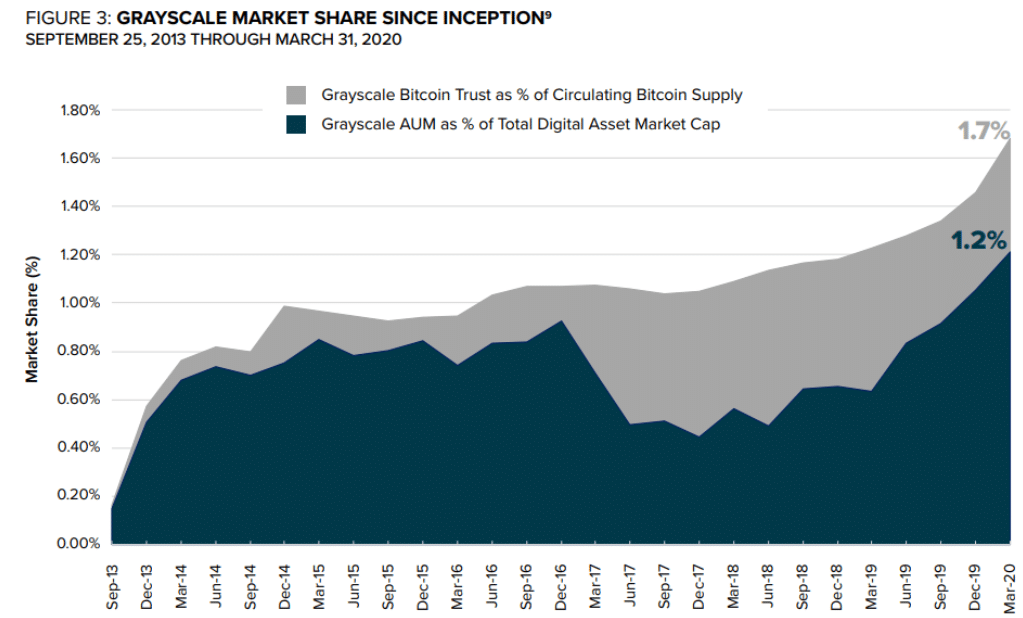

1.7% of Bitcoin Supply is Now Under Control of Grayscale as the Firm Raises Record $500M in Q1

Grayscale Investments, a cryptocurrency asset management firm having $2.2 billion assets under management, has revealed in a quarterly report released on April 16 that Grayscale Bitcoin Trust is now holding 1.7% of the circulating supply of Bitcoin.

In its “Digital Asset Report Q1 2020”, the crypto asset management firm has highlighted major progress made by the firm. According to the report, the firm and its Bitcoin Trust now have nearly 2% (1.7%) of the circulating supply of Bitcoin (BTC) under control. While on the other hand, the investment firm also holds 1.2% of the world’s cryptocurrency in terms of assets under management and currently has $2.2B assets under management.

Source: Grayscale

Grayscale raises over $500M in Q1 of 2020

The first quarter of 2020 has been record-breaking for the asset management firm Grayscale as the firm has noted major quarterly inflows in the first quarter. Reportedly on Thursday, Grayscale has raised over $500 million ($503.7M) into its products in the first quarter of the present year.

According to the quarterly report, this amount is more than 80% of the total capital that Grayscale raised last year in 2019. A vast majority of investments totals at 88% and it came from institutional investors, dominated by hedge funds. According to the report:

“The mandate and strategic focus of these funds is broadly mixed and includes Multi-Strat, Global Macro, Arbitrage, Long/Short Equity, Event-Driven, and Crypto-focused funds.”

The Managing Director at Grayscale Investments Michael Sonnenshein comments on this record achievement of the firm and says that the firm will carry on creating the momentum. He also says that the progress of the firm shows an increasing interest of institutional investors in crypto products as he said, “Inflows came from institutions.”

The quarterly report claims that the first quarter has proven record-breaking for the firm mainly because of institutional investors. So, those who worry about institutional money should now believe that institutional money has not gone and is still here.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.