Bitcoin Price Analysis: Here’s Why BTC Could Spike Above $25K

The price of the largest crypto is gaining momentum as Bitcoin’s bullish trend begins.

Bitcoin’s uptrend is inching over $24,500 against the USD. The flagship digital token is set for bullish momentum if it clears the $25,000 resistance.

The past couple of weeks has seen Bitcoin face a brutal market correction, which pushed the coin’s value downward. However, the start of August comes with relief as the asset posts positive price action.

Bitcoin Price Sees A Possible Surge

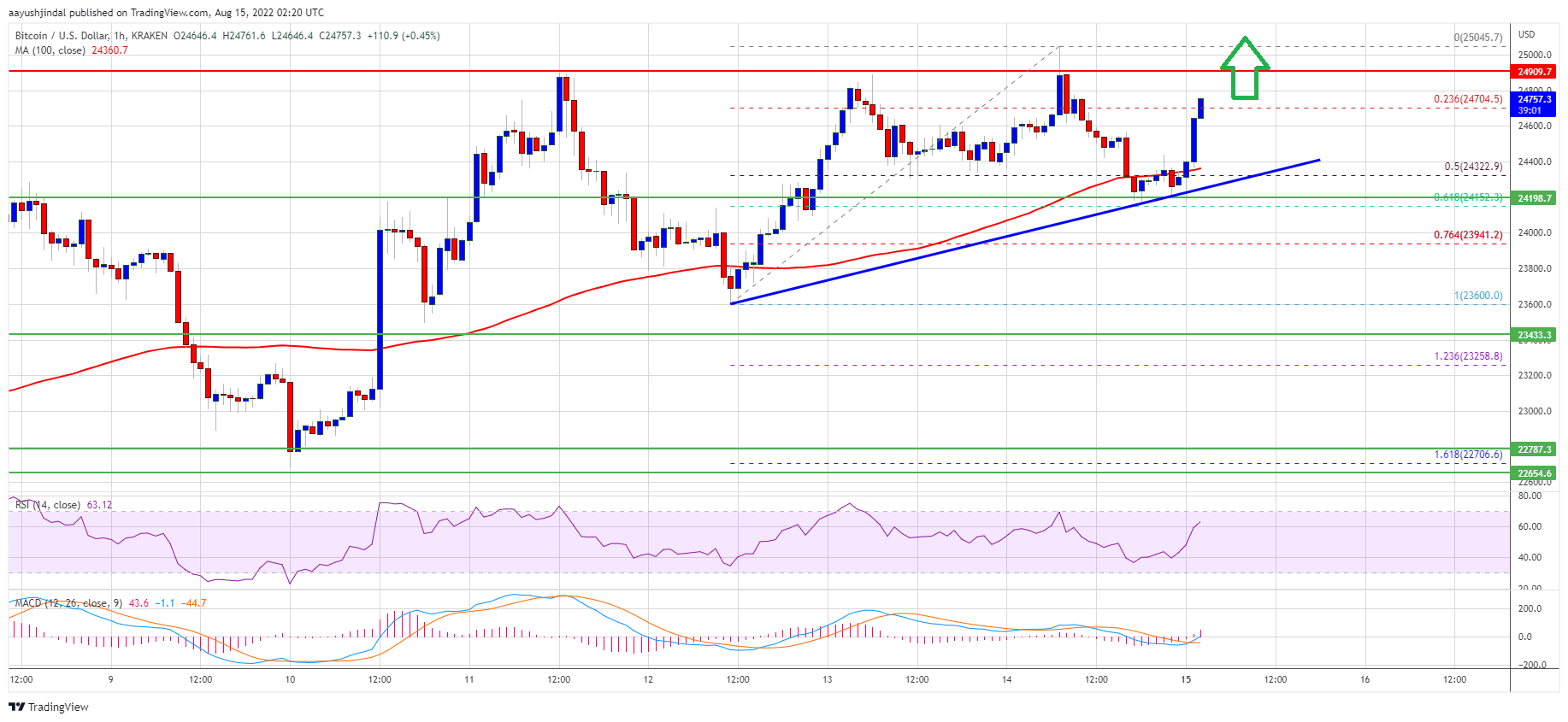

At the $24,500 price level, the value of Bitcoin attempted an upward movement that would see it breakout of the resistance zone. As a result, BTC accelerated its move above the $24,800 mark, just a little close to the 100 simple moving average (SMA).

Furthermore, the price climbed past the $25,045 level before a correction reversed the gain—a move below the support level at $24,500 simultaneously. However, at the Fibonacci retracement level, the price dipped 50%. That is, from a high of $25,045 to a low of $23,600.

The bulls appear to be active at the $24,200 support base. Likewise, the Fibonacci retracement level at 61.8% of the upward trend from the $23,600 low to the $25,045 high serves as vital support here.

Meanwhile, Bitcoin formed a critical bullish trend line with support close to $24,400 on the BTC/USD trading chart. Bitcoin is trading above the $24,000 price and the 100-hourly SMA.

BTC/USD performance chart. Source: TradingView

The upside of the price movement comes with immediate resistance close to the $24,800 support base. In addition, the next immediate resistance is near $25,000. If there is a close above the resistance zone, it could spark a price surge.

In this case, the price is likely to test the registry set at $25,800. Further gains would see the price climbing near the $26,200 zone.

Is BTC’s Price Downtrend Supported?

The leading digital asset is attempting a price trend reversal that has seen its value plummet for most of the year. As a result, if the price of BTC failed to break out of the $25,000 resistance hurdle, it would trigger a downward trend. On the downside, immediate support is close to the $24,600 mark.

Moreover, the critical support is found at $24,500, with the trend line and 100 SMA providing more support. Should the bears drive the price down below the support level, a move near the $24,200 level is imminent. Any further losses may push the price toward $23,500.

From all indications, Bitcoin is at a crossroads in price action. The tokens’ inability to begin the year on a solid footing has taken a toll on their performance.

Analysts believe that the absence of a consistent price uptrend so far in the year has influenced Bitcoin’s current condition. The broader market is red for most of 2022 as the world battles high inflation.

Nevertheless, the latest price analysis points to a possible breakthrough for the most prominent cryptocurrency as the market reverses from the slump.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.