Bitcoin surged to 104.8% as a result of US-China Trading Tensions

The clash between the two largest economies of the world, America and China, had started in 2017 and continued till today and there are chances that this battle will continue in the future. Due to this fight between two big fighters, the financial crisis is rising day by day. The financial crisis that happened in the period from October 2017 to March 2019, the S&P 500 has lost its half value of assets.

But there is a solution to this liquidity risk and bitcoin may act as a hedge against this financial loss. But the question arises that how bitcoin will overcome this liquidity risk? The bitcoin is better than traditional fiat currencies and assets due to the following reasons:

- The bitcoin has preservation quality such as gold that is positive in a liquidity crisis.

- Nowadays, bitcoin can be used to buy or sell things like cash and has a spending feature.

- Digital assets are continuously increasing stimulating the demand in the markets.

Bitcoin against Traditional Assets

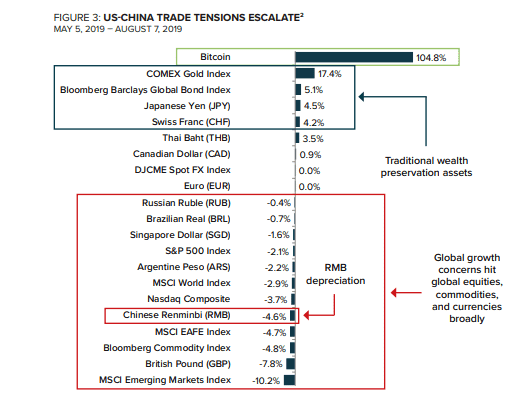

Since Donald Trump announced to put additional taxes on the Chinese goods, the growth of 20 assets given below in the chart has declined up to 0.5 % but on the other hand, the cumulative return of Bitcoin has reached to 104.8%.

This decrease in the value of assets is due to the escalation between China and America and as a result, the investors are affected very badly.

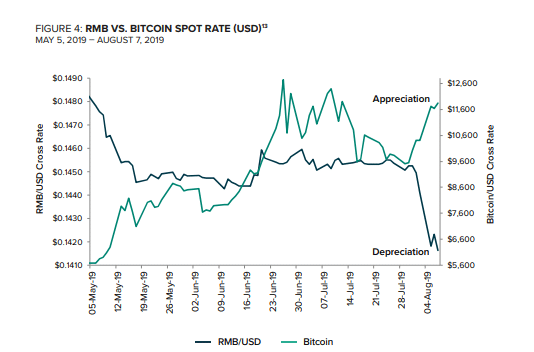

The green line in the chart is showing appreciation during the escalation time from May to August. Many investors spend his money in buying digital assets to cover up the losses from assets in response to liquidity risks.

According to the research report of the Grayscale Insights:

While we don’t know when or at what levels the current drawdown will end, it is clear that the challenges faced by politicians and policymakers will be difficult to manage given the complexity of our global financial system. Bitcoin could be a useful tool in helping investors insulate their portfolios from any failure to manage these problems effectively

What do think about this report? Share your opinions in the comment section.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.