Bitcoin Whale Moves $498 Million Worth of BTC

Even though BTC continues to push towards a new peak price, a large Bitcoin whale is moving millions of dollars in BTC. First identified by BTC block bot, the ledger tracker discovered that almost 8,700 BTC which is about $500,000,000 in worth was moved yesterday. Keep in mind that there is nothing anonymous about tracking BTC wallet activity because there is permanent and public storage of all Bitcoin transactions on the blockchain platform.

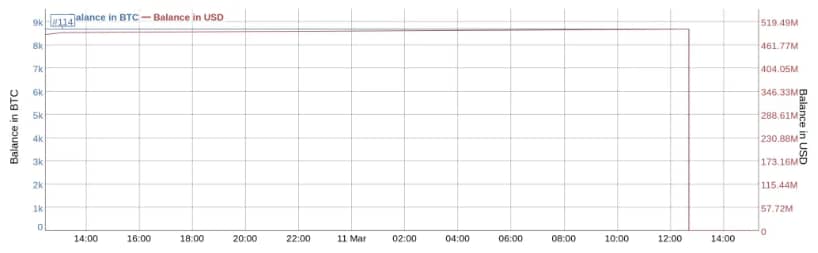

This whale completely drained his BTC wallet to $0 even though the cost of executing the transfer was approximately $53. Before he made the transfer, the whale’s BTC made him the 114th largest holder of the top cryptocurrency. Two separate wallets received the funds, one received about 4,700 BTC, while the other received 4K BTC.

As of this moment, the receiving wallets cannot be traced to any institutional investor or individual. Also, it is unlikely that an exchange is at the receiving end of this transfer. Suppose an exchange were to receive it, there is a possibility that it would be sold on the open market.

The only safe assumption is that the funds’ seller is moving it to make a direct sale or for safekeeping. Since this wallet address hasn’t been active for years before this transfer, most people are joking that he’s one of those early Bitcoiners who eventually remembered his password.

The BTC balance. Source: bitinfocharts

BTC Price Causing Multiple Whale Deals

After announcing a $1.5 billion investment in late February, the top cryptocurrency peaked at almost $60K. After dipping to almost 20%, at the end of last month, it has rallied back to almost $56K and its market cap is now over $1 trillion. Thus, BTC’s total market is almost 10% that of mined gold.

The rise in BTC price has led to multiple anonymous transactions. As a result, there has been a sharp drop in BTC supply at most digital exchanges. Coinbase has reported that they have recorded massive BTC sales in the last few weeks. It would seem that the BTC whales aim to cause an increase in BTC demand by shortening the BTC supply.

The Implication of The Whale Deals

Crypto strategists agree that there has been a massive drop in BTC liquidity in recent months. Currently, gold and the S&P 500 have more market liquidity than Bitcoin. An indication that small flows can cause a significant price change. One of the well-known crypto analysts on the bird app, William Clemente iii remarked that there are now very few addresses holding more than 10K BTC. He further said, while it is at an all-time low, it is good for BTC since the supply is now more distributed.

William Clement III tweet. Source: Twitter

Four years ago, there were at least 128 BTC addresses with over 10k Bitcoins. There has been a massive decline in that number as of this writing. Most BTC analysts believe there are not up to 90 wallet addresses that can boast of 10K BTC. The number of such wallets has been on a sharp decline since November of last year.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.