Bitcoin will Reach New All-time High after Overcoming This Resistance

Bitcoin is on the way to break above $12,000 if resistance at $11,800 overcomes by it. In the first attempt to rise above $12k, the top leading asset did not become successful but dropped below $11,000 in a brief period.

Bitcoin is currently trading at $11,623 with a 2.98% increase in the past 24-hours. After trading close to $11,000, the price value surged to $11,784 from $11,090 on August 5.

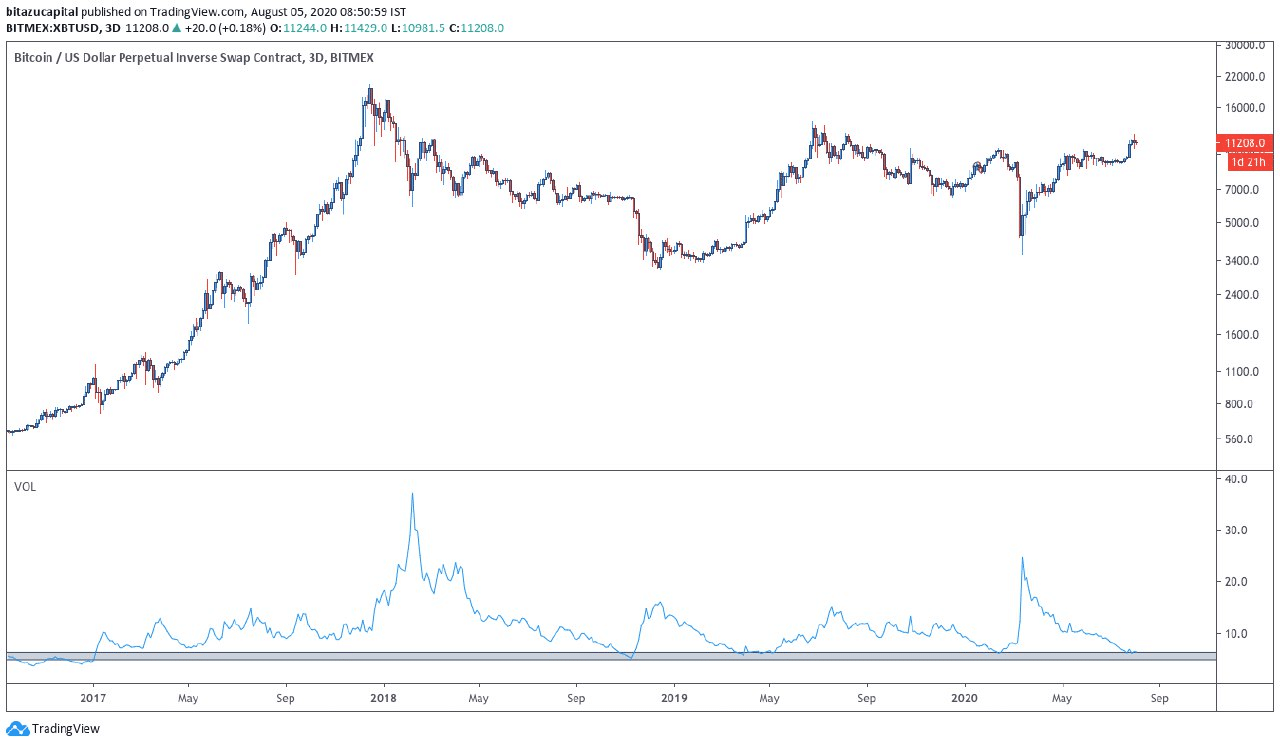

Founding partner at Bitazu Capital Mohit Sorout believes that value will reach an all-time high soon. “This $btc chart is legit giving me ATH vibes,” he said by sharing a graph.

Image via Twitter

Investors have no Choice except Gold and Bitcoin

Galaxy Digital founder Mike Novogratz said expressed his views about Bitcoin and gold. For him, Bitcoin will reach $20,000 in 2020 as there are solid reasons that will pump price including money printing on the part of the Fed. Novagratz said:

“Great bubbles usually end with policy moves. It doesn’t look like the Fed is going to raise rates … The liquidity story isn’t going to go away. We’re going to get a big stimulus… A lot of that retail interest shifted to the story stocks, to the tech stocks, because they were just more fun. Yesterday you saw a lot of money shift back over to gold and bitcoin. There’s an adoption game in bitcoin that you don’t have in gold. But I like them both.”

Investors are now turning attention towards those assets that result in high yield as futures volume on derivative cryptocurrency exchanges reaches new highs. Micah Erstling from GSR market said:

“The large percentage of headlines and traditional investors looking for higher yielding assets has led to a larger shift into crypto. As a result, open interest in futures listed on major exchanges reached a new lifetime high of $5.6 billion on August 1, surpassing the previous record of $5.36 billion in February.”

Despite post sell off, the bullish sentiments are still intact, he says. He added:

“Given the increased bullish sentiment, funding rates prior to the crash were at unsustainable levels as the funding rate for Bitcoin was hovering around 0.0721%. Furthermore, the imbalance for ETH was even worse as the funding rate was at 0.21%. However, post sell off, funding rates have stabilized despite still indicating a bullish tilt.”

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.