Mati Greenspan – There Is No Correlation Between Bitcoin and S&P 500 Now

The famous cryptocurrency analyst and Quantum Economics Founder, Mati Greenspan has claimed that there is no longer any correlation between the leading digital currency Bitcoin (BTC) and S&P 500. He said that even during the time period of the global pandemic, only a loose correlation between both of these markets was noted.

Bitcoin and S&P 500 correlation drops below 0.2

Mati Greenspan has talked about Bitcoin and S&P 500 correlation in his Quantum Economics letter published on August 5, 2020. In the newsletter, Greenspan has said that Bitcoin and S&P 500 are not closely correlated now.

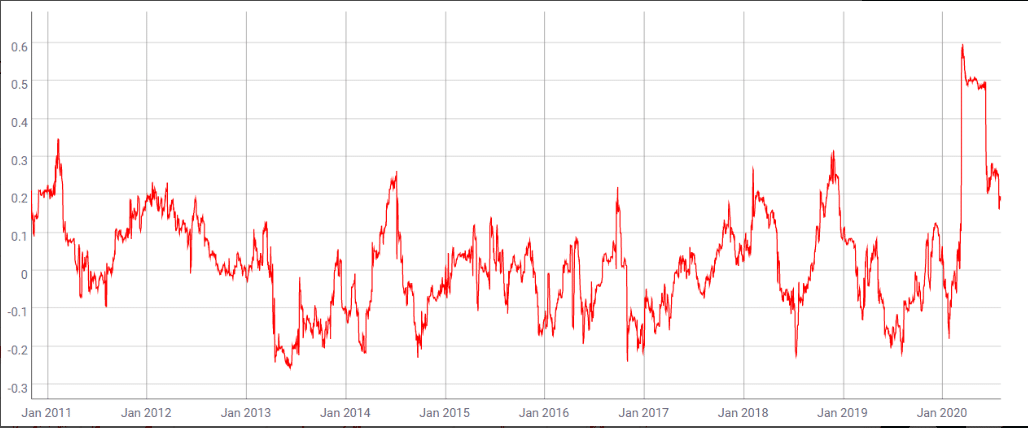

At the beginning of the year 2020, the correlation between Bitcoin and S&P 500 surged high and reached 0.6 because of the dramatic sell-off in the early period of the global pandemic, according to the cryptocurrency analyst. However, he says that this correlation level has now dropped below to 0.2 which means that the correlation between both of them is almost over.

Greenspan said in his newsletter:

“We can clearly see earlier this year, where the correlation spiked up to 0.6 due to the multi-asset early-pandemic sell-off. By now, however, we’re once again below 0.2, which basically means that there is no correlation on a day-to-day basis anymore.”

The cryptocurrency analyst also shared a “90-day Pearson correlation between Bitcoin and S&P 500” chart which clearly demonstrates his point of view.

Source: Mati Greenspan

The Federal Reserve drives Bitcoin and stock markets

Mati Greenspan, however, believes that there is still one factor that drives both the cryptocurrency market as well as the stock market. And that one particular factor is the Federal Reserve. He claimed that the Federal Reserve is the factor that causes the bullish price action in both of the markets. He said, “During periods when the Fed prints money, it sends prices upward in all markets.”

Greenspan is also bullish on the cryptocurrency market as he said on the 2nd of August that the bull market has returned. Almost most of the top cryptocurrencies including Bitcoin are trading bullish in the market at the moment.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.