Bitcoin price tied to its adoption on the part of traders, institutions, and investors. The new data unveils that the adoption of Bitcoin on the part of small entities is increasing while whales holdings of BTC are decreasing comparatively.

Bitcoin as an Asset against Inflation

Bitcoin is different from all other assets due to its fixed 21 million supply, which is a plus point as there is no chance of inflation at all. Due to its limited supply, Bitcoin provides a potential opportunity for investors in times of economic uncertainty.

Moreover, the minting of new coins is not continuous, but its production reduces every four years. It is due to scarcity that Bitcoin is most popular among hundreds of digital currencies. Before the happening of halving 2020, analysts predict that price would surge after the halving event. Now, the top digital asset is exchanging hands at above $11,800.

Whales’ Manipulation is decreasing

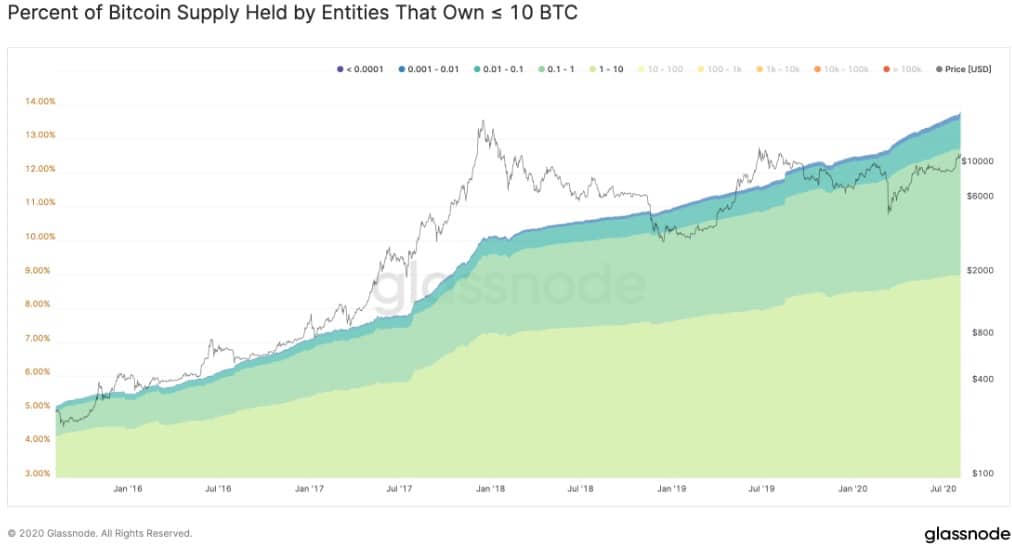

Cryptocurrency data provider Glassnode shares a graph and claims that the supply of Bitcoin is moving towards entities having BTC holdings in a low amount. Glassnode explained:

“Control of #Bitcoin’s supply has been steadily shifting towards smaller entities. The % of supply owned by entities holding ≤ 10 $BTC grew from 5.1% to 13.8% in 5 years, while the percent held by entities with 100-100k BTC declined from 62.9% to 49.8%.”

It is a widely discussed topic in the crypto community that whales are responsible for controlling price value as a result of manipulation, which means that decentralization is not at its full potential. But the increasing distribution of BTC supply among small entities makes the Bitcoin network more secure and decentralized. However, Bitcoin needs adoption on the part of large players as well as small level investors.

Bitcoin is different from gold due to its scarce nature and also has more features such as decentralization and security of the network. But it is difficult for Bitcoin to take the position of mainstream currency, but it can act as a safe-haven asset in economic decline.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.