Copper Expands its Trading Platform By Adding Support for OTC Derivatives Trading

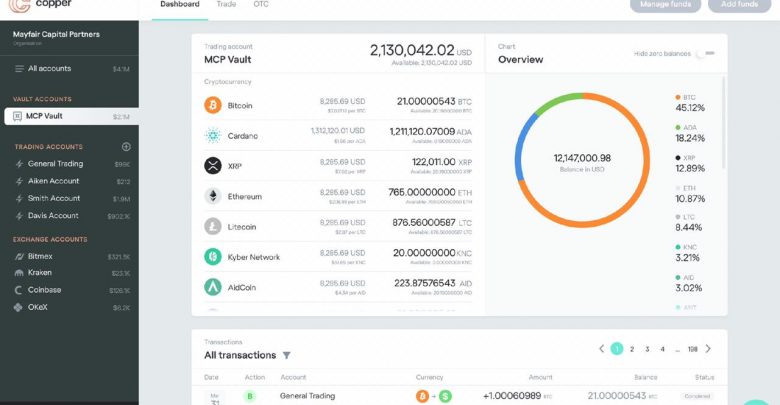

Copper, the London-based crypto assets firm, has announced today to expand its trading platform by adding support for Over-the-Counter (OTC) derivatives trading for institutional investors so that they might get involved in derivatives trading safely and securely.

Copper now allows large investors to trade cryptocurrency derivates

According to a press release issued today, Copper has added cryptocurrency derivatives’ collateral management into its ClearLoop trading framework in an attempt to expand it. This will allow institutional as well as large scale investors to trade over-the-counter cryptocurrency derivatives in the market.

It will also lower the counterparty risks for those investors who will involve in large cryptocurrency trades. It is not the only benefit of adding support for over-the-counter cryptocurrency derivatives on the platform. The other one is for new institutional investors who prefer to trade with low-risk investment trading strategies. By expanding its platform, the digital assets company Copper will create a marketplace for a large number of new institutional investors where they can trade with low-risks involved.

Commenting on this development, the CEO of Copper Dmitry Tokarev said:

“With the arrival of a fully developed collateral management framework to support the efforts of prominent market makers and others, we see great potential for further growth in the derivatives market.”

Copper’s ClearLoop custody platform reduces risks

The importance of Over-the-Counter cryptocurrency derivatives is that institutional investors use them to avoid “slippage” at the time when they make big trades in the market.

However, it may lead to various risks such as collateral management risk and the risk of credit exposure. To reduce such kinds of risks, Copper makes use of its custody platform known as ClearLoop. With the help of this custody platform, the company makes sure that its customers’ assets remain locked into segregated cold wallets until they execute their trading.

Copper CEO says that to manage counterparty risks in the cryptocurrency market, a high level of technology is needed. He said:

“In the world of traditional finance, services that manage collateral are well established, however, in crypto, the bar to providing such services is set extremely high because of the advanced technology required.”

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.