Blueberry Markets Review – Is Blueberry Markets Scam or Legit?

Blueberry Markets Review

Blueberry Markets is a broker based in Australia that has been in business since 2009. It is also a trade name that is often used by EightCap, a big and well-known broker. Dean Hyde, a former executive at AxiTrader, founded Blueberry. Blueberry has built a solid name not just among traders but also inside the industry since its beginnings. Blueberry Markets is an Australian forex broker with its headquarters in Sydney. Forex brokers are businesses that offer traders platforms via which they may purchase and sell foreign currency. Retail forex brokers or currency trading brokers are other terms for forex brokers. Retail currency traders, in turn, utilize these brokers to get access to the currency market 24 hours a day, seven days a week for speculation.

Blueberry Markets was founded in 2009 and is also a trade name for a well-known bigger broker that provides transparent pricing and enables clients to make use of cutting-edge technology via the finest liquidity providers. Blueberry Markets not only offers narrow spreads and lightning-fast execution, but it also caters to ambitious traders who want to become long-term winners. Blueberry caters to sophisticated traders with a business mindset and ambitious financial objectives. A forex account is a trading account that is mainly used to trade currencies and is owned by a trader with a firm like Blueberry Markets. The number and kind of accounts that a trader may establish with a broker business usually vary depending on the nation in which the brokerage works, the trader’s country of residency, and the regulatory bodies under which it operates.

Regulation

One of the first questions a prospective trader should ask is whether or not a broker like Blueberry Markets is trustworthy. Establishing whether regulatory bodies are watchdogs over a brokerage’s activities is one of the most reliable benchmarks for determining its safety. Blueberry Markets is an Australian-based broker that is licensed and regulated by the ASIC, one of the most stringent and demanding regulatory bodies in the world. One of the criteria of being a licensed broker is that customer money is held in separate accounts.

All customer money must be kept separate from the broker account, which may only be used by traders to perform trading operations, to comply with this. Blueberry Markets is also a member of a compensation plan or fund that pays out a certain sum to qualified customers if the business goes bankrupt.

EightCap uses the trade name Blueberry Markets, which is licensed by the Australian ASIC. As a result, Blueberry provides a secure trading environment for its customers. The authority continuously monitors the behavior of authorized brokers as well as the services they offer, ensuring that traders may invest safely. EightCap and Blueberry are both safe brokers since they satisfy the highest standards of governance, financial reporting, and transparency. Client money is kept separate in segregated accounts for business and retail customers, and clients are also covered by a professional indemnity insurance policy.

Platforms for Trading

The platform is the forex trading software that a broker firm provides to its customers and is used to execute transactions. A multi-asset platform enables customers to trade not just forex but also other asset classes such as CFDs on stock indexes, equities, precious metals, and cryptocurrencies. The platform a customer chooses will be determined by the kind of trading they want to do, therefore it will be one of the factors to consider when selecting a broker.

MetaTrader5 and MetaTrader4 are the platforms used by Blueberry Markets, and they are accessible for virtually every device, including desktop and mobile applications. Both platforms’ software offers a wealth of features, including many add-ons, excellent charting, trade automation, and much more. Blueberry advanced platforms, which include in-depth trading histories, free tools, and access to additional features, are only accessible to Blueberry Markets traders. MetaTrader 5, MetaTrader 4, and Virtual Private Service are all used by Blueberry Markets.

MetaTrader 4 is a strong platform that not only provides a versatile trading system but also advisers who are specialists in their area and can implement a successful plan for traders, regardless of how complicated it may be.

MetaTrader 4 has the following features:

- With this platform, One-Click-Trading is simple to utilize.

- With hundreds of online plug-in tools, the platform is simple to modify.

- Orders may be carried out immediately.

- Charting software is very useful.

- Pending orders and up to four trailing stops

- The trade history is extensive.

- The most widely utilized platform on the planet

- Trading is automated, and traders are guided by experienced advisers.

- This platform allows you to trade on the go.

MetaTrader 5 has quicker processing speeds, the ability to hedge a trader’s holdings, and additional tools and indicators.

MetaTrader 5 offers additional advantages in addition to a range of outstanding features, such as:

- Pending orders of six different kinds may be exchanged, as well as the ability to purchase and sell Cryptos, Forex, Single Share CFDs, Commodities, and Metals.

- There are 38 technical indicators, 44 analytical items, and 21 periods in all.

- Thousands of plug-in tools make the platform readily configurable.

- Instantaneous execution of trade orders is possible.

- This platform allows for one-click trading.

- The economic calendar, which provides macroeconomic news from across the world.

MetaTrader 5 is compatible with the following platforms:

- PC for iPad, Mac, and iPhone

- Android WebTrader and Android Tablet

Virtual Private Service is deemed beneficial depending on the trader’s trading environment and is only available when traders satisfy the trading volume criteria, which is at least 10 round turn lots traded in a calendar month.

Leverage

Leverage is a feature that allows a trader to have considerably greater exposure to the market than the money placed to start a transaction. Leveraged goods enhance a trader’s potential profit while simultaneously increasing the risk of loss. Blueberry, as an Australian broker, offers leverage levels ranging from 1 to 500, as well as narrow spreads, despite legal limitations on leverage. All account types have the same maximum leverage. These ratios apply to Forex products, which provide a wide range of options, particularly for retail traders.

Blueberry provides three primary accounts, as well as a practice account for those who are just getting started with the trading platform. A basic and professional account for more experienced traders is also available. Practice Accounts are ideal for new traders who want to learn more about the business and the fundamentals of trading, as well as the terminology and its meanings, to gain a better understanding of trading.

The following are some features of the practice account:

- On request, a non-expiring demo may be accessible. The account is valid for thirty days.

- The practice has a fifty thousand dollar balance.

- 0.01is the smallest transaction size.

- Leverage ranges from 1 to 500.

- As a trading platform, MetaTrader 4 is used.

- Four-dollar instruments that may be traded

Blueberry’s expenses are already included in the basic account’s spread. This account’s trader earns money from the moment their trade enters a successful position, with no extra fees to pay.

The following are standard account features:

- There is no cost to you.

- Spreads start at 1.0 pips.

- A one-hundred-dollar deposit is required.

- Four-dollar instruments that may be traded

- Maximum leverage of 1:500 and a minimum transaction size of 0.01 are available.

- As a trading platform, MetaTrader 4 is used.

More transparency comes with the professional account, enabling the trader to view the raw market spread. Blueberry deducts its brokerage fee from each transaction as soon as it is finished.

Features of professional accounts:

- Commissions start at $7 and are adjustable for customers who spend $50 or more.

- Spreads begin at 0.0 pips.

- This account has a two-thousand-dollar minimum deposit.

- Four-dollar instruments that may be traded

- Leverage ranges from 1 to 500, with a minimum transaction size of 0.01.

- With this account, the MetaTrader 4 Blueberry trading platform now includes a Free Live Forex Trading Room.

Withdrawals and Deposits

Blueberry Markets accepts a wide range of payment methods, with the exception that certain methods are restricted depending on whether the trader’s account is in USD or AUD. Depending on the method, the time of day, and the day of the week, depositing money through Bank Wire Transfer may take some time. Clients may withdraw money by filling out the online Withdrawal Form in the Secure Client Area. Withdrawals are free of charge, and they are handled within 24 hours. Traders should verify with their payment provider to see whether any costs are eliminated as a result of international money-transfer rules.

Fees

Trading costs are determined by a variety of variables such as spreads, fees, and margins. A currency pair’s spread is the difference between the bid and ask rates. A pip is the lowest unit of change that an exchange rate may make. The amount of money needed in your account to initiate a trade is known as margin. The size of the position, the current price of the base currency versus the US dollar, and the leverage applied to your trading account are all factors that go into calculating margin.

Commissions are fees that an investment broker charges a trader for executing transactions on his or her behalf. The amount of commission charged by each broker varies, depending on the item being traded and the kind of service provided by the broker. Execution-only brokers charge cheaper fees since they do not provide personal financial advice and offer traders full discretion over how they trade the markets.

CFD trading, a popular kind of derivative trading that allows traders to bet on the increasing or falling prices of fast-moving global financial markets, will cost money. CFD transactions on other marketplaces do not have a fee, but they do have a spread wrapped around the market price of a particular item. The spreads and commissions a trader pays are determined by the kind of account he or she creates, either a Standard or a Professional account. Traders with trading volumes of $50,000 or more have the option of paying reduced commissions.

When compared to brokers, Blueberry Markets offers a low and competitive spread. The kind of account the trader has, as well as the type of financial item being traded, will influence the list. Traders should be aware that some financial instruments may only be traded at certain times of the day, particularly when considering various time zones, and that if they maintain these positions after they have closed, they may be charged extra costs.

For positions kept open for more than a day, overnight costs, also known as swap fees or rollover fees, may be levied. Blueberry Markets does not provide Muslim traders with the opportunity of opening an Islamic account. When utilizing Debit cards, Credit cards, POLi, Bank Wire Transfers, or China UnionPay, Blueberry Markets does not impose any deposit fees. There are no withdrawal fees at Blueberry Markets, and there is no inactivity fee if a trader’s account is idle for a specific period.

Bonuses

Forex brokers often utilize enticing deposit incentives to entice new traders. This may be beneficial, but it’s critical to understand what constitutes a suitable bonus. Because once the account is created, the trader will have the same costs like any other, such a bonus is just a method to reward traders for selecting a certain broker. The bonus is just compensation for the trader’s decision to return part of these costs to him once he has shown himself to be an active trader.

Investor protection restrictions have been imposed by the European Securities and Markets Authority on the distribution, marketing, and selling of CFDs to retail customers. These regulations prohibit brokers from making a payment to a retail customer in connection with the distribution, marketing, or selling of a CFD, other than the realized profits on any CFD supplied. This implies that a Deposit Bonus is not available to retail customers at this time. Blueberry Markets does not provide any sign-up incentives to new traders.

Instruments and Products

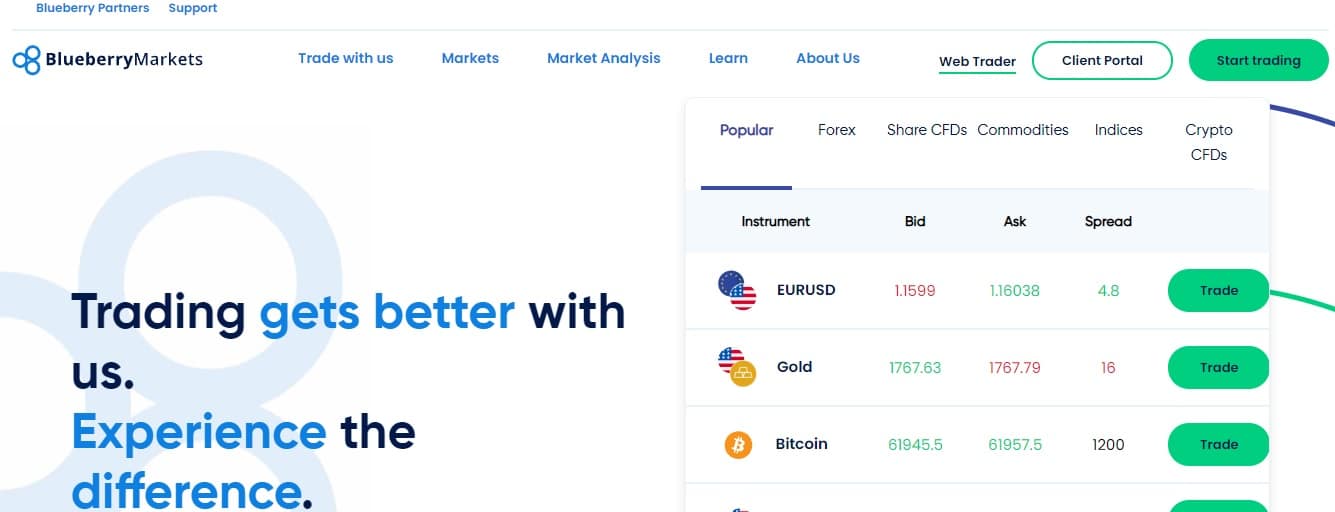

Traders may choose from more than fifty products, including indices, Forex currencies, metals, and commodities, at Blueberry Markets. Forex trading, often known as currency or FX trading, is a kind of currency exchange in which businesses, individuals, and financial organizations trade currencies at fluctuating prices. Commodity markets, like currency exchange markets, provide traders with a variety of investing options. Investing in contract-based tradable products is a safe method to protect yourself against inflation and economic instability.

Actual stock market indexes that assess the worth of a particular sector of the stock market are known as equity or stock indices. They may represent a particular group of a country’s biggest corporations or a certain stock exchange. Hard commodities, or contract-based tradable products, are used in the trade of gold and other precious metals. The significant volatility of energy prices as a result of supply and demand, political and environmental issues, severe weather, and global economic development is a common characteristic of this commodity, making it a popular trading option.

Customer Service

Blueberry Markets provides customer service via a Blueberry Blog and a part of FAQs that contains fundamental information as well as current concerns, inquiries, and other pertinent information. If a query or question isn’t already mentioned, it may be typed into the supplied Query field. Blueberry is also on Twitter, Facebook, Linkedin, and Instagram, among other social media sites. Potential traders must be certain that the broker firm they choose can provide them with the required support and assistance anytime they need it. Blueberry Markets provides customer service through email, phone, or leave a message and they will get back to you.

Education

Blueberry Markets provides a risk-free start to trading by providing a practice and trial account. This allows novices to learn not just the standard vocabulary but also how to utilize the tools in a risk-free environment. The demo accounts provide newcomers a free $50,000 and the chance to learn about the trading business, but it must be a fast learning process since the account is only operational for thirty days. Blueberry also provides trading advice in addition to practice or demo accounts.

Before beginning to trade, prospective Blueberry Markets customers should gather all of the necessary knowledge and trading abilities to succeed in the field of FX and commodities trading. If Blueberry’s website does not offer enough information, a trader can go into other helpful websites and methods to learn more. Except for a FAQ and the opportunity to create a demo account, Blueberry Markets does not cater to novice traders.

Research

Before engaging in speculative trading, potential traders should do as much research as possible. Trading with confidence and success is largely reliant on market information and comprehension, therefore research options provided by brokers are an important aspect to consider when selecting the appropriate firm to trade with. Blueberry Markets does not provide any research tools for traders other than the Blueberry Blog, which publishes articles, and Blueberry News. Apart from the option to compare spreads and rates, Blueberry Markets offers few research tools. However, no extra tools, such as economic calendars or charting software, are accessible.

Blueberry Markets is an Australian-owned and licensed online brokerage that offers over fifty market instruments via the popular MT5 and MT4 trading platforms. Traders may choose between commission-free accounts with a narrow spread and accounts with a low commission. Trading circumstances are favorable, but research and instructional resources are lacking.

Blueberry Markets is a well-regulated broker that offers a wide range of services to both experienced and novice traders. When typical limitations are taken into account, Blueberry provides cheap spreads and satisfactory leverage, but there is a shortage of trading platforms when there are so many currently available. However, there are more than 50 market instruments, which is a plus. Along with CFDs, there are also competitive trading conditions for trading currency pairs. Blueberry Markets offers an excellent mix between trading conditions, trading environment, and customer service.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.