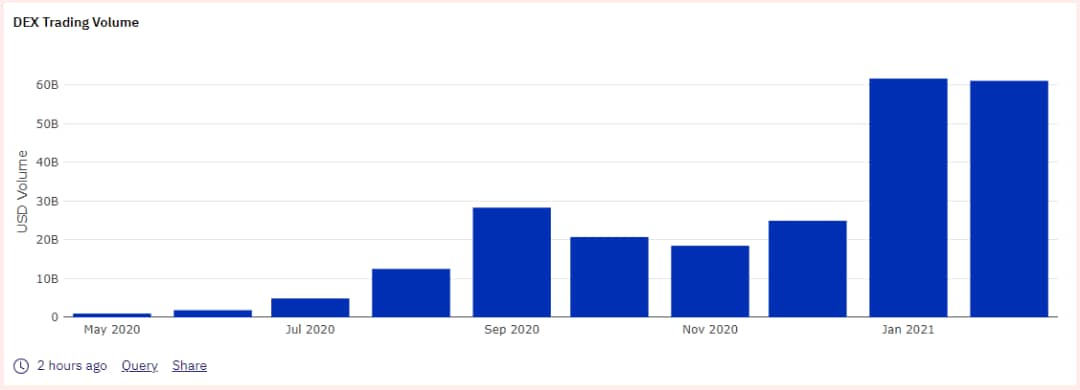

DEX Trading Volume Approaching an ATH

Uniswap, Sushiswap, and other significant DEXs recorded their peak volumes ever this past week despite massive downtrends in most major digital assets’ prices. This trend shows an uptrend in usage and which might go on unabated. It is becoming apparent that decentralized exchanges’ trading volume figures for this month will far exceed that of last month.

While this month is yet to end, DEXs recorded volume figures for this month is close to that of last month. Should those figures exceed that of last month’s, then the DEX volume will be the highest ever.

In January of this year, Ethereum’s DEX trading volumes hit $63 billion, a new record with the old record standing at $28 billion. Despite the high gas fees on this blockchain, this month’s trading volumes continue to rise. Thus, it is highly likely that decentralized exchanges on the Ethereum network will reach new heights this month. At the time of reporting, DEXs has processed over $60 billion worth of transactions.

Why Forecasters Might Be Right About DEXs

Dune Analytics, a team of blockchain analysts, predict that DEX volume will reach $67 billion this month. If the figures turn up as predicted, that figure will represent a 6.35% increase.

DEX trading volume. Source: Dune Analytics

Thus far, the total trading volume for this year is well over $123 billion. According to dune analytics, this volume is higher than all the ones ever processed. Who is dominating the market? Sushiswap and Uniswap account for 65% of this volume, making them account for the trading volume’s largest share.

However, Uniswap is more dominant. Its volume figure for this month accounts for nearly 50% of the market portion, and it’s almost twice that of sushi. This was the second time in a row, Uniswap will exceed $30 billion in trade volume. Uniswap is also dominant in the number of addresses with trades in the past week. This decentralized on-chain network accounts for trades from over 143,000 addresses.

By comparison, there aren’t up to 9,000 addresses that traded on Sushiswap within the same period. The rising transaction fees have made several users leave decentralized exchanges on the Ethereum platform. However, this sector continues to move from strength to strength as the total value locked in DEXs keeps increasing.

Most of the users who left Ethereum-powered decentralized exchanges are moving to pancake swap by Binance Chain. Even though it’s still in its early stages, PancakeSwap’s market cap was $1 billion as of last week. Its lower transaction fees on the Binance Smart Chain network is one primary reason this project continues to garner lots of attention.

Why Is Any of This Information Relevant?

DEXs now offer competitive price spreads, which solve a significant challenge facing usage in recent years. Also, DEXs can now be combined in various ways. For example, on PoolTogether, users can now switch digital assets without being compelled to move to another site because the PoolTogether app can infuse the exchange into the front-end directly.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.