Ethereum Settlement Value For Q1 2021 Could Top $1.6 Trillion

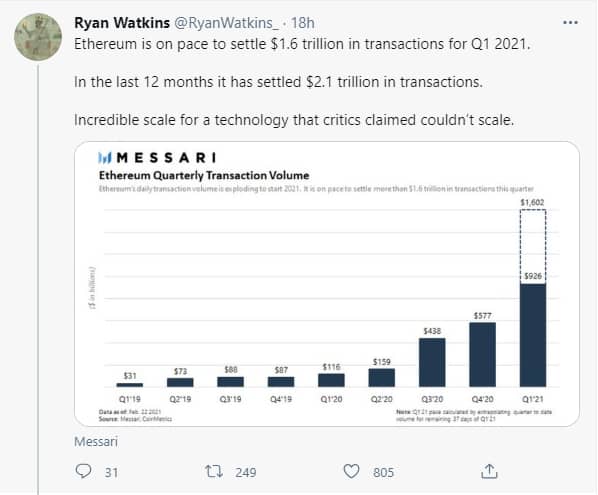

With each passing quarter, there is an increase in the number of completed transactions on the Ethereum network. Thus, increasing Ethereum’s settlement value from one quarter to another. This postulation was confirmed by one of Messari’s researchers, Ryan Watkins, through a chart he shared on the bird app yesterday.

According to him, the value of transactions documented in the last quarter of the past year is far less than that settled in this year’s first quarter. He further forecasts that Ethereum’s quarterly settlement value might hit $1.6 trillion this year.

More Than $1 Trillion Transactions Likely to Be Settled On The Ethereum Network

Messari remarked that the first quarter of this year had seen a settlement of $926 billion worth of transactions. A good indication that more people are adopting this network massively.

Compared to the more than $100 billion settled in the first quarter of last year, today’s record indicates a rise of 698% and over 5,000% increase to that of 2019. It also shows a 60% rise compared to the over $550 billion settled in the last three months of the past year. In the whole of last year, a little over $2 trillion worth of transactions were settled on the Ethereum network.

Now that there is a rise in the number of people adopting the ETH blockchain, the value of transactions this year may be too high. Cryptocurrency expert analysts from Messari already predict that at least $1.6 trillion worth of transactions should be settled on the Ethereum network before the end of March this year.

Source: Twitter

Possible Consequences of the Massive Transaction fees on The Use Of Ethereum

Today’s information provides enough proof as to why there has been a massive rise in transaction fees. It is reported that one top DeFi user paid over $36,000 worth of Ether in transaction fees during this past week. When average transaction fees hit $40 some 48 hours ago, Ethereum made almost $50 million in transaction fees on that day alone. Thus, the 7-day average transaction fees generated was a little over $32 million. But within the same timeframe, average daily transaction fees generated by bitcoin was $8 million.

One reason for this rise in fees is network congestion. When there is network congestion, transaction fees rise, and using the network becomes highly expensive. When the transaction fees kept rising recently, most users had to switch from the Ethereum network to the Binance Smart Chain, while a few others switched to other Blockchain networks.

Records available yesterday show that 2.67 million transactions have been recorded on the Binance Smart Chain, while Ethereum recorded only 1.28 million transactions. One way that crypto influencers are suggesting might help reduce the high transaction fees might be the launch of eth 2.0 which should lessen congestion on the network.

Regardless of the huge transaction fees, decentralized exchanges built on the Ethereum platform continue to rise. In this year alone, over $120 billion have been processed by the DEXes.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.