EQUOS Review – Is EQUOS Scam or Legit?

EQUOS Review

The world of cryptocurrencies is one that has witnessed rapid fire activity from speculators because of its perceived value. In this EQUOS Exchange review, you will learn how the platform stabilizes digital assets and encourages traders to transact securely.

One reason for the irregular price changes of cryptocurrencies is the non-stop trading leverage of traders that increases the market volatility of Cryptocurrencies. Within three months, the volatility of Bitcoin, a digital asset, was nearly 8%. But that was between October 2017 and January 2018, three years ago.

Its price volatility doubled that in January last year within 30 days. Since speculators, traders, and institutional investors are never going to stop investing in Cryptocurrencies, trading or investing with a trusted exchange is an imperative. Because of the massive entrance of individual and collective investors in trading several Cryptocurrency assets, traders are basically looking for an exchange where they can trade clean. Investors and traders are not only looking for a safe exchange platform, they want to trust the exchange platform.

Trading on any Cryptocurrency platform requires a trading account. Before investors choose an exchange platform to conduct their trade, they want to know the transaction convenience of the exchange such as buying, selling and the general exchange of cryptocurrencies. Apart from trading convenience, the functionality, support, and reputation of an exchange platform are also important indices that investors take to heart before investing their assets.

In this Equous exchange review, we will shed light on the EQUOS exchange, unraveling piece by piece the specific elements that make the platform popular.

| Exchange Platform | EQUOS |

| Website | Equos.io |

| Traded Crypto assets | 5 |

| Registered Account required | Yes |

| Verification | Obligatory, 2FA, offline storage, SSL |

| Levels of Verification | KYC/AML FATF level, Crypto Provenance checks, and market integrity controls |

| Trading Platform | Web-based, Spot, Derivatives |

| Payment Method | Crypto and Fiat |

| Customer Support | Yes, email, Twitter, and Phone |

What is EQUOS?

EQUOS is a centralized Cryptocurrency exchange located in the heart of Singapore. It is an offshoot of Diginex, a parent company, the first financial organization running a full-fledged Crypto exchange that is listed on Nasdaq. EQUOS was launched on May 26, 2020. Although launched last year, this exchange is one of the leading exchanges out there.

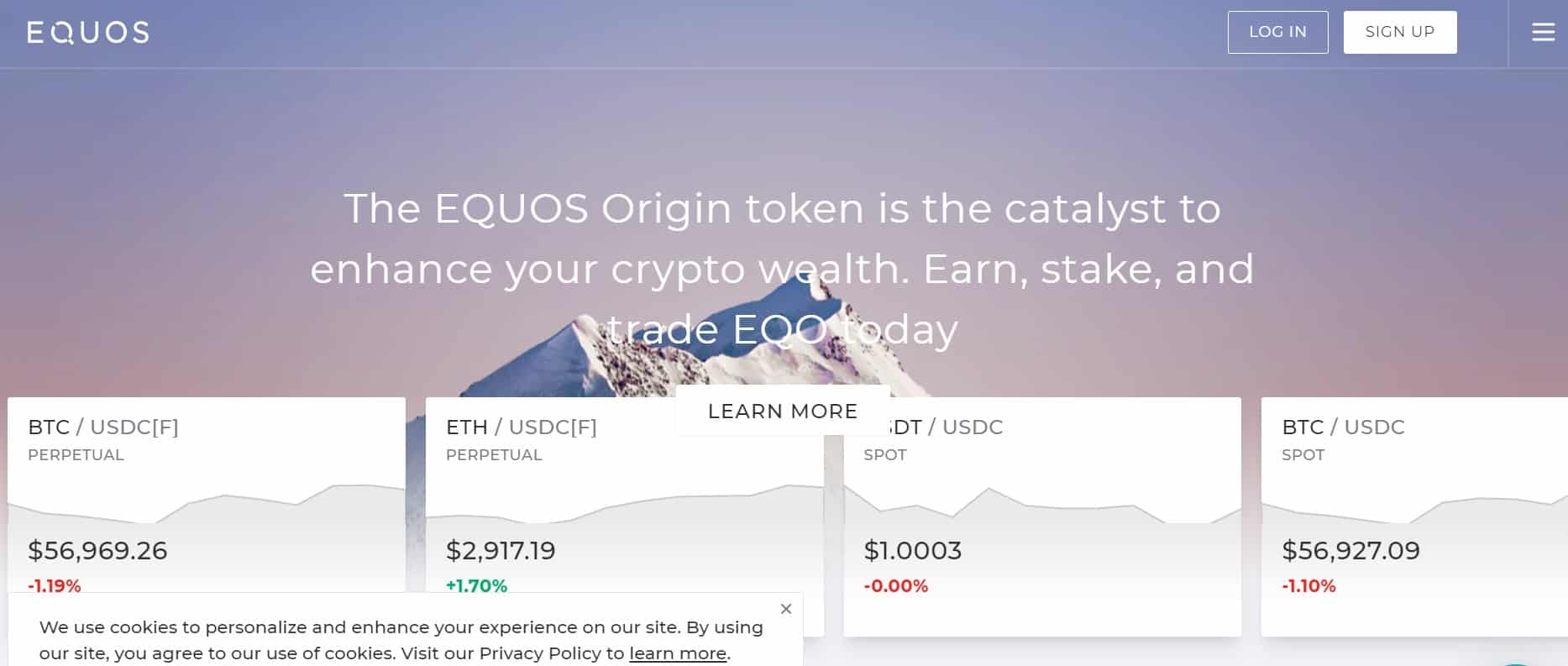

While EQUOS awaits a permanent license from the Monetary Authority of Singapore under the Money Services Act, the exchange runs a temporary exemption license. On the 8th of April, 2021, EQUOS Origin also known as EQO went live. EQUOS Origin is also the first native token of EQUOS.

EQO holders will receive several benefits such as subsidized trading fees, rewards staking, and significant earning from the interest margin. Since the inception of EQUOS last year March, their trading volume is up $70 million US dollars.

EQUOS Trading services

The trading platform of EQUOS is open to both amateur and professional investors. There is also the section assigned to the trading of Crypto assets. Once a trader registers and provides liquidity, the team at EQUOS is trusted to deliver with expediting your funds.

EQUOS Fees

One parameter to measure a performing exchange is transaction fees. Since traders are always rational about their investment and trading decisions, they rarely pick an exchange that charges high transaction fees for lower return on investment. Generally, an exchange with marginal transaction fees that guarantees profit in the long term is sought after. Users and investors should not pay through their nose before they can trade or earn profit.

Trading fees on EQUOS are charged on SPOT fees and perpetual Futures fees. EQUOS facilitate spot trade to trade securities for expedient or immediate delivery in the market at a particular period, usually in days. SPOT fees are obligatory in nature because they are fees paid to process transactions and Crypto facilitation. These fees are paid to Spot. First, a user places an order for a specific tier and period. For example, a taker trading the SPOT market will pay 0.090% taker fees for a 30-day trading volume that is below $200,000. A maker, who provides the much-needed liquidity on tier zero will pay 0.080% maker fees for a $200,000 trading volume. As the trading volume increases, the fees that takers and makers pay reduces. For example, a user who is a taker trading the SPOT market will pay 0.020% trading fees only for assets that are higher than %500,000,000. The maker’s fee for the same trading volume is 0.010%

EQUOS facilitates perpetual contracts that require settlement in the future. Unlike spot Cryptocurrency assets, trading perpetual contracts or assets is long term in nature, allowing traders to transact securely for an extended period. There are six tiers for trading the perpetual contracts on EQUOS. The liquidity provider trades the perpetual futures at no direct cost for all tiers. Only the taker will pay taker fees that reduces marginally as the trading volume increases down the tiers.

EQUOS also trades Stablecoin pairs. The maker will pay 0.010% fees for a 30-day trading volume. While the trading volume can be as low as $200 and high as %500,000,000, the maker pays 0.010% and the taker pays 0.010% for picking up the liquidity in the market for any period.

Getting an account with EQUOS is free. You are not paying anything at all. Likewise, the Crypto assets in your account are not unnecessarily deducted.

- Withdrawal and Deposit Fees

On EQUOS, any deposit on the platform, either cryptos or fiat, does not attract fees. EQUOS credits your registered account with the amount that you paid over-the-counter or through the blockchain. The only fees that will be charged are transfer fees, which are usually from the user’s or trader’s bank. Once transfer fees have been deducted from an initial deposit from the bank, the amount that EQUOS is credited with is usually smaller than the amount deposited.

Apart from transaction fees, EQUOS desires to bring customers and financial institutions together for trading purposes. They partner with a few banks such as Far Eastern International Bank (FEIB), Prime Trust, and Signature Bank. Depending on the trading volume of customers, these financial institutions are particularly helpful. For example, the Signature bank accepts large deposit. Therefore, customers that are making an initial deposit of $50,000 or more can use the Signature bank.

On the other hand, users can select their own banking partner by going to the Profile screen and making changes to the User Preferences section. Institutions can also choose their own banking partners for several Exchange accounts.

To do this, account administrators will tap Institutional Setting which redirects them to the Exchange Account Management display. From there, they begin to make changes to the account under Manage Account settings. Going forward, authorized people can choose a banking partner and also make FIAT deposit with the Institutional account.

Once your Crypto deposit has been validated, deposit and withdrawal are given a temporary status. For example, there are two deposit statuses for Crypto deposit; one is processing and the other, complete. A processing status means the user’s funds have been received and transaction request is pending. In essence, the funds undergo specific obligatory checks. Once the necessary checks are completed, the transaction status changes to complete which means that the funds can now be accessed in the user’s EQUOS account.

Similarly, there are four statuses for withdrawing Crypto. They are pending, processing, complete, and cancelled. There are four deposit statuses for Fiat; they are pending, processing, complete, and cancelled.

Users cannot place a withdrawal request once their withdrawable balance is less than the withdrawal fee. Usually, the amount a user deposits in an Exchange Account, depending on the purpose of trade, may have been debited. Transaction fees and unrealized losses for new traders may amount to a significantly low withdrawable amount.

All users including institutional traders are subject to a daily or monthly withdrawal ceiling.

EQUOS API

The Application Programming Interface on EQUOS is one of the best among exchange platforms. EQUOS accepts several APIs such as FIX Protocol, REST, WebSockets and ccxt library.

Any registered user can access API through FIX, WebSockets, and REST. Users also require an API username, password, and SenderCompID (which is a requirement to connect to FIX).

Their API encourages users to use real-time information through the Websocket feed. For developers, there is a documentation designed by EQUOS that determines how third party application interacts with the EQUOS exchange platform. Developers can use the rules of engagement in the documentation to create trading applications, and connect an existing application that they have created to the EQUOS Exchange.

Apart from its benefits to developers and those looking at blending EQUOS API into their business structure, the EQUOS exchange platform is open to all through the API. Users can leverage the massive APIs to create instrument information on the products that are traded on the EQUOS Exchange. The API also allows users to retrieve order history and earlier position.

APIs are particularly useful to automate trading activities. Users can check their balance, stream real-time market data, submit and manage orders. Not only can users fully automate deposit and withdrawal requests, they also replicate functions on the GUI web application using their API.

There is also a full support platform for users and developers to use the EQUOS API. Users can check their account manager or the integration support, check out the API documentation, and reach out to the API support team on their email.

EQUOS Limits and Liquidity

EQUOS encourage users to manage their exposure to risks with certain limits put in place. Users can trade spots and derivatives to leverage their digital asset transactions. The balance in a user’s exchange account must cover the transparent fees and the order’s value. On EQUOS, there are no order limits for trading Bitcoin. There is no minimum order volume for Bitcoin trade, likewise, is there no trade limit for trading Bitcoin for spot traders.

Also, EQUOS encourages users and traders to leverage their digital assets transaction and hence, placed no restrictions on order volume for spot trades. This is true for Bitcoin and other digital assets on the Exchange.

However, orders can be limited when a user assigns certain conditions like ‘set to buy’ when the price of the asset shoots past a particular point. Sometimes, a part of the limit order is executed where the remaining order awaits execution or cancellation by the user or trader. Also, when a scheduled maintenance happens, EQUOS cancels active limit orders.

Regardless of the digital asset that a user transacts on EQUOS exchange, the user can always leverage orders to manage risks and provide liquidity.

EQUOS Portfolios

Users and traders can manage their risks by leveraging the dynamic markets on EQUOS. There are two extensive markets: the Spot and perpetual trading markets. While Spot markets are short-term, Perpetual is long-term in nature.

Users can trade Bitcoin and Fiat currencies. There are other digital asset transactions such as ETH, USDT, BCH, and EQO. The market diversity of digital asset encourages users to spread their risks over short and longer periods.

Trading on EQUOS for a 30-day period has passed the $1 billion mark and is gradually speeding up to the $2 billion trading volume.

Compared to other popular exchanges, EQUOS is proving to pull its own weight with its market diversity. Traders can leverage their investment to reduce risk and tap into several markets to make profit.

Available Cryptocurrencies on EQUOS

Daily trading volume on EQUOS is about $6 million which means there is money in the market. Monthly trading volume is moving towards the $2 billion ceiling, this is a great indicator of high liquidity. The market liquidity attracts traders interested in trading for the short or long-term. With high liquidity, traders can effectively control transaction risks.

EQUOS supports USD fiat currency to be transacted on its platform. The Exchange trades 5 other Crypto assets such as Bitcoin: Ethereum, EQO, USDT, and BCH.

The launch of EQUOS token (EQO) on the 8th of April, 2021, imploded daily trading volumes on the exchange, but the wider range of asset pairs traded on EQUOS may have contributed significantly to the increase in trading volume.

Apart from Crypto pairings that are traded on the Exchange, traders can also manage their risks by trading Stablecoin. The value of Stablecoins is attached to a strong fiat like the USD, which means that the asset is not liable to volatility. Therefore, traders can minimize their risks by trading the Stablecoin.

Be aware of the trading regulations in your home country as regards trading currency pairs and Crypto assets. Regulatory requirements and trading laws of jurisdictions varies. Some countries support the trading of a few digital asset pairs while others outrightly disallow the digital asset trading.

Check the order book on EQUOS for more information about the trading of asset pairs; especially its validity.

User Experience on EQUOS

Traders can easily find the currencies they are trading and the type of trade on the EQUOS platform. The interface is very simple to use and users have said there is a professional feel they get on the trading platform.

There are also several trading tools for traders on the Exchange, such as the type of trade, asset pairing, and current market performance indicators of digital assets. Other features available are trade, book, real-time charts, orders, and history.

The order book is further broken down into columns showing the size of the digital asset, its bidding price and its asking price for specific trading volumes.

EQUOS Security

There is a satisfying guarantee of your digital assets on EQUOS. Every user has a feeling of security during their account setup. EQUOS runs an error-free account setup and management system for individuals and institutions that are trading on the platform. Trading institutions can create institutional accounts conveniently while adding authorized account users. Similarly, individual traders can set up personal and exchange accounts on EQUOS to facilitate their trading preferences.

Users choose how to receive emails from EQUOS and for the sake of security or personal choice, there is provision to disable how traders get toast notifications on the user interface. To strengthen security on its platform, EQUOS has a few browsers that it supports.

As part of the verification protocols on EQUOS, the team has put in place a verification system for individual accounts called Suspended Account and Dormant Account. A user uploads a means of identification such as a document or ID to initiate the identity verification process. As EQUOS runs a check on the details that you provided, the user may be asked for further information like an address, in addition to the identity details.

Identity verification for individual accounts happen at three levels. Once a user with an individual account has email address verified and accepted the terms and conditions on EQUOS, the user will earn level 1 clearance.

At level one, the user fully explores the EQUOS dashboard anytime. Also, the user can get customer support for any concerns about EQUOS. Users cannot deposit or withdraw Fiat and digital assets at this level of clearance, neither can they trade.

Once the identity verification process has been initiated, the user enters the second level of clearance where such individual can enter more personal data and upload an identity document. Providing personal information and details allows EQUOS to forestall illegal activity on your trading account throughout your trading activity. A level two clearance lets the user deposit cryptocurrencies and trade the Spot market; although withdrawing funds at this level of clearance requires the completion of the identity verification process. Traders with level two clearance cannot deposit fiat currencies, withdraw cryptocurrencies and fiat. They cannot trade on margin too.

To further enforce KYC measures, EQUOS disables the withdrawal of funds for level two users while identity verification remains pending. Individual accounts are suspended if the identity of the user has not been verified within a month. If the suspended account exceeds three months without the verification process being completed, the individual account is then terminated.

At level three, the verification process instigated at level two has been finalized. The verification of the user’s individual account is now complete. The user can now deposit, trade digital assets and withdraw on EQUOS without restrictions. Users at this level can deposit and withdraw fiat currencies. They can deposit and withdraw cryptocurrencies, and conduct spot and margin trades.

Usually, EQUOS decides to arrange a video call with the user if the details are insufficient for the identity verification process. If identity verification is not finalized within 30 days after the identity details have been submitted, EQUOS holds the prerogative to suspend transactions on the account temporarily. The temporary suspension includes deposit and trading where the user will be notified via email.

EQUOS closes an account indefinitely once the account has been suspended for 90 days. This is part of their compliance with regulatory policies and procedures, although they let a user know how to get funds out from a closed account.

Users know that their connection to the Exchange is secure once they see a ubiquitous padlock icon in their web browsers. The padlock feature means that the platform is encrypted with the SSL/TLS safety protocol. It is an indication that the communication between the web server and browser are encrypted. Therefore, the exchange of information is secure. Virtually no one else can modify or intercept the data exchanged over the browser or website.

To safeguard a user’s account and password, EQUOS requests two-factor authentication (2FA). On the Exchange, a user enters a username and password and further validates their account with extra security information before exploring their dashboard.

The user receives a 2FA code that expires whether it is used or not. The 2FA code is sent to the user via a text message or a very secure application that cannot be intercepted by a third party. EQUOS deploys TOTP that runs with mobile apps on users’ smart phones.

Users can download a couple of authenticator apps on the Apple Store and on Google Play. Some of the good ones that are compatible and secure for EQUOS are Google Authenticator, Authy, 1Password, and Microsoft Authenticator.

2FA is requested on the Exchange when security settings are updated, withdraw addresses are being whitelisted, and withdrawals are requested.

Customer Support

The support team at EQUOS is committed to improving users experience on the platform. The customer team does not conduct outbound calls to customers asking for their 2FA codes and password.

The support team is always available for your questions especially during the mandatory system maintenance schedule where all trading activities are paused.

Users submit their request to EQUOS through emails attached to registered individual accounts.

Updates to the EQUOS platform, general system maintenance, and fresh information about market expansion are shared on the twitter page of EQUOS. Personal requests and queries are not dispatched on twitter, but through emails.

- Phone

The customer support team conducts regular phone calls especially video calls during the identity verification process. Phone calls are also done for account closure and the recovery of an account.

Conclusion

In terms of trading volume, transparency and security, EQUOS is no doubt one of the best exchanges out there. In addition to these features, they have extensive tools that make trading very convenient for all users.

The user interface of the exchange is quite professional, which is a commitment to improving customer experience on the platform.

Traders can pick from a variety of digital assets to transact, including Stablecoins and asset pairs. EQUOS is a promising platform that will continue to make a mark in the future of digital assets.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.