Leading Financial Institutions Will Adopt Cryptocurrency Trading Soon

Bloomberg recently interviewed Vikram Pandit, a top crypto enthusiast, and investor, to seek his opinion on the possible broad adoption of digital currency. The top crypto investor opined that almost all financial-related firms and banks, including the largest ones, will soon join the crypto trading train and even expose their customers to it in the next few years.

Crypto Interest Will Continue To Soar

Right now, there is a lot of interest in digital currency trading by these financial institutions following BTC price’s surge above $65K and the US SEC’s approval of a first BTC ETF. Two years ago, banks would readily dismiss crypto trading, but most of them have now created departments dedicated to digital currency. Pandit cited the examples of Goldman Sachs and Australia’s common-wealth bank as large financial institutions providing crypto exposure to their clients.

Pandit has been actively involved in the crypto world through his investments in crypto exchanges. He opined that apex banks’ adoption of private virtual assets would enable greater adoption of the national virtual currencies.

The banker further said the adoption of private virtual assets would significantly improve the current fiat-banking practice and create an easier way for currency exchange. While some nations have adopted virtual currencies, the majority are still on the fence about it. El Salvador’s recent adoption of BTC as a legal tender makes it the first country ever to do so.

Elon Musk Seeks Public Opinion On Spending His $26B

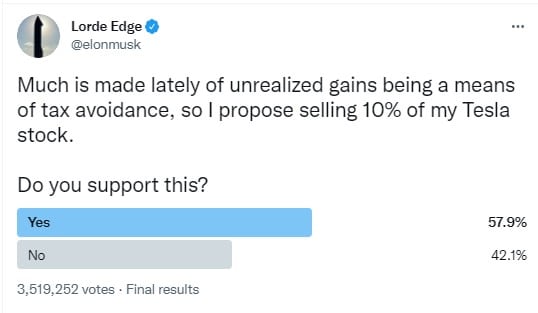

Electric car billionaire, Elon Musk, sought the opinion of his Twitter followers on what he should do with the proceeds from selling 10% of his Tesla shares. The Tesla chief had previously said his stocks’ sales are the best way to remit his tax payments. Musk’s Tesla shares are roughly 193m, and selling 10% of it will give him roughly $26B.

As of this writing, about 58% of the 3.5m votes support Musk’s idea. Elon Musk further remarked in a follow-up tweet that he wouldn’t disregard the results of the poll. Bloomberg billionaire data suggests that Musk’s net worth has grown astronomically, especially this year. Tesla shares rose significantly since the start of this year, and about 50% of his $340B net worth was earned this year. Musk also owns majority shares in SpaceX, with his holdings there estimated to be worth more than $120B.

Musk Should Invest In BTC

As the Tesla CEO is likely to have lots of cash soon, some crypto community members are encouraging him to invest in cryptocurrency. Chairman of North America’s Bitcoin Mining Council (BMC), Micheal Saylor, suggested that the electric car billionaire invest his incoming profits in BTC because it would protect him against inflation.

Despite enjoying protection against inflation, Saylor further said that Musk would enjoy other benefits such as a diversified investment portfolio. You’d recall that Tesla invested $1.5B in BTC following a friendly discussion between Saylor and Musk on Twitter late last year.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.