LTC20 Upgrade and Upcoming Halving Event Driving Bullish Market Trend

Key Insights:

- Litecoin’s upcoming halving event in August is driving a surge in active addresses and bullish sentiment.

- The interdependence between LTC20 and the halving event is crucial in forecasting Litecoin’s future performance.

- Technical indicators indicate a potential consolidation phase, but breaching resistance levels could lead to further gains.

Litecoin, a well-known digital currency, is preparing for an upcoming halving event in August. As a result, there has been a recent surge in the number of active addresses associated with the cryptocurrency. This sudden increase in activity has been attributed to the introduction of LTC20, an innovative upgrade that is shaking up the distribution of supply and wallet usage.

The interdependence between LTC20 and the halving event is essential in forecasting Litecoin’s future performance. Tracking these fluctuations is imperative to uncover potential prospects and hazards for traders and investors. By comprehending the influence of these two factors, stakeholders can confidently evaluate and decide on Litecoin’s future path.

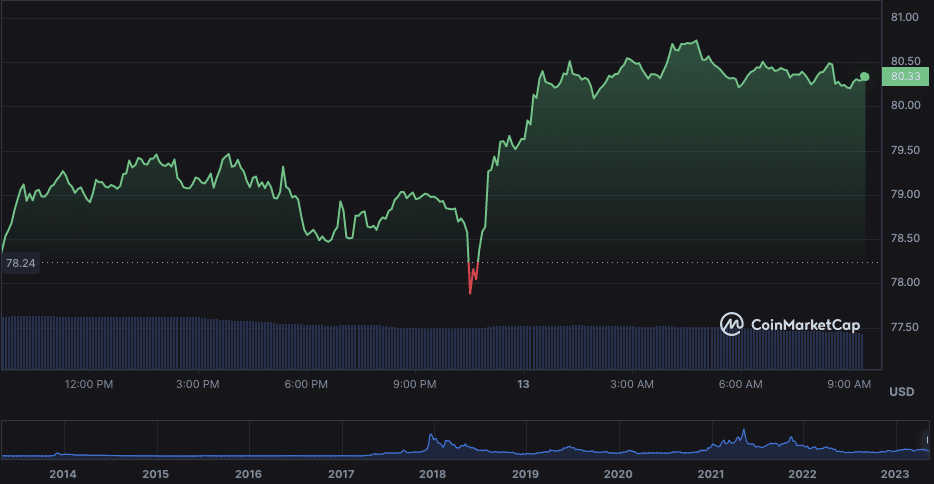

Based on the most recent Litecoin price analysis, the market has a significant upward trend. With the LTC/USD pair surpassing the $80.00 mark and reaching $80.32, buying pressure is rising. Over the past 24 hours, the coin has seen a gain of more than 1.96%, and it likely continues to rise to even greater heights in the coming days.

LTC/USD daily chart: (Coin market cap)

In the recent past, the market was under bearish sentiments, but now, the bulls have regained dominance. Today, the price was tested by the bears, and it dipped to $77.85, which is the current support level. However, the situation has now changed, and the bulls are in charge of the market. If the price breaks through the $81.00 mark, it would indicate a bullish trend in the market.

Recent market data shows Litecoin’s market capitalization has been valued at $5.85 billion, reflecting a notable uptick of 1.59 percent in the previous 24-hour period, indicative of a bullish market sentiment. Nevertheless, the trading volume has remained low at $439 million, suggesting a period of consolidation. Additionally, the overall supply of Litecoin in the market has expanded, with 79 million LTC tokens circulating.

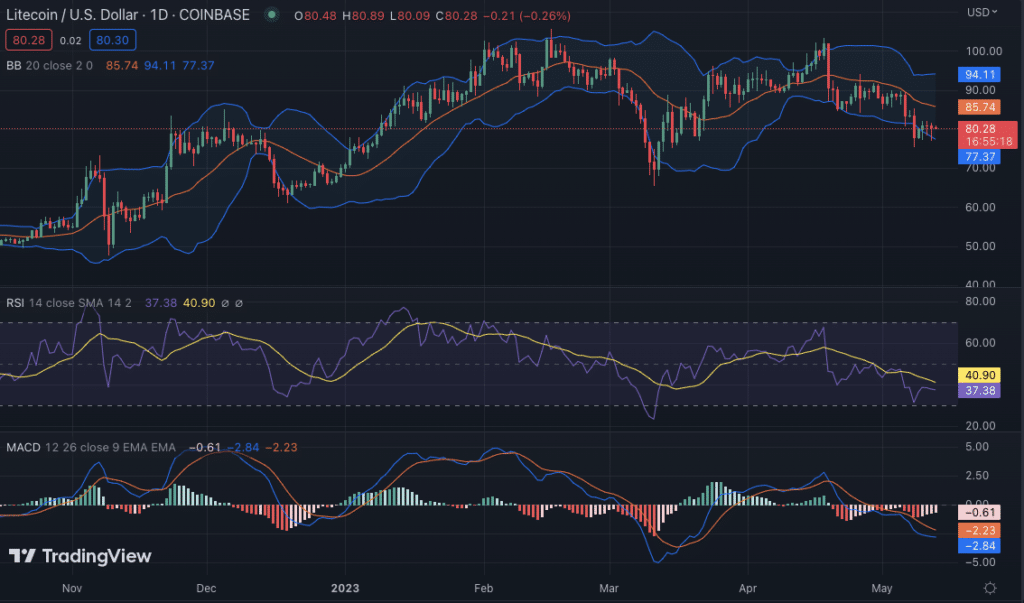

The current market trend appears bullish, as suggested by various technical indicators. For instance, the Bollinger bands have been gradually widening in the upward direction, which implies that the demand for buying has been on the rise lately. Based on this, investors may be targeting the upper Bollinger band at $94.11 as their potential next buying opportunity in the near future. Meanwhile, the lower Bollinger band at $77.37 could provide a cushioning effect for the market in any unexpected downturns.

LTC/USD 1-day price chart: (TradingView)

The present market situation displays an ascending trend in the Relative Strength Index (RSI), which currently stands at 37.38, indicating a neutral zone. The Moving Average Convergence Divergence (MACD) line is exhibiting a similar rise, pointing toward the possibility of increased buying activity. The histograms also shift towards the positive area, further supporting the optimistic market trend.

Conclusion

In general, today’s market for Litecoin shows a significant upward trend as bullish sentiment dominates. While there is evident buying pressure, traders are advised to exercise caution due to some technical indicators pointing towards a potential consolidation phase. If the current resistance levels are breached, buyers could potentially target $81.00. An essential factor to consider when predicting Litecoin’s future is the correlation between the surge in active Litecoin addresses and LTC20.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.