NFT Daily Sales Drop By About 61% Since Peak

After a peak some months ago, there has been a drop in interest for the non-fungible token (NFT) market based on various metrics. A nonfungible survey showed that this drop became rose sharply last month.

Various Metrics Prove A Decline In NFT

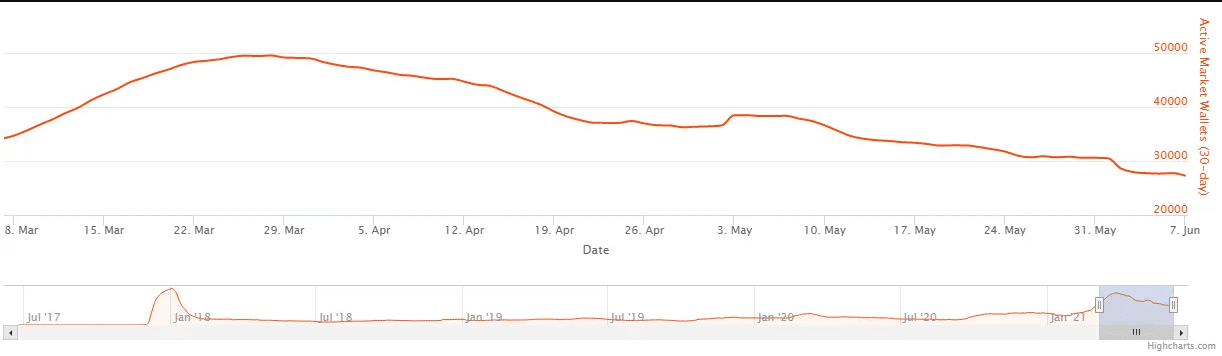

Daily sales declined by more than 61%, while the number of active wallets also reduced by 41%. These figures represent a sharp nosedive for this market space after growing in popularity since the beginning of this year. Almost all metrics showed that peak activity in the market occurred in April and early May 2021. This decline is reminiscent of the one that happened in the first quarter of 2018.

The number of active NFT wallets. Source:

Also, there has been a massive decline in sales; in April, the dollar value of sales was about $323 million but is now about $88 million. However, the number of sales remain stagnant at just 15,000 despite reaching about 25,500 early last month.

In the past seven days, the most popular NFTs (Meebits, Sorare, and Cryptopunks) raked in a total sum of $5.1 million. Out of the three, Sorare stands out as it is the only NFT with about 10,000 sales within seven days. Ethereum name service is its closest competition.

Meetbits NFTs contributed to the largest sales of the past seven days. Built by the popular larva labs, the voxel art-inspired NFT sold for $154 million; the second-highest sales recorded was $143 million.

Is The NFT Market On A Temporary Decline?

The NFT market has been on a rollercoaster ride since the beginning of this year, mainly because it’s attractive to the general audience and celebrities are involved. Even though almost everyone also became interested in the crypto market, especially the Defi world, interest in NFT was far greater than the interest in Defi and the general crypto market.

Could the drop in interest now be that the uniqueness in the NFT market is no longer there, or the recent crash in the entire crypto market is starting to affect it? The former doesn’t seem to be the case, as continued activity in the NFT market occurred throughout the crash last month.

What is clear is that various factors might be responsible for this dip. Yet, various NFT-related initiatives are still being launched as top firms in the crypto industry continue with their activities. The most notable mentions are christie’s auction and Sotheby’s.

NFT has also transcended offline, with various sports teams using it for exclusive features such as merchandising and ticketing. Major league baseball already has a licensing deal for NFTs, while Dynamo Kyiv (a Ukrainian football club) has also revealed that they would sell NFT tickets for next season.

NFT Could Worsen Art’s Money Laundering Problem

Meanwhile, art experts, especially David Hockney, believe that NFTs are for crooks and swindlers. However, using art to launder money isn’t an exclusive preserve of NFT; it has been an existing problem of the art world.

Last year, the U.S. Senate released a report connecting expensive art and money laundering. Owing to the rising popularity of NFTs, especially this year, the financial action task force has already proposed to categorize NFT trading platforms as virtual asset providers (VASPs) to combat the money laundering menace.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.