OFP Funding Review – Is OFPFunding Scam or Legit? (Complete ofpfunding.com review)

OFP Funding Review

What is OFP Funding?

OFP Funding is a proprietary trading platform that is owned and operated by FINTEKNOLOGY LTD based and registered in UK. A propriety or prop trading platform or brokerage company is when a firm allots funding to traders to allow them to make trades.

It means that you can open a pre-funded trading account for a small fee at OFP and get a chance to earn real profits. OFP reserves the right to mirror the trades taking place on an OFP account and make changes in it for accounts with a positive profit history.

OFP allow account holders to collect payouts or withdraw sprofits after every 28 days. Account holders at OFP can allocate their funds in various asset classes namely commodities, Forex, stock indices, bonds, and crypto CFDs. OFP traders can easily contact the customer support for queries and FAQs via various social media platforms such as TikTok, Telegram, YouTube, Instagram, LinkedIn, X, and Facebook.

Trading Options on OFP Funding

Commodities

Invest in Brent crude oil, WTI, natural gas, corn, cotton, orange juice, coffee, cocoa, wheat, soybeans, and sugar. Trade metals such as silver, palladium, and platinum against USD and gold against USD/EUR/AUD.

Cryptocurrencies

CFDs for 18 big market cap cryptocurrencies paired with USD including Bitcoin and Ethereum.

Bonds

Purchase US treasury notes, treasury bonds, UK long Glits, 10-year Japan bonds, BTP Italian bond, Euro bonds, Bobl and Schatz bonds.

Forex

Choose from 61 Forex trading pairs with options from diverse economic zones.

Indices

Invest in 23 of the most active stock market indices including China50 and Japan225.

How to Create an OFP Funding Account?

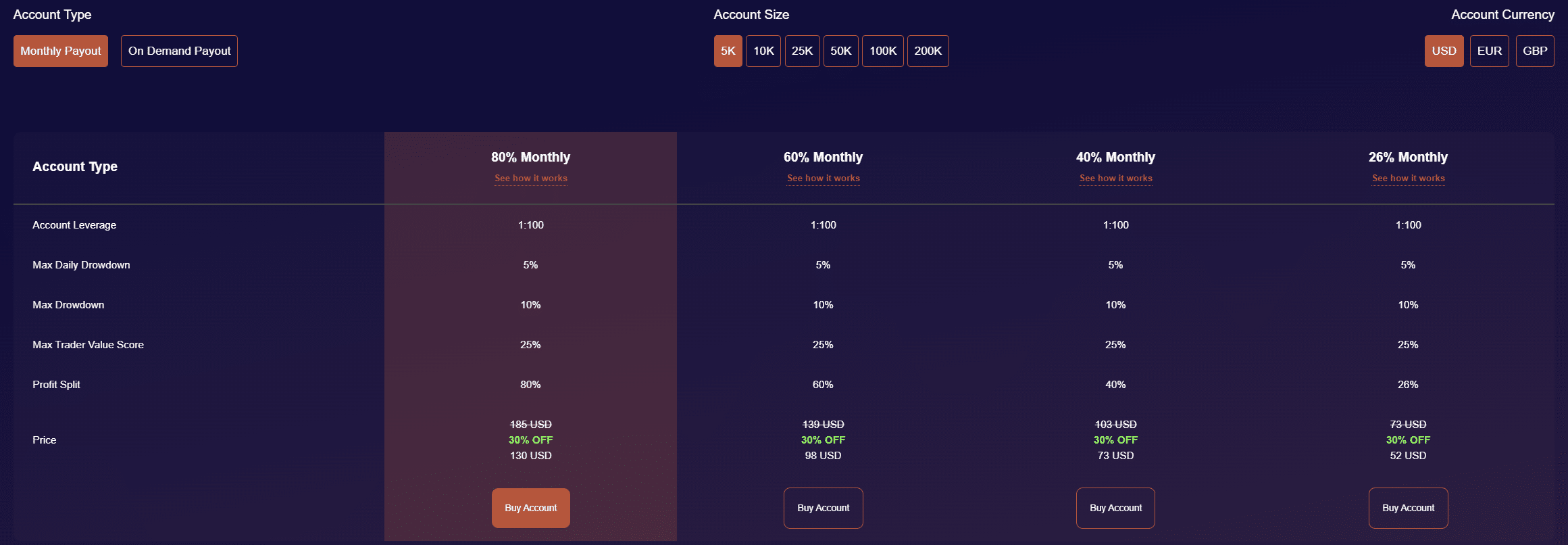

Users can sign-up on OFP Funding using their active email address. However, the important part is to figure out the fee and profit sharing structure when choosing a suitable account. It is important to note that OFP account is a demo trading account that traders opt to purchase for a fee. The fee is based on two factors namely funding capital and profit-sharing percentage. Here is the fee table that traders should recheck for changes before signing up:

| Funding Amount | 80% Monthly Profit Fee | 60% Monthly Profit Fee | 40% Monthly Profit Fee | 26% Monthly Profit Fee |

| $10,000 | $277 | $209 | $154 | $103 |

| $25,000 | $443 | $333 | $246 | $171 |

| $50,000 | $876 | $658 | $487 | $348 |

| $100,000 | $1,675 | $1,258 | $931 | $686 |

How to Trade at OFP Funding?

After purchasing a pre-funded demo account, traders can start devising trading strategies and placing their bets on available investment options. The account holders are subjected to daily margin payments, shared during the account creation process.

Traders who are in profit can collect payouts after every 28 days. Traders have to close all open positions before the next payout deadline otherwise it is added to the next payout date.

Some account holders can change their profit sharing ratio later by paying a preset fee for the switch. OFP has defined three golden rules that all account holders must abide:

OFP Rule#1: The total account balance and equity should not be below the difference of daily max balance and account margin.

OFP Rule#2: Maximum withdrawal limit is set at 10% of total initial funding capital.

OFP Rule#3: This is called Trader Value Rule whereby per day P/L ratio exceeding 25% since first day of trading or last payout. In case, the P/L ratio rises above 25% the payout maybe postponed until next account review date.

As long as OFP traders follow these rules, they can continue to generate risk-free profits with pre-funded trading accounts. The amount of profits a trader can generate is up to their skills, experience, knowledge, and capacity to learn.

OFP Funding is best for traders who wish to improve their trading skills or test out various types of investment strategies. However, it is important to keep in mind the following trading styles that are forbidden at OFP:

- Gap Trading

- Grid Trading

- Hedging

- Latency Arbitrage

- Long/Short Arbitrage

- Martingale Trading

- News Straddling Trading

- Reverse Arbitrage

- Reverse/Opposite Account Trading

- Tick Scalping

Advantages of OFP Funding

- Trading risks or fund losses are bore by the funding organization.

- A huge list of day trading strategies allowed such as scalp and news-based trading.

- A wide array of trading assets such as stocks, commodities, bonds, cryptocurrencies, and forex.

- Users do not have a set profit target to keep accounts active.

- 100-1 Leverage Ratio.

- Support for MetaTrader4 and MetaTrader5 platforms.

- User-friendly dashboard with technical analytics, fundamentals, and market updates.

- Disadvantages of OFP Funding

- Does not offer Expert Advice (EA) automation trading support like MT4 and MT5 platforms.

- External copy trading option not available.

- Takes time to learn the intricate rules and trading restrictions.

Conclusion

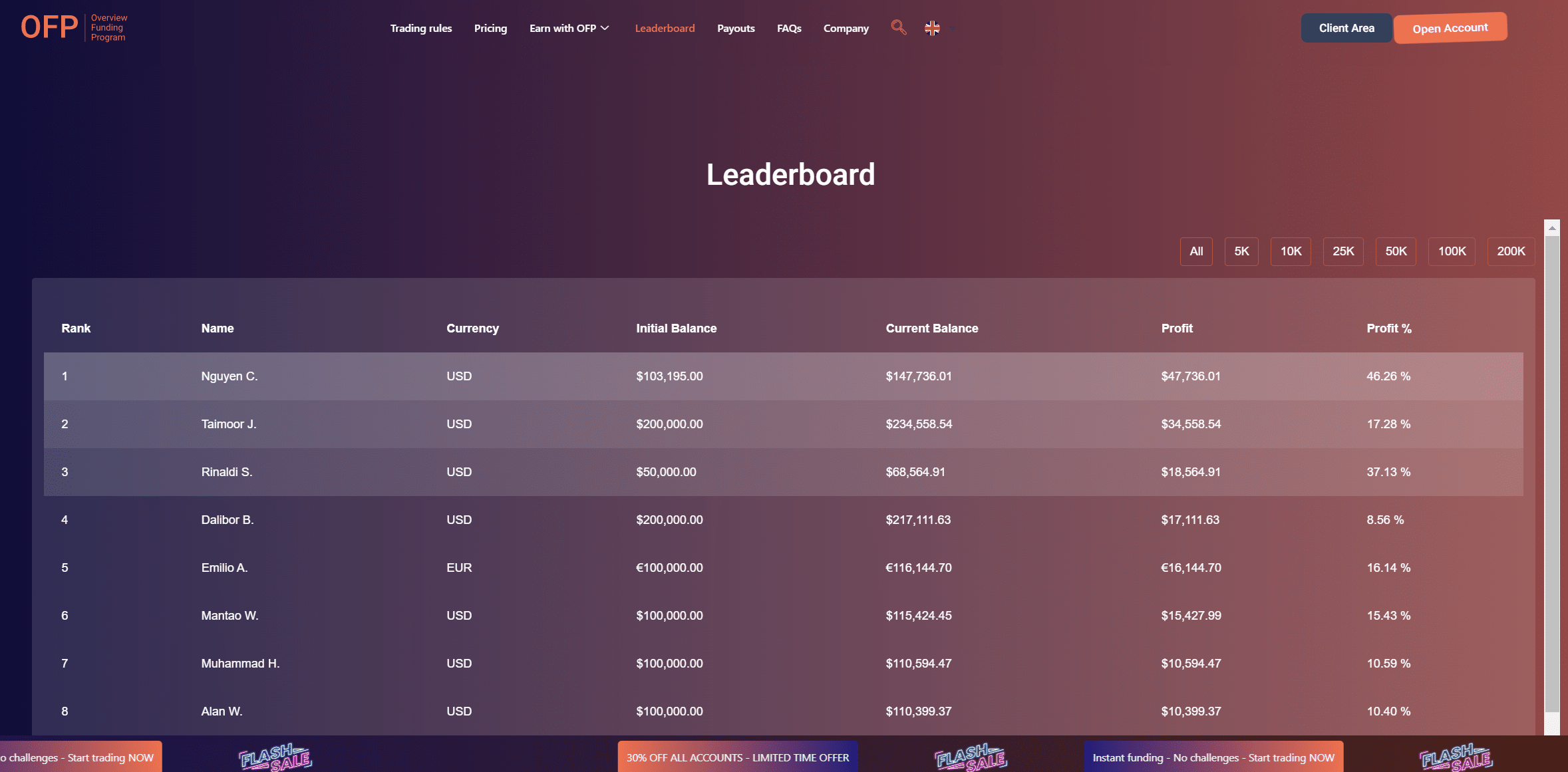

OFP Funding is one of the best trading platforms that are suitable for investors who are looking to test out new trading strategies and examine the market. It is a low-risk trading option that allows the investors to start making profits in real-time and grants them valuable experience.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.