Square set to launch a Bitcoin-centric DeFi developer platform

Square, the payment platform founded by Twitter CEO Jack Dorsey, is planning to add another business venture to his portfolio. The new business will be centered on bitcoin.

Although the details from his tweet on July 15th were little, Dorsey made it clear that Square plans to establish a platform where developers can create DeFi projects that are centered around bitcoin, and give users full control of their funds. He also said the project will be open-source, like the BTC hardware wallet it plans to release. He added that Mike Brock, Square’s strategic and development lead, will pick and lead the team.

In the tweet, Dorsey signifies that Square is set to create a new division alongside its older divisions like Seller, Tidal, and Cash App. The aim of this new division is to make it easier to develop a DeFi platform that gives users have total control over. The project will be called TBD. No one knows if that means the project is called TBD or if the name is “to be determined” at a later date.

TBD’s aim is to focus on developing a platform that will be open-source as we go, Dorsey stated. The tweet garnered mixed responses, with some stating that Ethereum already fulfills that role. They claim that this is another unnecessary attempt at reinventing the wheel.

A look at Bitcoin DeFi

Square’s decision to focus on bitcoin is an interesting one, as there are currently no smart contracts on BTC’s network, giving ETH the chance to dominate with DeFi projects.

Historically, users have called bitcoin less effective and slower than its ETH counterpart. But with bitcoin expecting to receive its first big update, called Taproot in November, perhaps ETH will no longer lead the DeFi race.

Taproot is a BTC soft fork upgrade promising to bring users more privacy, security, and lighter transactions. The Taproot upgrade will help reduce transaction costs and increase the networks’ scalability, giving bitcoin-based DeFi the boost it seriously needs, which Dorsey is hinging TBD on.

Despite the pandemic last year, Square saw its revenue increase by more than 100 percent, a situation that is due to the crypto-related transactions made on its p2p payment platform for mobile devices.

Ethereum Still Holding the Defi Front.

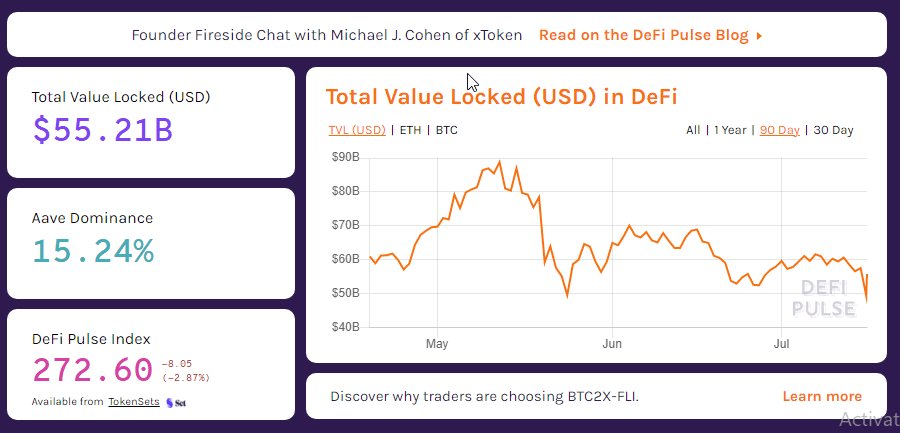

DeFi is still mainly Ethereum’s playground, with ETH-based projects leading (TVL) charts. According to DeFiPulse, the total value locked on all DeFi projects is about $55 billion.

Live TVL chart from DeFiPulse

Despite Ethereum’s dominance, there is an ever-growing demand for DeFi projects centered around bitcoin. The fact that Wrapped BTC has a market cap of about $6.3 billion highlights this demand.

One of the complaints about ETH-based DeFi projects is the gas fees. If Bitcoin-based DeFi projects have lower gas fees, then ETH will face some serious competition. Will Square’s TBD will help bitcoin wrestle DeFi dominance from Ethereum? The answer is still unknown. Either way, it promises to be an exciting future for DeFi and the overall crypto community.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.