It is often a significant hurdle to generate momentum and attract investor attention in a bullish crypto market. However, the hurdle becomes more significant when the market is on a downtrend like we have witnessed recently.

Despite this recent decline in the entire crypto market, one coin (Perlin, PERL) has managed not to experience the dip. Instead, PERL rose from about $0.053 to about $0.135 between June 8 and 18, 2021, a remarkable 150% increase in price. Also, its average 24-hour trading volume rose sharply from $3.5M to approximately $123M.

PERL/USDT chart. Source: TradingView

Three factors are responsible for PERL’s fast price rise and demand. These are the listing of PerlinX on the Binance Smart Chain, the availability of the Perl.eco registration ledger, and enticing staking options for token holders to make profits from several cryptocurrencies.

The “Planetary Ecosystem Registration Ledger”

The PERL price experienced an astronomical rise after the firm released its “planetary ecosystem registration ledger” (also called the Perl.eco), making it possible for real bioecological assets to be tokenized.

Perl.eco release announcement. Source: Twitter

The official reason for the release of the Perl.eco, as announced on their blog, is an “effort at democratizing the biosphere system via liquidity pools, tokenizing carbon credits, and biodiversity in the decentralized finance (Defi) space.”

A side benefit for PERL wallet holders is that they will be entitled to airdrops of tokenized carbon credits.

Once the tokens are released, holders of these airdrops can trade the liquidity pool with it or use it in any other way as specified.

Also, the PERL will become the official governance token of the ecosystem. Hence, holders can exercise their rights when vital decisions regarding the PERL ecosystem are being taken, such as votes on distribution and model fees.

Perlinx Launches On The BSC

In mid-April this year, PerlinX (the project’s Defi platform) was launched on the Binance Smart Chain (BSC) to reduced transaction fees. Also, this BSC listing automatically meant that PerlinX’s liquidity pool was listed on the PancakeSwap. Consequently, the PerlinX ecosystem had access to more excellent farming opportunities.

Also, yields earned from protocols on PancakeSwap are paid in that protocol’s cake token. Thus, PERL liquidity holders can redeposit their earnings in the Perlin pool and earn more PERL in a compound interest fashion.

The combined effect of these factors led to an increase in the demand for PERL.

PerlinX offered PERL holders still on the Ethereum network other yield options such as simple staking, liquidity pools between PERL and USD coin (USDC), Dai (DAI), balancer (BAL), and Binance USD (BUSD), and wrapped ether (WETH).

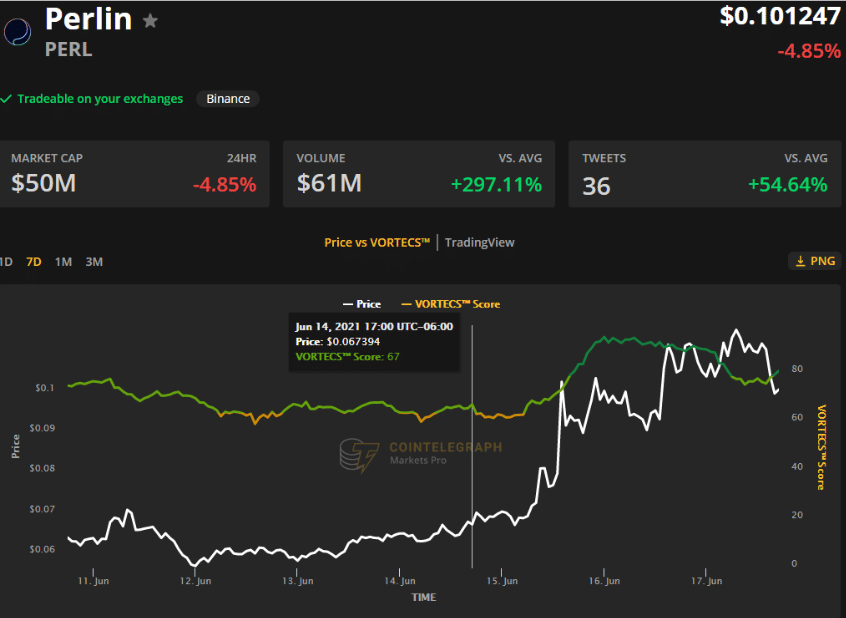

The VORTECS score (a Cointelegraph trademarked app) shows that market conditions remain favorable to the PERL.The VORTECS score compares past and present market conditions by combining several data points like Twitter activity, recent price movements, trading volume, and market sentiment.

VORTECS Score Perlin Chart. Source: Cointelegraph Market Pro

Perlin and its Perl.eco platform could solve the environmental concerns regarding crypto mining – a hot debate that continues to dominate discussions in the crypto community.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.