Veteran Chinese crypto journalist, collins Wu has suggested bitcoin hashrate may never achieve its previous all-time high, which it attained last month.

Bitcoin Hashrate Tanks by More Than 50%

After reaching a new milestone of 171 eh/s around the middle of last month, the bitcoin hashrate has continued to plummet and is now 50% of that historical peak. The primary cause of the drop is the ban on bitcoin miners in major bitcoin provinces in China, especially Xinjiang and Sichuan, which are the top bitcoin mining centers in the country.

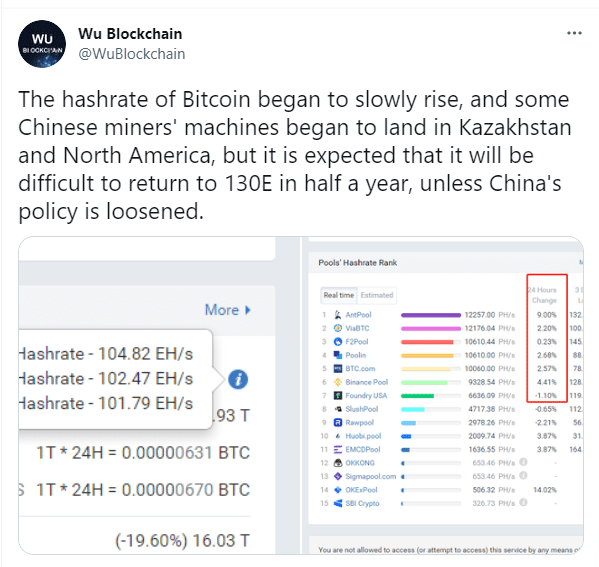

The ban has caused bitcoin miners to migrate from China to countries with a friendlier disposition towards bitcoin mining like Kazakhstan, Russia, Canada, the United States, particularly Texas and other central Asia countries. However, Wu opined that the bitcoin hashrate is likely to keep declining for at least another six months, except Chinese authorities softens its forceful stoppage of mining operations. It is worth noting that the hashrate has been rising steadily.

Collins Wu Tweet. Source: Twitter

The Decline in Bitcoin Hashrate Impacts Bitcoin Price Negatively

The low BTC hashrate has led to a low bitcoin price. The leading cryptocurrency decline below the $30,000 price on June 22. But it quickly bounced to about $35,000, and as of this writing, it trades around the $31,000 range.

Deputy president of Foundry (a crypto mining firm), Kevin Zhang, has said that he expects at least 85% of Chinese miners to stop operations totally by the end of this month.

Is Bitcoin Mining About to Be Highly Profitable?

The oldest crypto mining pool, the slush pool, has suggested the number of recent block times may push bitcoin’s difficulty to a maximum negative adjustment of 26%. The adjustment rate is the metric that measures the level of difficulty for miners to mine new blocks and receive rewards.

At the current 21% drop, the rate is already bitcoin’s largest difficulty adjustment. But it will lead to the greatest increase in profits for miners. Slush pool predicts that other ASIC miners will enjoy massive profits beyond even the most hopeful estimate for this year.

Slush pool states that “ASICs that remain online will enjoy a rising value because there are hundreds of thousands of ASICs in trucks, cargo ships, planes and warehouses which cannot be utilized at this moment.” An example is the Antminer S19 Pro which will start mining 87,000 Satoshis daily once the subsequent difficulty adjustment is complete next week.

Bitcoin Continues to Trade Under Pressure

Despite surpassing its monthly and quarterly expiry, bitcoin remains under pressure. It has declined by over 8.5% and still trades around the $31,000 range. Hence, there is an 8% decline in the market cap of the entire crypto market; it stands at about $1.27 trillion now.

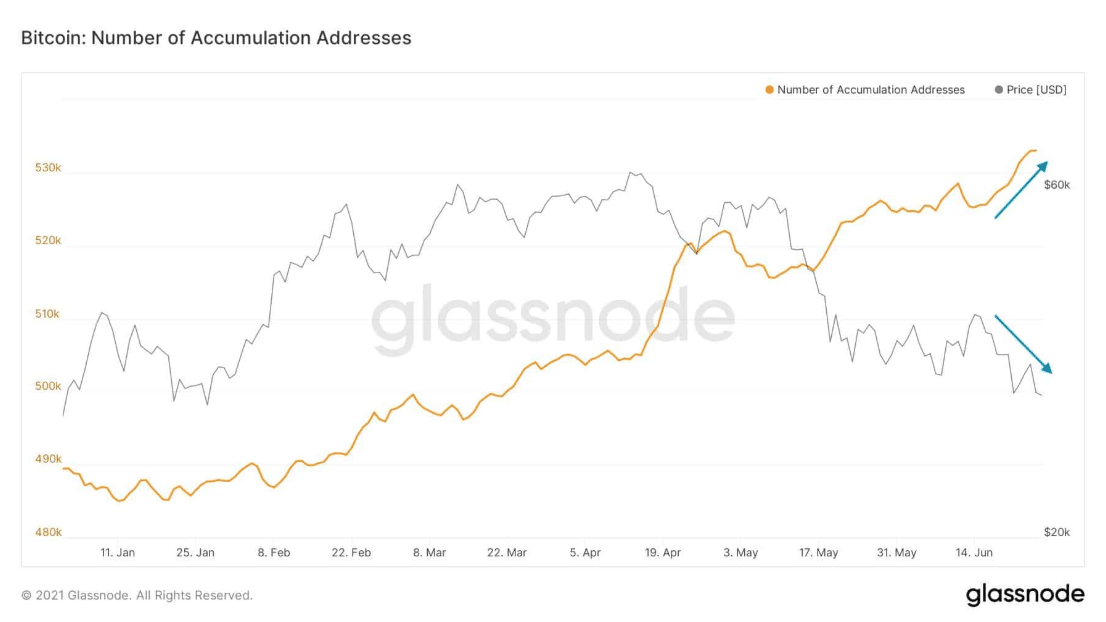

Regardless of these circumstances, the number of buying addresses keeps rising. A Glassnode chart reports that the bitcoin price and the buying addresses are in clear opposite directions. Since buying addresses are rising, the supply at exchanges is falling already. Is the bull around?

Glassnode buying addresses and bitcoin price chart. Source: Glassnode

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.