With the recent dip in the crypto market and ensuing turnaround all within the space of a few days, the past week has been a rocky one for the community. While many people seem pensive about the next move Bitcoin and by extension, the market might make, crypto analytics platform, Glassnode, has come out with some good news.

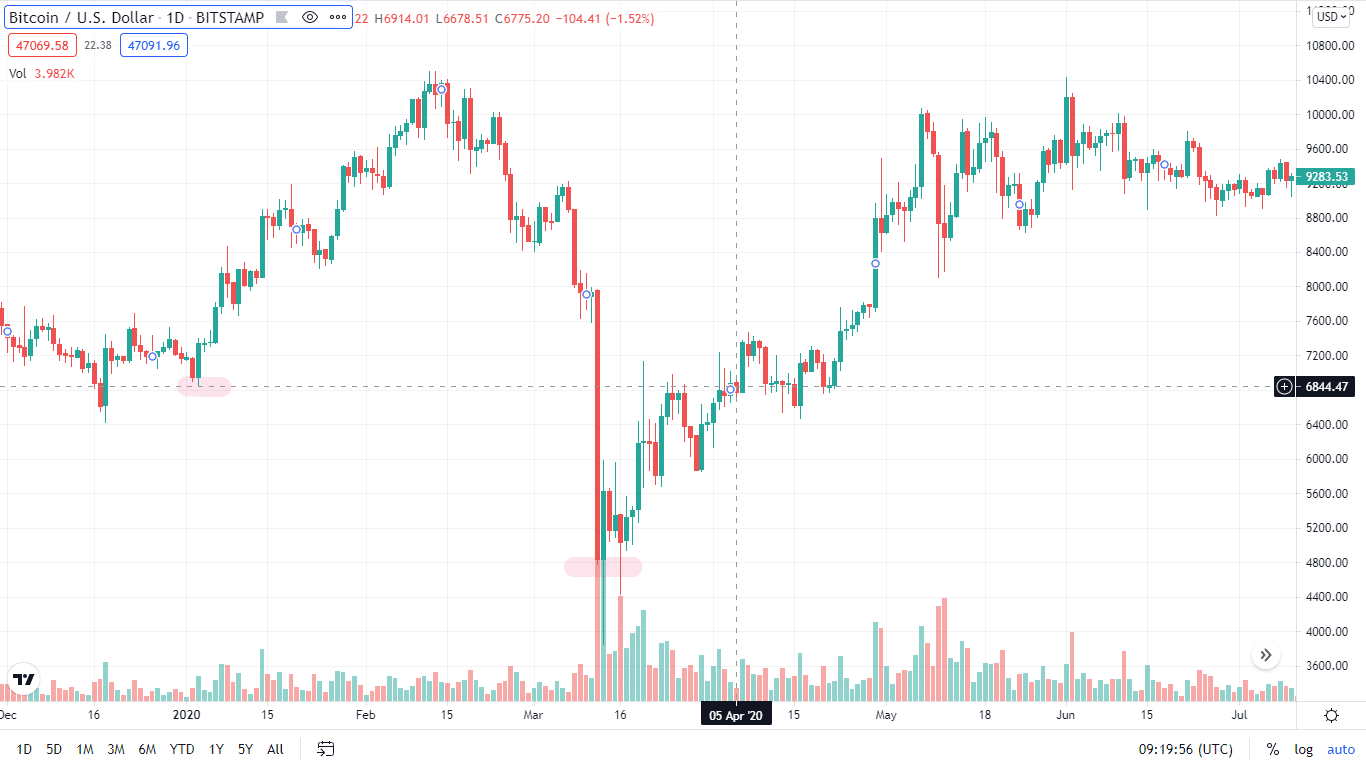

Taking a look at the Bitcoin hash ribbon shows that the 30-day moving average has recently crossed above the 60-day moving average forming a “golden cross”. The golden cross serves as an indicator that short term transaction rates are beginning to go against the previously established trend in the market. This particular cross for the hash rate has been a relatively reliable precursor of upwards price moves in the past. It foreshadowed a rally in January 2019 as well as three separate rallies in 2020.

BTC/USD 2020 Chart showing January & March Rallies. Source: TradingView

Hash Rate And Its Reliability

Hash ribbons are a mining-related term created by Founder of Capriole Investments, Charles Edwards. Simply put, they are an indicator of the amount of computing power currently going into mining of new blocks in the blockchain. Mining is a very intensive process requiring large amounts of computing power and as a result, large amounts of capital to maintain. As a result, miners have to strike a balance between the amount of power they use and the amount of income they gain.

Miners are rewarded for every new “block” of transactions on the network they completely authenticate which allows them to continue their work by balancing the income they get with what they require to keep mining. Due to this, lulls in the market where transaction rates are low cause many miners to reduce the amount of computing power they are putting into the network at that time in order to cut costs and maintain their profit margins. As previously stated, this reduces the overall network hash rate and makes it a reliable indicator of price movements.

The coding of the network done by anonymous Bitcoin creator, Satoshi Nakomoto however, corrects for this problem by reducing the difficulty of mining to ensure a block continues being mined every ten minutes. The hash rate eventually levels out at an equilibrium or “bottom” before it begins to rise marking increased transactions once again happening on the Bitcoin network. The combination of all of this serves as a reliable indicator that network activity is on the rise and a possible rally could be incoming.

Experienced traders are able to read these signals and capitalize on them before the price rallies solidify and make large profits. Some reports believe the newest increase in mining activity could be as a result of miners previously forced to move out of China by increased regulation have finally settled down in more conducive environments.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.