Bitcoin is hovering below the mark of $8,500 that is very alarming for the crypto traders. Some experts claimed that it will go down further and then bounce in the upward direction. The lower target will be at $7,400 that will act as a strong support level.

But on the other hand, some have given very optimistic statements about the future of BTC. The coming year is the period of BTC halving that will inflate the value of BTC. The support at $8.030 might act as a strong trigger and will push the value towards the green zone.

ETH/USD

The most voiced coin after bitcoin is Ethereum the volatility of it dismantled the minds of many traders and investors. After calculating the data at the start of the week informed us that the value is stable and there are minor ups and downs in the trend line.

The parabolic movement from 14 September to 24 September had pumped it with green gas but then it shattered again towards the low position. It is currently running at $173.83 with a 2% increase since the beginning of the day. According to our technical analysis, the arrow is heading towards $175.

XRP/USD

The third rank on the top list of digital assets is the Ripple that is displaying a greenish flag high than out of all top members. You can estimate its jump in the upward direction by knowing that the market starts from $0.24 and now it is standing at $0.26. The successful movement is represented by the 8.13% boost in the given value.

The Ripple is stable from some past days. This is so because it has made partnerships with a lot of financial firms and companies which supported it to be stable. It is reported to Tokenhell recently that Binance is adding XRP staking for its customers. All these factors lead to the market gain of XRP.

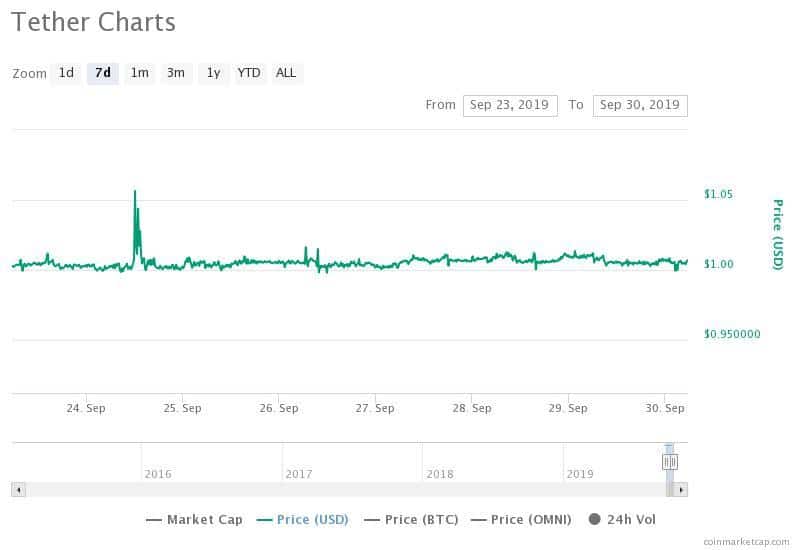

USDT/USD

The price value of Tether is standing at $1.01 at the time of writing. Since it is backed by the US dollar there are very fewer chances of volatility. According to a report, almost 320 addresses control 80% of Tether supply.

It is reported to Tokenhell that in order to reduce the bumps of volatility, the Libra cryptocurrency is also going to be backed by fiat traditional currencies the same as Tether. In these fiat currencies, the US dollar will back the Libra as it filled the 50% space in the reserve basket of Facebook’s cryptocurrency.

BCH/USD

The technical condition of Bitcoin Cash is not very satisfactory as it dips in the bearish trend from some past days. However, the 24-hours data unveil that the value is stopped to remain in the bearish trend. Rather, it has shown a slight recovery of about 2.50%. It is expected from the coin that it will make a great jump in the next coming days. It might outshined the Tether in the future and attain the 4th rank in the Coin Market Cap.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.