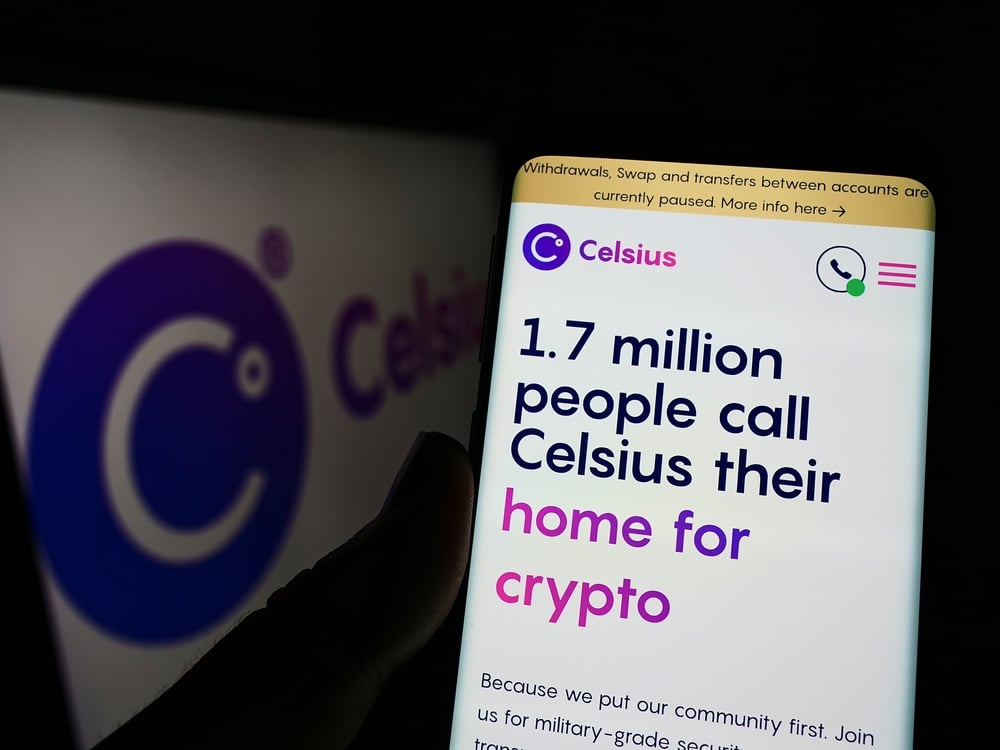

Celsius, a crypto lender recently declared bankrupt, is looking to raise funds to repay its creditors by selling credits and coupons for the Bitmain mining firm, worth $14.5 million. This proposed deal was filed with the New York-based Bankruptcy Court on Friday.

The filing states that the deal includes coupons worth $7.3 million and grants holders a 25% discount on future acquisitions of Bitmain’s mining equipment. However, Christopher Ferraro, Celsius interim CEO, explains that these coupons will expire six months after they are bought and will be worthless afterward.

Ferraro adds that the coupons’ value on the secondary depreciates massively as they approach their expiry date. Therefore, holding these coupons in hopes that you will realize more value when you sell them in the future would be a big mistake.

How Credits Work in the Mining Industry

Further, Celsius stated that it would be selling Bitmain credits worth $7.2 million. When a mining company places a large order of mining machines, they get delivered in bunches, and payments are made in installments.

However, since Bitcoin and energy prices can change in value during order fulfillment, the order value may drop below the amount that the company has paid. Therefore, the mining firm issues credits to make up for that difference. In addition, unlike coupons, credits don’t expire.

Bitmain credits used to be transferable until a few weeks ago when the firm adjusted its terms of service, making the credits untransferable. Ferraro says monetization of these credits is in the best interest of their creditors and debtors’ estates.

Creditors Committee Rejects Celsius Request for Deadline Extension

Last week, the Celsius committee of creditors rejected the lender’s request to extend the deadline of its restructuring plan. In addition, a trustee from the US Justice Department, William Harrington, who is assigned to oversee the administrative process of the bankruptcy, supported the committee’s decision.

Harrington argued that the rate at which Celsius attorneys were using the lender’s assets was a solid reason to reject the deadline extension. Previously, the bankruptcy court had given the green light for Celsius to sell its stablecoin holdings worth $18 million to shoulder administrative costs.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.