Bitcoin Below $70K After Drop Wiped $1.3B BTC Open Interest

Bitcoin lingered lower on June 7, after a “doubly strange” U.S. trading session, with BTC price support in question. BTC circled $69,000 on June 8 as traders recovered from a snap sell-off.

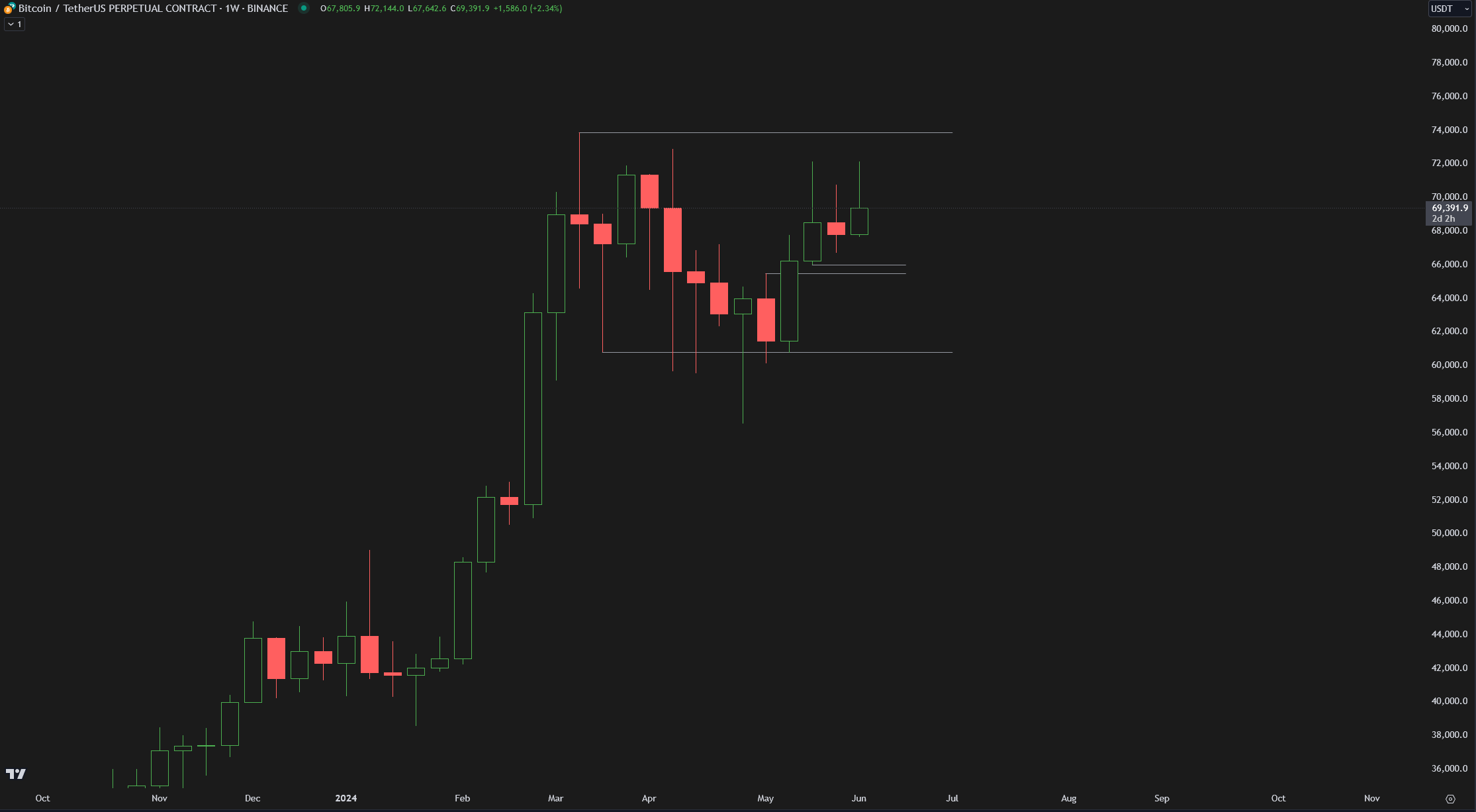

Data from TradingView showed Bitcoin stabilizing into the weekend. The flagship crypto endured abrupt volatility at the opening of Wall Street on Friday thanks to what was called “schizophrenic” United States employment data.

That was then compounded by a rout in altcoins, which came because of market reactions to a livestream published by pseudonymous investor Roaring Kitty. BTC/USD saw local lows of $68,450 on Bitstamp, while Ether (ETH) briefly dropped below $3,600.

Responding to the last 48 hours’ events, trading company QCP Capital called the U.S. session “doubly strange.” It was confusing enough to trigger a risk-off ahead of US inflation numbers and FOMC on June 12, 2024.

QCP referenced next week’s macro data prints, which include the Consumer Price Index (CPI) together with the Federal Reserve meeting to determine the real interest rate policy. QCP continued:

“Followed by a Roaring Kitty live stream which had almost a million viewers, during which GME stock price crashed. It was probably not a coincidence that Alts and Memecoins started collapsing as well with over $40 billion wiped in market cap.”

The company nevertheless highlighted local lows on ETH and BTC as “a good opportunity to buy the dip” according to the future Fed moves possibly benefitting risk assets.

Critical BTC Price Levels Form

Reviewing critical levels, the crypto market analysis seemed to look to the monthly open near $67,500 as the level to hold as support if market weakness continues.

A popular trader Crypto Chase wrote in part of his latest X posts:

“Lots of coins are at do-or-die levels IMO, these are the types of trades I like. If we lose all these levels, we lose the current HTF bullish bias to a degree IMO. BTC holding 64-65K would be the last hope before destruction.”

A possible silver lining came in the form of a leverage flush across Ether and Bitcoin. Another trader Daan Crypto Trades noted that Bitcoin lost nearly $1.3 billion in Open Interest on this drop. Ether also lost almost $800 million for a total of over $2 billion for just Ether and Bitcoin.

Previously, other reporters commented on global liquidity trends already supporting Bitcoin’s price to explode to all-time highs in the coming weeks.

Bitcoin Network Transaction Fees Surges To Almost $52 Briefly

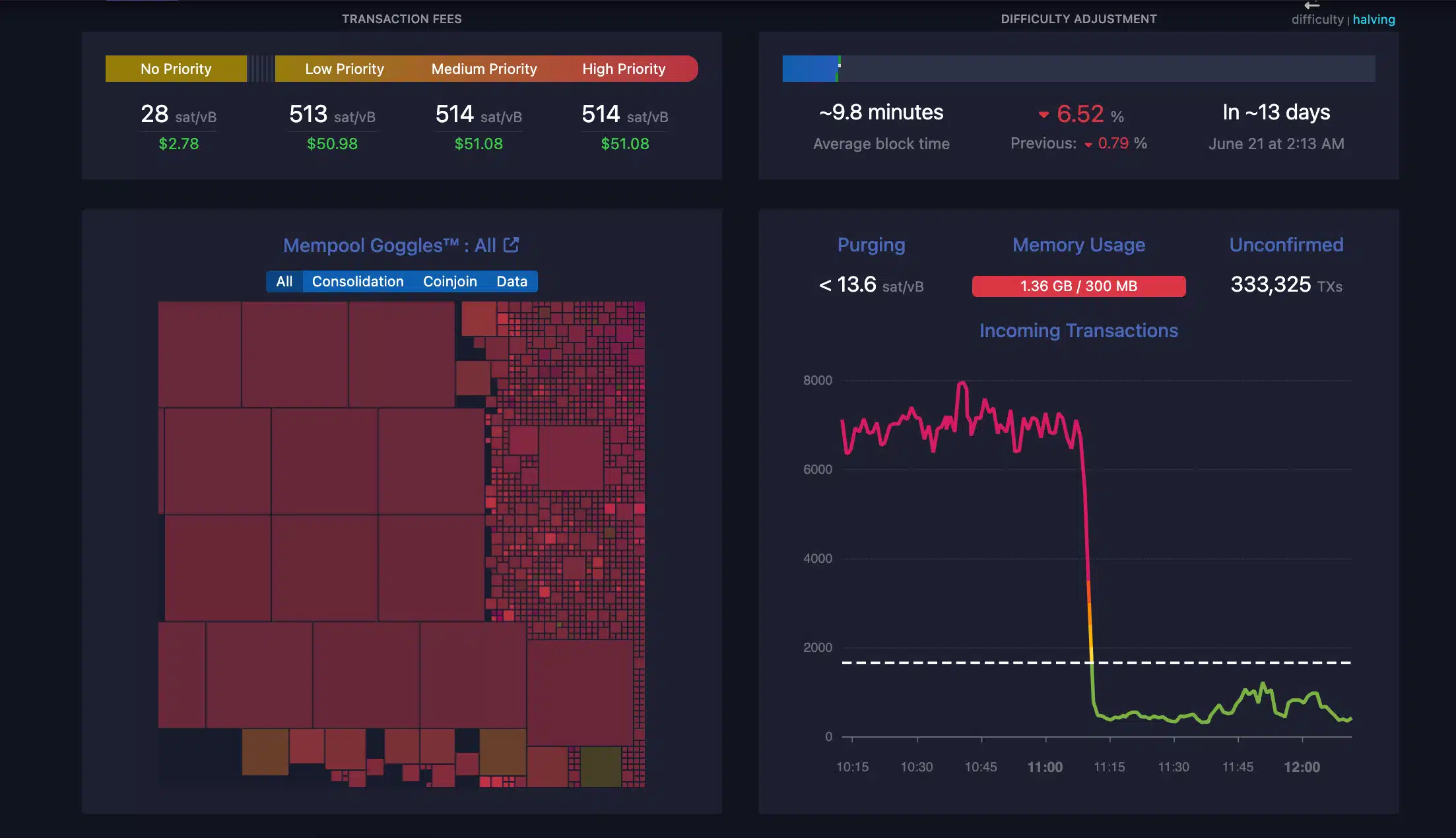

The network recorded temporary congestion because of more than 300,000 unconfirmed transactions waiting to be processed on June 7. Notably, the network experienced a steep surge in network fees pushed by 332,000 unconfirmed transactions.

Network fees at the time reached 514 sats for high-priority transactions coupled with 513 sats for low-priority transactions, with prices increasing to nearly 520 sats per transaction earlier in the day. In US dollars, this translates to $50–$52 in fees per transaction. Priority fees have since dropped to nearly $46 per transaction.

Based on a renowned blockchain reporter Colin Wu, the unconfirmed transactions are suspected to be the result of centralized exchange OKX collecting and sorting through wallets, although this was not confirmed by the time of publication.

Post-Halving Economics And The Challenge To BTC Miners

Issues surrounding miner difficulty, high network fees, and miner profitability on Bitcoin’s network have come into sharper focus after the April halving event. The cutting of the block reward from 6.25 BTC to 3.125 BTC has majorly affected miner profits.

Bitfarms has reported a 42% plunge in mining revenue for May, the first full month since the halving. The Bitcoin mining firm highlighted in its end-of-month report that 156 BTC was earned in May compared to 269 BTC in April.

The Bitcoin miner also explained that the temperatures in its Argentina facility were strangely low in May, recording some of the worst weather seen in 44 years. The poor weather conditions caused the firm’s Rio Cuarto facility to shut down for eight days, contributing to a drop in the cumulative number of Bitcoin mined.

Since the beginning of 2024, BTC miners in the US have spent up to $2.7 billion on electricity despite the increased computing difficulty and lower rewards. Based on an observation by analyst Paul Hoffman:

“Since the start of 2024, Bitcoin mining in the U.S. has consumed an enormous 20,822.62 GWh of electric power.”

He added that the energy consumed by Bitcoin miners since the beginning of the year could power 1.5% of US households for a year. In April, it took up to $52,000 to mine one Bitcoin. After the halving event, the cost of mining a single Bitcoin has increased to nearly $110,000.

Experts believe these are some of the factors hindering Bitcoin from surging to a new all-time high.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.