CEO and founder of Ark Investment, Cathie Wood, shares her views on bitcoin mining and its energy consumption in a recent interview. She acknowledges that the problem is a vital one, yet insists that it is only temporary. Wood believes that getting rid of the energy-intensive miners is healthy for the crypto space, and it’ll allow the renewable mining community in the US to flourish.

In her statement to CNBC, she recognized that the shutdown on crypto miners and traders in China played a key role in Bitcoin’s declining price. Still, her overall sentiment for the number one cryptocurrency remains bullish, and she believes that the price will make a shocking comeback soon.

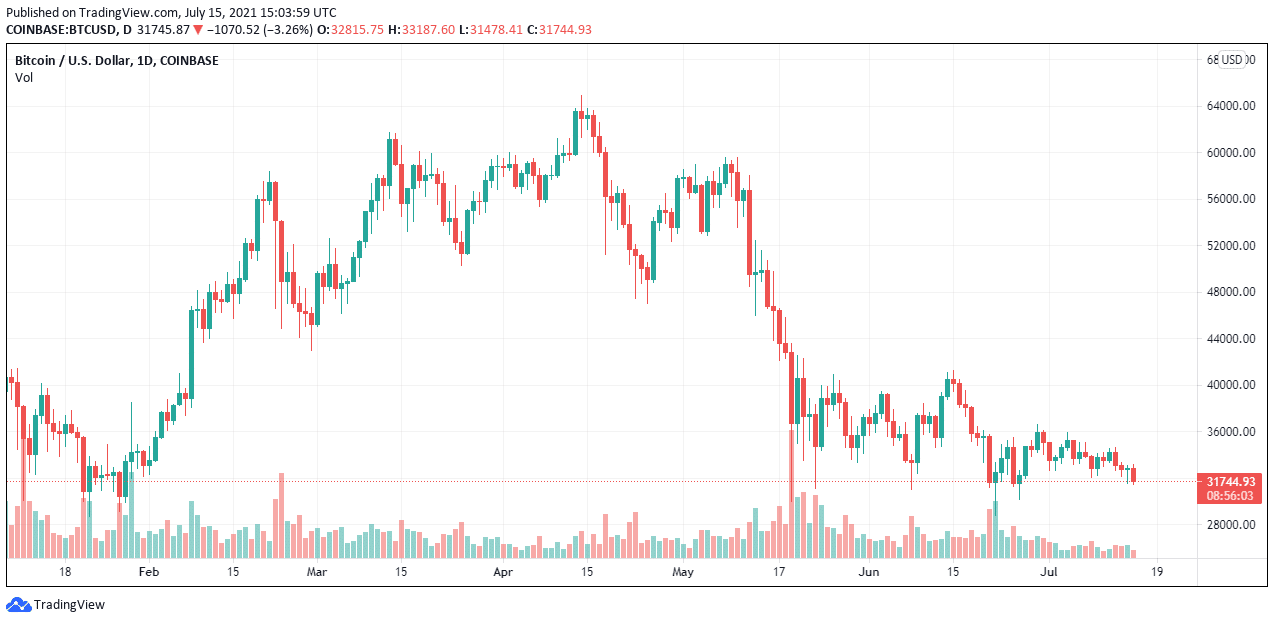

Live update of Btc price from TradingView

Tesla Set to Resume its Bitcoin Payment Plan

Tesla and SpaceX CEO, Elon Musk dropped a tweet on Sunday that saw Bitcoin’s price rising by over 9%. The tweet hinted that Tesla would accept bitcoin transactions as payment when more miners use renewable energy. In his tweet, he stated that Tesla will continue bitcoin transactions once there’s a reasonable confirmation (at least 50 percent) of clean energy usage by miners.

Elon Musk stopped bitcoin payments for Tesla back in May, listing environmental hard from crypto mining as the cause. He stated that the company plans to look for other environmentally friendly crypto alternatives. Following the statement, the market saw heavy price corrections, with bitcoin dropping by more than 11 percent.

Two months later and it appears that Musk, and by default Tesla, is ready to give bitcoin another chance. He also repeated that the company only sold 10 percent of its bitcoin cache in April, meaning that Tesla has not sold any more bitcoin since then, even with the bearish performance in the market.

Last month, Musk met with several North American miners to discuss ways to make bitcoin greener. He has called the proposed steps “promising.” For now, the crypto community watches and wonders how he plans to confirm the miners’ clean energy usage. Still, the tweet gives bitcoin enthusiasts and holders hope that they’ll see Tesla accepting bitcoin as payment soon.

GBTC Continues Unlocking of Shares

Cathie’s energy consumption statement came as GBTC continues to unlock its shares, a process that has been ongoing all week. Ark Invest currently owns a 1.25 percent stake in GBTC meaning they own about 8,685,452 shares or $258,913,324. According to a CNN business investment sheet, Ark Investment holds the largest amount of GBTC shares.

According to J.P. Morgan, the unlocking of GBTC shares may cause institutional investors to withdraw their investments, causing lower BTC prices. FNY Investment, another GBTC shareholder, reportedly sold off some shares, reducing it from 2600 to 750 shares. The company also bought some GECT (Grayscale Ethereum Classic Trust), increasing its position by 20.

The remarks from Cathie have investors trying to guess if Ark Investment or any other major investor intends to sell its GBTC shares like J.P. Morgan predicted, seeing as they believe BTC will drop to $23,000.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.