The investment procedure is getting more and more complicated as Blockchain investors are going to present new criteria for funding decisions that we call Revenue Generation.

Some good numbers related to the quantity of money flowing into blockchain since 2013 which have more than $23 billion accumulating into early-round investment are revealed in a current report.

The report of investments in Blockchain release date corresponds with the launch date of Outlier Venture’s first Base Camp program to “support the development and growth of new technologies in the open data economy”.

Geographic regions and vertical segments of the industry are seeing the investment beyond the early stages of investment because of the shift that is taking place.

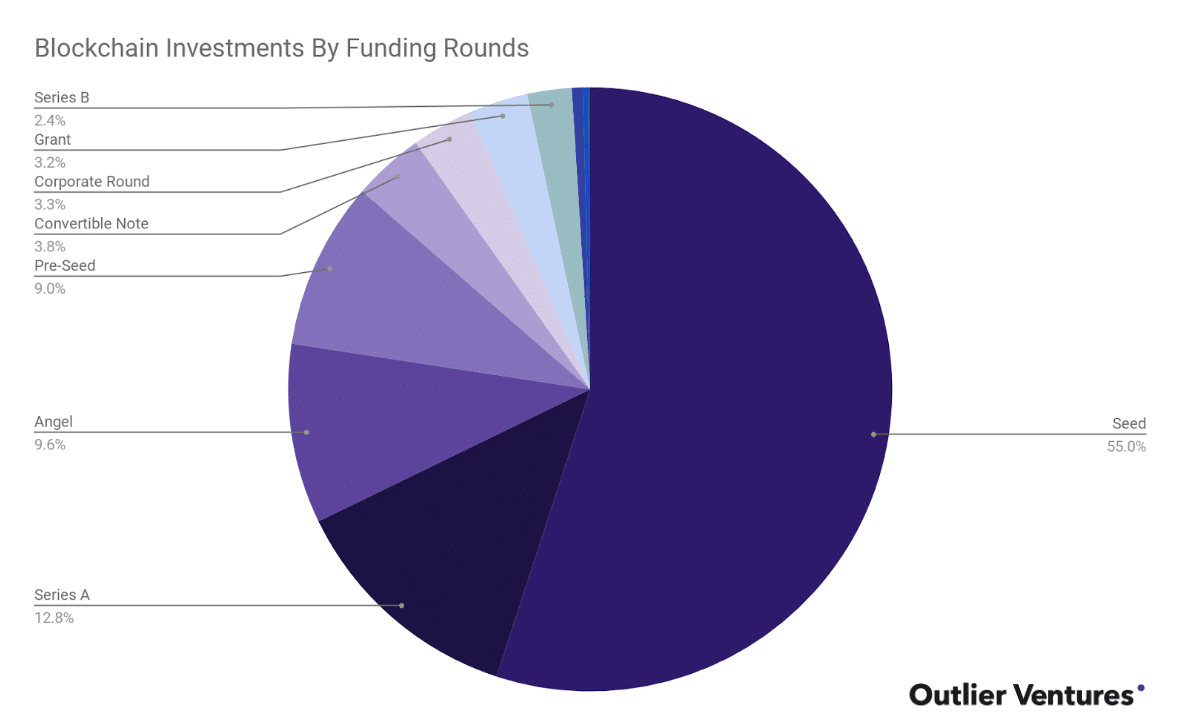

The number of companies who have invested for blockchain projects in early-round fundraising is 3,378 but the later round of investments eventually came down.

Mostly the investment has been done through ICOs which involve debt, crowdfunding, and direct investment as well. The report says that there has been no involvement of major application except of few changes and wallets.

Early-stage financing for Blockchain

A research analyst, Joel John, says elaborate at Outlier Ventures that the early-stage development requires more expertise and guidance. As he says:

The heavy stage in early-stage financing for blockchain-based startups means a large number of investors provide nothing more than capital

courtesy: Outlier Ventures

There have been massive returns from early investments in Bitcoin and Ethereum having more than 75% of all deal flow with focused on early-stage rounds. This is the reason that early funding has been easy.

Recently, it does seem that Ventures Capital investors need revenue generation before they continue their further investments because they say that without proper guidance, it is a hard task to do a profitable business.

Role of Shift in investment priorities

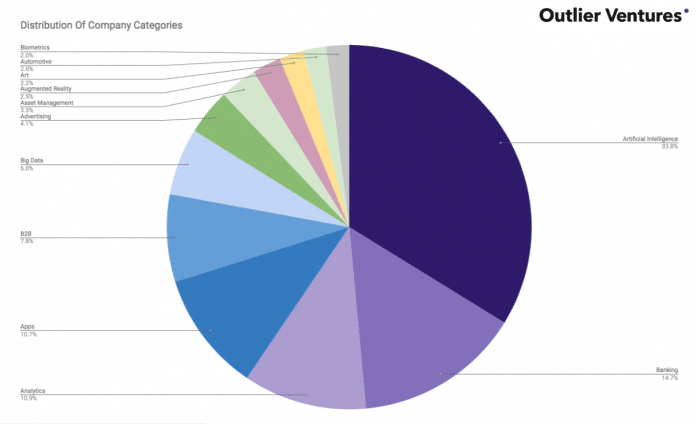

The report says that moving from cryptocurrency to convergence applications, there is a shift developing in investment priorities. Al and Fintech lead the charge in this case with data analyst and ownership.

Self-sovereign identity is also showing their interest because of recent exploitation scandals and breach of data.

Competition for Backing

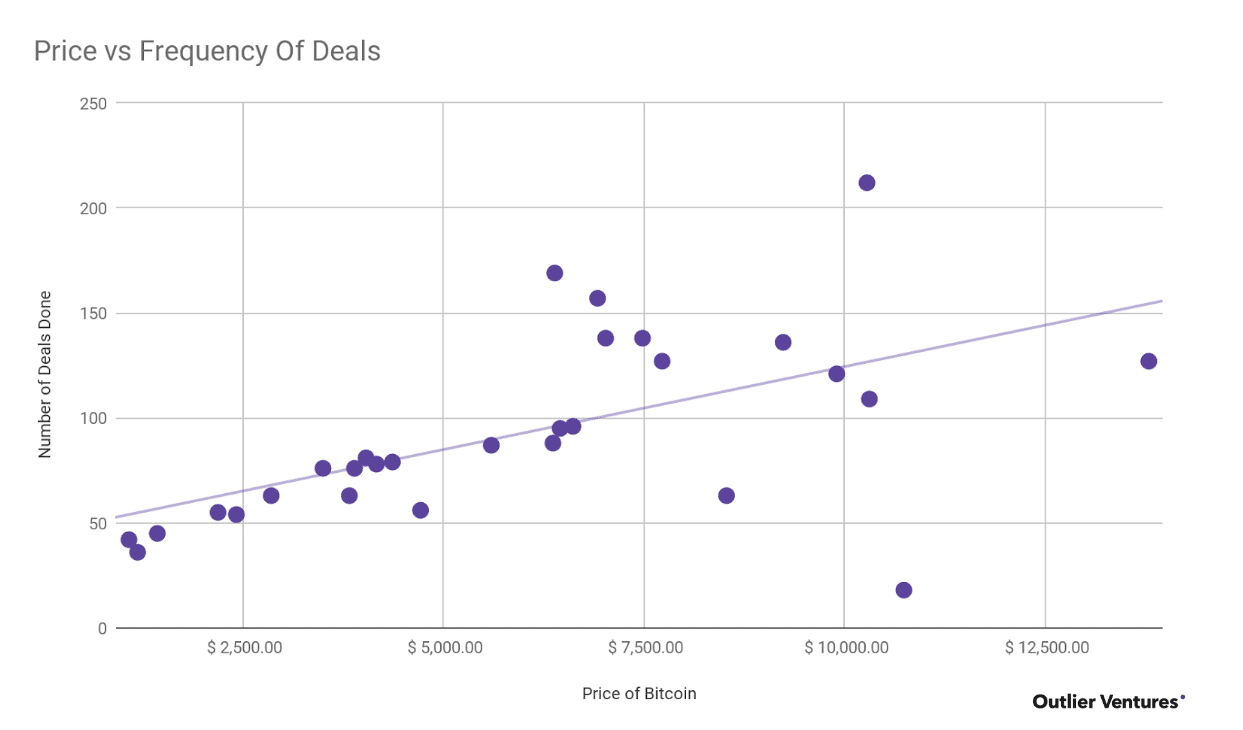

The report says that startups are competing for a smaller handful of backers because of some bearish conditions. To get a strong backing there may arise a competition between projects in a bull cycle.

As BTC price increases, the frequency of early-stage deals also increases. But the most important thing for projects is that they have to bear the expertise and value-added services on which teams rely upon during the bullish stages of a bull cycle.

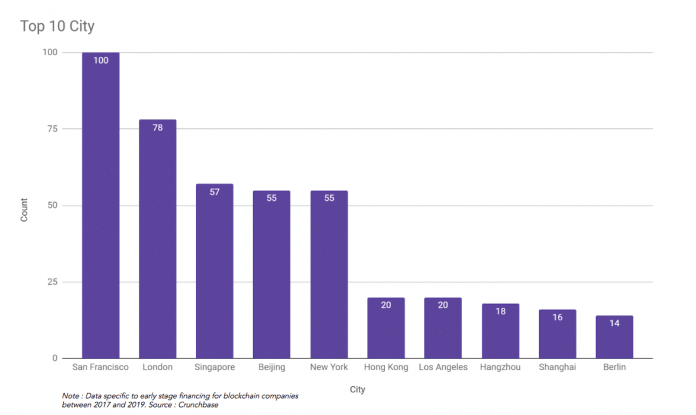

Importance of Location

Lastly, the report concludes that in investment location does matter because in blockchain-friendly regions it is easy for the company to raise funds successfully during follow-on rounds. In this part, the United States is on the top, second most is San Francisco, New York on fifth and on the seventh spot is Los Angeles in the world.

Since 2013, more than $1 billion is raised by blockchain companies in London and they have got the Vibrant Fintech hub as well which means that the UK is now going up.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.