Ether (ETH) might be ready to set a new all-time high after launching the first spot Ether ETFs, but $3,500 remains a considerable resistance line to cross in the near term.

The price of Ether could be on track to hit a new all-time high as the sector is almost seeing the launch of the first spot Ether exchange-traded funds (ETFs), which might happen as soon as next week.

Ether To Hit New All-Time High After ETF Launch

Ether’s (ETH) price seems to be preparing to reach a new all-time high after introducing the first US spot Ether ETFs, as highlighted by Matt Hougan, the CIO of Bitwise.

Hougan highlighted three primary reasons for Ether hitting a new all-time high, including ETH’s Inflation Rate, since Ether stakers are not selling like Bitcoin (BTC) miners, and 28% of Ether supply is already out of the market.

Based on a July 16 blog post, Hougan wrote:

“Ethereum’s inflation rate over the past year is exactly 0%… Significant new demand meets 0% new supply? I like that math. And if activity on Ethereum ticks up, so does the amount of ETH being consumed. That’s another lever of organic demand working in investors’ favor.”

Other factors also point to an imminent rally, including the number of Ether withdrawals from centralized exchanges, as stated by crypto analyst Leon Waidmann.

This analyst wrote in a July 19 X post:

“$126M worth of #ETH was withdrawn from exchanges this week, signaling massive accumulation ahead of the ETF launch. Next big $ETH rally incoming.”

$3,500 Is A Major Resistance

Nevertheless, Ether futures currently show minimal confidence in the chance of ETH rising above the $4,000 mark in the near-term. That remains the case because the $3,500 zone is still a major resistance.

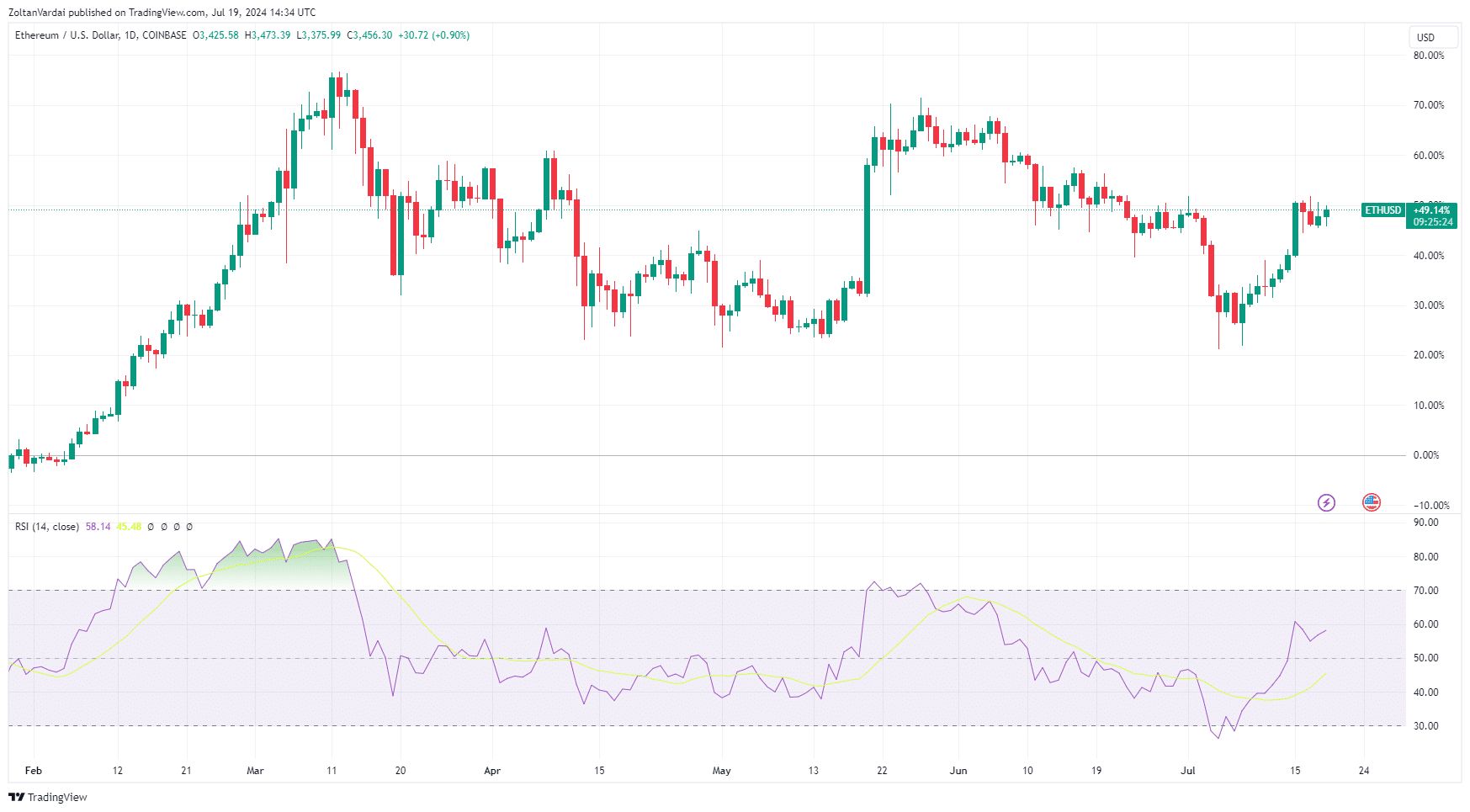

Ether’s relative strength index (RSI) also indicates that Ether’s price must cool down before it rallies to hit a new all-time high. Looking at the daily charts, Ether’s RSI surged to 58, which means the asset is not yet overbought. However, it is now trading above its fair value, as noted by TradingView data.

The RSI is a popular momentum indicator that measures whether an asset is oversold or overbought based on the magnitude of the recent price drops.

Ethereum Shakeout May Happen First

Ether’s price might initially see a sell-the-news event and after the initial ETF launch before starting its long-term rally toward new all-time highs. Thus, the real chance to invest in Ether long term might come after the first several weeks of ETF debut, as mentioned by Alvin Kan, COO, Bitget Wallet.

Kan commented:

“Similar to how the market reacted when BTC spot ETF got approved, we expect ETH to jump in price for a short time after its own ETF gets the green light. However, there might be followed by some selling pressure for a week or two afterward, as a result of outflows from instruments like Grayscale’s ETF.”

Ether’s price will surge in a highly sustained manner after the original shakeout, as stated by Kan:

“Once this initial shakeout is over, the price of ETH could start to climb steadily each month, depending on the daily inflows into the new ETH spot ETF.”

Other analysts believe that Ether ETF will have widespread impacts on the altcoin market. For example, popular crypto trader Mikybull believes the ETFs will catalyze the next altcoin bull market cycle.

The trader published in a July 19 X post:

“ETH ETFs will be the major catalyst for a massive rally sparking a huge Alts season in this cycle.”

ETH’s price gained over 11% in the last week. However, the altcoin is still trading 29% below its all-time high of $4,890 set in November 2021.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.