Compound Finance Review

These days, several cryptocurrency brokers, lenders, and exchanges keep springing up. Hence, most traders are confused about the choice to make, with some quitting after making few mistakes. It is only human that we can’t examine all options. Even if you take the time to review the current ones, you can’t keep up with reviewing all because new ones keep springing up now and then.

This is the essence of this Compound Finance review. It will reveal the complete truth about all that you need to know about this lender/exchanger. This Compound Finance review will save you the stress of going through endless research of various lenders or exchangers. More importantly, you have enough time to profit from the several opportunities in the virtual currency space. If you have ever searched for a reliable exchange, you will know that the process is often tedious and without guarantees that you will find the right exchange that’s suitable for you.

This Compound Finance review will expose its reliability or professionalism as a crypto exchange that suits your trading needs. You already know that there are lots of shady and unregulated exchanges in the virtual asset space. Most of whom have made away and continue to run away with people’s money.

While you could choose any exchange from a random Google search, it is likely that they won’t have all the features you desire in a broker, or there is no way you can guarantee their authenticity. If you don’t lose your money and your private details, your best option is to choose a reputable exchange for your trading needs. The real question is, does Compound finance suit your trading needs? You will discover the right answer after reading this review. Follow us now.

| Lending platform | Compound finance |

| Website | Https://compound.finance/markets |

| Crypto pairs | 13 |

| Account needed | Yes |

| Verification steps | 1 |

| Trading platform | Mobile app |

| Payment method | Cryptocurrency transfers |

What Is Compound Finance?

The best way to understand Compound finance operations is a piece of background know-how in decentralized finance (DeFi). DeFi allows anyone to perform financial operations without involving a middleman or exposing their privacy. The financial service can be anyone that can be done with centralized financial institutions. Note that all DeFi transactions are conducted in cryptocurrencies and not cash. Compound finance was launched September 17, 2021, by California-based firm, Compound labs inc. Binance listed its token on June 25, 2021.

Within that short period of its Binance listing, it has risen to become one of the top lending projects in the decentralized finance (DeFi) world. While Compound started as a centralized crypto firm, it became a community-governed autonomous platform after launching its token, COMP. The basic precept behind Compound is to help you make more gains with your cryptocurrency. As a Compound user, you can borrow and lend several Ethereum-related assets such as Wrapped BTC (wBTC), 0x (ZRX), and Basic Attention Token (BAT).

Compound Finance does not mandate you to fill any credit details, anti-money laundering, or Know Your Customer forms. Apart from earning insane interest rates, your crypto borrowing or lending frequency enables you to get COMP rewards.

Most crypto users are attracted to Compound because there are opportunities to earn more than 100% annual percentage yield (APY).

Compound Finance Services

Members can be lenders in the Compound ecosystem or borrowers depending on their choice. Lenders can either provide loans directly to borrowers or collaborate with other lenders to form a lending pool to disburse loans. Each asset in Compound has a lending pool. Members are only eligible for a loan less than their collateral supply (usually, 60% of their collateral). An asset’s market cap and liquidity also determine how much loan can be disbursed to a borrower.

As a lender on Compound, the amount you earn (denoted in cTokens) is often larger than your deposit amount. cTokens are ERC-20 tokens and constitute a portion of a basic asset. For instance, right now, 1 DAI will result in an equivalent of 50 cDAI using the Compound ctokens interest rate. Users can earn interest with cTokens. Also, members can increase their asset holdings without paying extra cToken amounts.

Interest rates in traditional financial institutions are often fixed or an agreement between the borrower and the lender. This isn’t the case in the Compound ecosystem and even the DeFi world. Supply, demand, and a frequently upgraded algorithm are the factors that determine interest rates in Compound.

In general, interest rates for lenders and borrowers rise in proportion to the growing demand for an asset. Thus, lenders are more inclined to lend while borrowers caution themselves against over-borrowing. Lenders are also permitted to cease their lending operations anytime they deem fit.

Any member that over-borrows because of favorable interests or any other selfish motive risks his asset being liquidated. Owners of a borrowed asset can liquidate or buy collateral at a discount. Borrowers can also increase their borrowing ability by repaying part of their debt till it’s over the minimum liquidation amount.

Compound Finance’s Yield Farming And Liquidity

- Liquidity

Compound utilizes what is known as liquidity mining to give lenders and borrowers the motivation to keep using the Compound protocol. The idea is to retain borrowers and lenders and prevent them from moving to other DeFi protocols.

As motivation, Compound pays lenders and borrowers with its governance token when they are actively involved in the platform’s liquidity mining. Other factors considered for giving out COMP tokens include the level of interaction with the lending pool, the asset’s interest rate in the lending pool, and a smart contract.

This lending protocol gives out almost 2,900 COMP tokens every day, 50% reserved for the loaner and the other 50% for borrowers.

- Yield farming

While there are noble intentions behind the creation of DeFis, the most important reason lots of crypto enthusiasts’ flock DeFi projects is the insane interest rates they can access when they leverage smart contracts among various DeFi projects.

This concept is called yield farming, and it involves the various combination of trading, lending or borrowing that makes Federal Reserve money looks like minimum wage. While some assume that yield farming has some similarities with leverage trading, they are right, especially when considering that it involves a high level of risk.

The risk is in the high amounts traders can use for trading, often a hundred times larger than the amount in their trading account. It can be likened to an inverted pyramid scheme. The pyramid sits on one leg (the asset), which must increase, maintain its price, or spirals down and lead to copious amounts of debt.

In Compound Finance, lenders or borrowers can participate in yield farming to earn COMP. Therefore, members can earn from Compound’s crypto loans. Members often use instaDapp to achieve this purpose. This app makes it possible to access several DeFi apps from one dashboard.

An important feature of instaDapp is the “maximize COMP mining,” where you can multiply your COMP by up to 40. While the process is slightly complex, the next paragraph should simplify it for you.

Assume you have 200 DAI, which you’ve deposited into Compound. You can use this 200 DAI to borrow 400 USDT from Compound. This is possible because of instaDapp’s “flash loan” feature and because Compound doesn’t disallow you from utilizing your funds despite being locked.

You can now convert the 400 USDT back to DAI, which gives an estimated 400 DAI. You will be assuming the role of a lender with this 400 DAI. Hence, you can lend 600 DAI, but you still need to keep in mind that you owe 400 USDT.

Your yield here will be in COMP, and your annual percentage yield (APY) rate will be well over 100% even after you’ve repaid your loan. Is that astonishing? However, always keep in mind that the base asset strongly determines your earnings.

For instance, the DAI used in this analogy can fluctuate to the extent of causing a huge debt even though it is regarded as a stablecoin. It is an open secret that crypto market fluctuations affect all cryptocurrencies, including the so-called stablecoins.

Positives

- Passive earnings. You can earn by lending your idle virtual assets

- Security is top-notch. Top security audit firms like open zeppelin and trail of bits have completed security audits on the platform and certified its coding as safe and dependable

- Excellent user experience. Compound Finance is interactive with other DeFi projects. Also, other platforms can build on Compound’s API

- Autonomy. Compound’s smart contracts operations are independent and automated. The contract’s functions include storage, capital supervision, and management

- Lending and borrowing are easy. Users with the platform’s governance token access the yield pool as a lender or borrower. Also, funds are approved without the bottlenecks associated with conventional financial institutions.

- Astounding interest benefits for lenders

- Zero loan punishments

- General accessibility

Negatives

- Lack of education. There is little education on the importance of DeFi projects and their applications to real-life situations. Hence, many people might remain oblivious to the benefits that Compound offers.

- The interface might sometimes be clumsy.

- There have been reported cases of delay in customer response.

Compound Finance Fees

- Interest rates

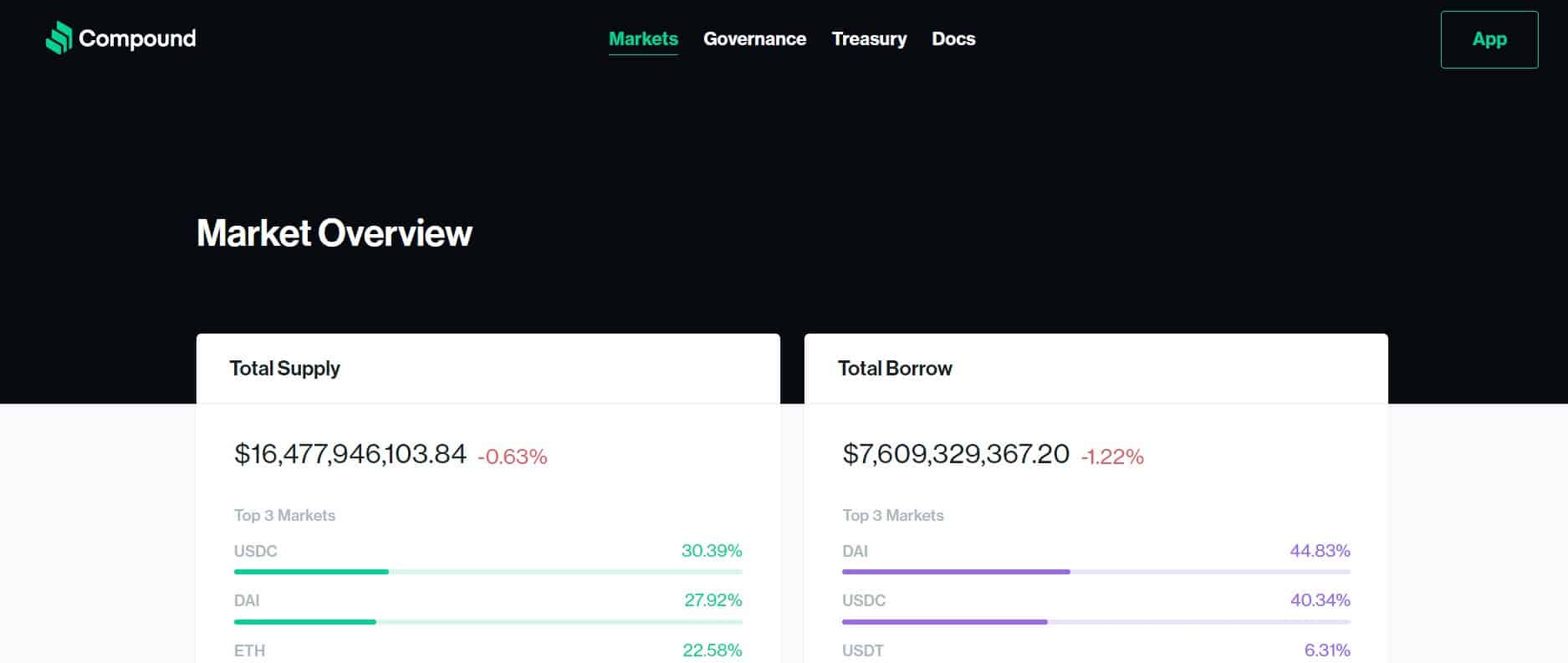

Supply, demand, and available liquidity determine interest rates—low liquidity results in high interest rates and vice-versa. There is no fixed interest rate, and Compound’s market page shows the interest rates for various assets in the last eight weeks. Most times, the “borrow rate” is higher than the supply rate, and that’s because of the excess market liquidity, which makes it possible to borrow or withdraw funds quickly from Compound.

Though asset lenders earn part of the interests from borrowers, the interest rate is often lower because there are usually lots of lenders. However, Compound keeps remaining part of the interests earned as reserves.

The Compound community determines the purpose of the reserves, but some of them are usually retained for insurance purposes.

- Withdrawal fees

Fees (whether deposit or withdrawal) are an important feature of any exchange, broker, or lending platform. No one wants to pay the majority of his earnings as fees. Hence, a lender/exchange with little or no fees will be attractive to crypto traders. Ideally, lenders/exchanges must always ensure that charges are an almost negligible portion of any member’s funds.

That’s where Compound Finance shines. As of this writing, Compound Finance doesn’t charge any amount for withdrawals. Also, creating an account and depositing funds with Compound is free. However, bear in mind that deposits and withdrawals can only be made in cryptocurrencies.

Compound Finance API

If you are a programmer with experience in JSON, Compound Finance’s application trading interface (API) webpage is resourceful enough for you to develop various to access the lending market. There are also ways you can tweak this API and use it in RESTful format.

The development channel of Compound’s discord server is the place to ask for Compound API keys. Right now, no authentication is necessary to use this API, but the platform has revealed that this won’t be so for long.

Compound Finance Features

- Time locks for admin operations

- Community members can assign community rights to other members

- Only COMP holders have community rights

Safety of Private Details

Any lender/exchange worth its salt will take the safety of its platform very seriously. Everyone is concerned about hackers having unauthorized access to Compound’s smart contract, which allows them to divert funds from the platform to their chosen locations.

There is a public verification for contract balances and code, which you can only understand when you are knowledgeable in that respect. Also, security hackers are incentivized to report any possible breach within the platform.

Also, Compound’s security page contains details of the security verification and audits performed on the site. The only security concern with this platform is its utilization rate. This rate is the number of lender’s assets that can be accessible by borrowers.

Right now, that rate is 70%. Therefore, if a lender wants to withdraw all its assets, including those lent to the borrower, there might be a serious issue on the Compound platform. The platform attempts to solve this problem using the dynamic interest rate method, where lots of borrowings increase interest rates. But, it still doesn’t solve the problem completely.

Even though Compound isn’t perfect (no system is), it remains one of the most dependable lending protocols in the virtual asset space. Its smart contract is worth almost a billion dollars, and it’s central to the continued rise in interest in the DeFi space.

Compound Finance App

Compound Finance has a web-based app where lenders and borrowers can perform their transactions. You’ll need to connect your wallet before you can perform any transaction on the app.

The web app page has two main sections – the supply and the borrow markets. The supply market is for the lenders, while the “borrow market” is for the borrowers. Some less mentioned assets available for lending or borrowing include ETHER, LINK, trueUSD, Uniswap, and Tether.

Customer Assistance

If you are a newbie to the crypto market and without adequate knowledge of the financial markets, don’t hesitate to seek help. Don’t assume you can learn on the go because most of the available resources at your disposal aren’t designed for newbies.

That’s why the getting started section of Compound Finance’s docs page is your best knowledge bank to understand what works on the platform. However, if you need further assistance, Compound’s twitter channel is your best option. There isn’t any link to the customer service on Compound’s website.

You can also seek clarifications from other community members where needed. The only issue is that customer is mainly offered in English, but you will always get the required help you need when you ask.

Conclusion

It is almost incomprehensible trying to imagine the future of this platform. The current features are astounding already, and with more features soon to be added, the sky can only be the starting point.

As a lender/exchange in the DeFi space, Compound holds some lofty promises. It is deploying the use of blockchain smart contracts beyond payment settlements. The DeFi market remains untapped, but it remains the ideal option for common problems in the financial world, especially the involvement of a middleman in financial transactions.

If there are no interferences with the governance ecosystem, especially from the founding members, it will be the most desired platform for all crypto yield farmers. There is no doubt that Compound now ranks among the pioneers revolutionizing the finance world. Once this revolution is complete, anyone can access a safe, private and decentralized financial system.

The platform ensures that lenders receive their due interests without delay while preventing borrowers from over-borrowing. It has also put in place important protection against hackers to prevent a breach of member funds. While they have a single platform for customer assistance, their fast response doesn’t give any cause for concern on the kind of regard they have for their customers.

Finally, you can’t perform any lending or borrowing operation without connecting your wallet with the Compound web app. Acceptable wallets are Coinbase, WalletConnect, ledger, and Metamask. We hope this Compound Finance review is of tremendous help in your sojourn in the DeFi world.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.