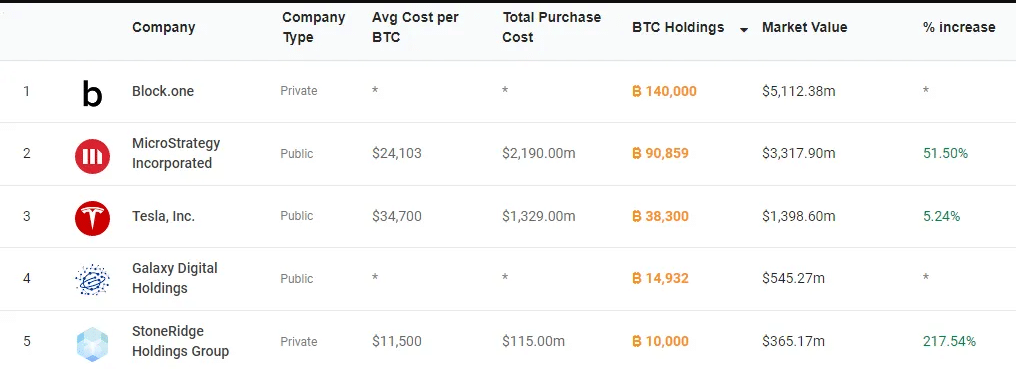

According to a crypto-treasuries survey, 32 companies currently hold a combined 325,014 Bitcoin (about $12 billion). Similarly, only 11 companies hold a combined 169,280 ETH (which is about $470 million). While these figures are only estimates, they indicate how much value investors attach to these assets.

Five companies with bitcoin on their balance sheets. Source: cryptotreasuries

The Bitcoin Top Shots

With 140,000 bitcoin holdings, block one leads the pack and is followed by MicroStrategy incorporated and Tesla inc. In that order. MicroStrategy is especially a bitcoin bull, reflecting in the amount of bitcoin it holds (over 90,000). Microstrategy’s bitcoin investment has increased by almost 50% in recent months, with its CEO, Micheal Saylor, singing the praises of bitcoin in a recent chat with Max Keiser.

In the last couple of months, the firm has been increasing its bitcoin holdings gradually. On the contrary, tesla’s gains of 5% have been significantly lower, considering Elon Musk’s derogatory bitcoin remarks.

Even though Galaxy digital and Stoneridge holdings complete the top five, Square’s holdings of a little over 8,000 BTC are getting close to Stoneridge’s. Square’s cash app gives the potential investor an excellent chance to hold bitcoins, and the company’s bitcoin profits rose prominently in the past year.

However, Galaxy Digital seems to have diverted its focus from bitcoin to Ethereum; at about 99,000 ETH (about $280 million), the company currently holds an enormous Ethereum. Coinbase Global and Meitu, with about 32,000 and 15,000 ETH holdings, respectively, complete the top three Ethereum holders.

While cryptotreasuries remarked that companies hold these assets and other digital currencies, it confirmed that assets under management like exchange-traded funds (ETFs) were excluded from this list. If those were included, the amount of bitcoin and Ethereum holdings would have shot up massively.

Proof of Crypto’s Legitimacy

This survey proves that leading companies in various industries are now investing in this asset class. In addition, investors are now more confident in investing in the crypto space than a few years back when companies held the notion that cryptocurrencies were mere fads.

Microstrategy’s swift change of its stance on bitcoin is strong proof of this change of heart. A few years ago, the company and its CEO disregarded bitcoin, but now, they are among its most passionate enthusiasts.

Some governments’ financial decisions following the COVID-19 pandemic are why these companies diversify into crypto investment. Also, Ethereum has made most of these companies realize the value of decentralized apps (Dapps) and decentralized finance (Defi), two areas representing a subset of the digital currency space.

Ruffer Investment Company Makes Over $1 Billion Profits from Bitcoin

According to the company’s investment director, Hamish Baillie, the company invested roughly 2.5% of its funds in purchasing bitcoin (a percentage that translates to about $600 million bitcoin worth) last year November when its price was around $15K. But by December last year and early this year, the bitcoin price doubled.

The company then sold some during that period before selling the remaining amount two months ago to amass a profit of about $1.2 billion. Despite selling its entire bitcoin holdings, the company still plans to invest in the leading cryptocurrency soon.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.