Bitcoin’s constant fluctuation between the $31,000 and $34,500 mark through the weekend further proved that its rise was temporary. Hence, JPMorgan analysts are convinced that it’s not yet a time of excitement for the digital currency market. The note released by JPMorgan chase’s team last Friday disclosed that it would be difficult for bitcoin to attain its near-term setup.

Analysis by JPMorgan’s analysts’ team revealed that “there are some brief underwater positions that the crypto market still needs to scale.”

The note insists that there are positives to be drawn from the stability in the bitcoin futures market and miners’ migration from China which has increased production costs, which proves that the fear, uncertainty, and doubt surrounding bitcoin is starting to lose their effects. Numerous metrics prove that bitcoin price and its production cost always go hand in hand.

Hence, if the mining costs increase, the bitcoin price will increase too. JPMorgan analysts insist that the virtual assets market isn’t entirely healthy yet, but it’s at the start of a healing process.

Investors Need to Be More Careful

David Grider (Fundstrat’s CEO) (during a recent interview with Bloomberg TV) advised investors and traders to reduce their risk or buy additional protection. Almost immediately after JPMorgan’s notes were released, the leading cryptocurrency bounced off the critical support level of $31,000.

Per the data from Tradingview and Cointelegraph market pro, bitcoin price decline to about $30,060 before rallying to about $33,450 throughout the weekend. As previously reported on Tokenhell, another positive note for the leading cryptocurrency over the weekend was from Mexico’s top three richest men, Ricardo Salinas Pliego. He referred to bitcoin as the new gold.

As of this writing, the bitcoin price has risen to about $34,500. Bitcoin miner sales drop to new major lows.

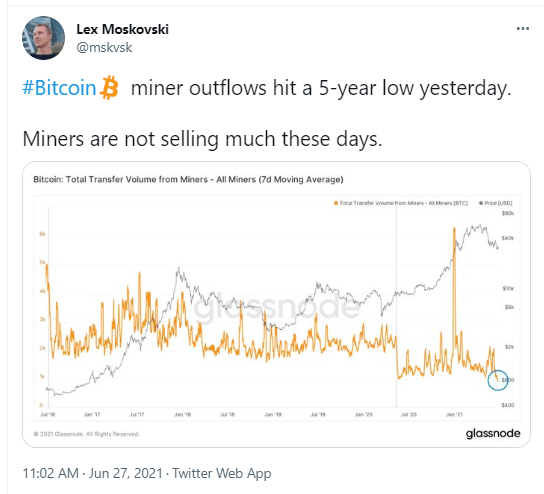

A Glassnode analytics survey has revealed that most bitcoin miners are no longer selling their bitcoins now. The chart revealed by Moskovski capital’s CIO, Lex moskovski, revealed that the 7-day average of the total transfer bitcoin volume from miners is now at a 5-year minimum. This proves that bitcoin miners are more willing to hold than to sell their bitcoins.

Lex Moskovski Tweet. Source: Twitter

BTC Outflows from Centralized Crypto Exchanges Are Rising

Foremost crypto analyst and investor Joseph Young has revealed that bitcoin outflows from top crypto exchanges are starting to increase. But he warned that no one should consider it the start of a bull trend even though it looks promising.

Joseph Young Tweet. Source: Twitter

Bitcoin Shows Strength Amidst Recent Events

In all these events, bitcoin was expected to have tanked more than its current price, but the leading cryptocurrency seems to show strength by not declining to its predicted levels. For example, the discount on the Grayscale Bitcoin Trust (GBTC) shares continues to decrease, now at about 12%. Hence, it won’t be a surprise if GBTC’s July 19 unlocking has no significant negative impact on the bitcoin price.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.