More Than 350 Million XRP Interchanged Between Ripple, Exchanges And Others

A Whale Alert data disclosed that an anonymous wallet sent more than 205 million XRP to Ripple (XRP’s parent company). That amount of XRP is worth almost nearly $281,000 as of this writing.

Whale Alert $281K XRP Transfer. Source: Twitter

Other XRP Transactions Revealed By Whale Alert

Bithomp, a crypto analytics firm, revealed that the exchange above took place between Bitstamp exchange subsidiaries and its headquarters. The exchange is Ripple’s ODL partner across Europe. It also revealed that Ripple transferred 66m XRP to this exchange within eleven hours.

Furthermore, whale alert disclosed that 21m XRP exchanged hands between Bittrex and Upbit, while Binance and Huobi exchanged 71m XRP between them. Hence, the total worth of XRP transfers among Binance, Huobi, Upbit and BitTrex exchanges is valued at almost $198,000

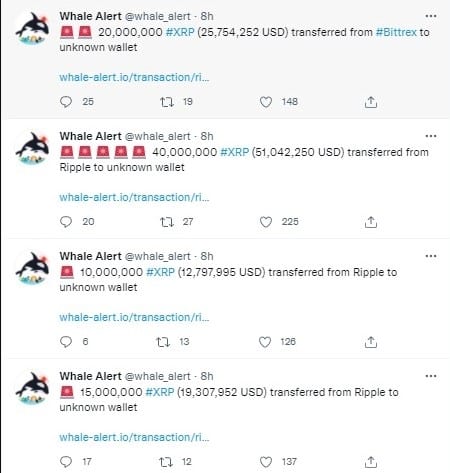

Whale Alert Other XRP Transactions. Source: Twitter

XRP Still Holding Out Strong

Recently, XRP ledger developers launched federated sidechains, which creates smart contract options and improves XRP ledger’s abilities. Also, one of Ripple network’s top executives, David Schwartz, reiterated the need for the platform to use NFTs as in-road towards asset management and development. Hence, Ripple has been investing in various NFT-related brands such as Mintable, Animoca and Jon Oringer.

A side benefit of creating and executing the federated sidechains is to enable Ripple to develop market-trendy offerings. Hence, these sidechains can lead to the development of stablecoins, NFTs or DeFi-related projects. Also, these sidechains can have individual ledgers since the federator software can merge the sidechains with XRP ledgers. Analysts have identified similar patterns between XRP price chart and IOTA before the latter’s strong bullish run few days ago.

FTX Exchange To Increase Its Spot Trading Offerings

Various news sources agree that the FTX crypto exchange will soon add spot trading of different new digital assets in the next few months. AAVX, DOT and ADA are among the well-known tokens that FTX is planning to add. FTX’s decision to increase its spot trading offering is one way it plans to expand its client base by attracting more retail investors.

Ftc CEO, Sam Bankman-fried, said FTX is increasing its service offering to ensure it covers almost all the tokens of the important blockchains in the crypto sphere. Bankman-fried remarked the three tokens mentioned above are attracting the highest from its exchange userbase. Despite being among the top four crypto exchanges, FTX aims to keep growing to become the number one crypto exchange globally.

Why FTX Is Focused On Those Three Tokens

While bitcoin is still struggling to surpass its $50K key resistance, almost all the altcoins are on a bullish run. ADA’s parent company, Cardano, is set for a new update to enable the blockchain to start offering smart contracts. Hence, ADA’s price has been rising sharply to that effect.

Even though DOT and AAVE are relatively new, they have surged in popularity, volume and audience to attract the attention of top exchanges, including FTX. While FTX’s primary product offering is futures products, it has a spot trading offering which it now seeks to keep expanding.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.