Famous crypto trader and analyst Alex Kruger has stated that there is a possibility of the burry BTC scenario happening, and it’s one primary reason some long-term investors have started selling. Hence, the burry scenario remains a critical determining factor for the crypto market, and the bitcoin price can decline to $24,000.

Alex Kruger Tweet. Source: Twitter

Kruger says that the market is seemingly dead, with the market even undergoing a “simple short squeeze” yesterday. He also remarked that the volume of stablecoin purchases keeps rising.

Can Longs Lever Up?

Meanwhile, bitcoin would have to be “bulled up” and allow the longs lever up before it can experience a hard break down and a further fall. Kruger cited the example of the November 2018 and the September 2019 support breakdowns as a contrasting scenario to what currently obtains in the market.

In September 2019, money kept flowing into the market for long periods with positive funding prior and a 9% swing up that resulted in a bull trap. Also, two months before the decline, there were multiple retests of the support levels between $8900 and $9200.

In November 2018, two weeks of steady cash inflow happened before the market’s fall. Nine months before the fall, the market retested the $5800 support level several times, but these retests resulted from several fundamental factors.

In both cases, there was a steady inflow of cash into the market and positive funding prior. But the funding prior has been negative for some time now. In contrast, Kruger pointed out that this year’s case is different. There has been a steady decline in cash flow into the market since about the middle of last month. Since that time, the $29,500 support level has been under intense pressure.

Is The Bitcoin Price Set for An Upswing?

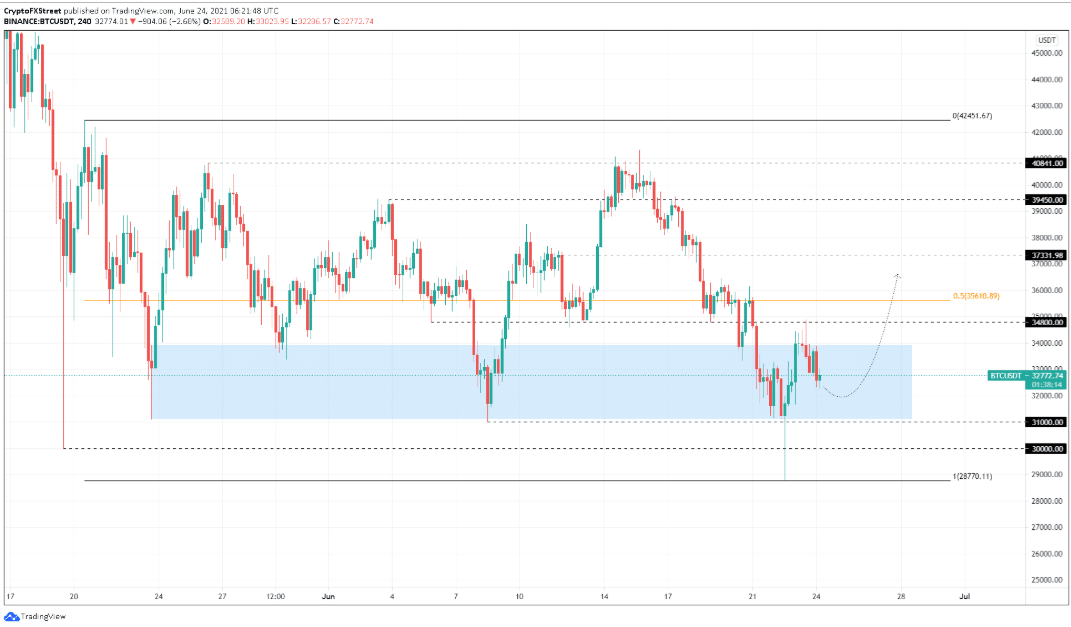

Bitcoin price declined by an awful 21% for two days straight this week (June 20 and June 22). But it has since started a rally and has recovered by 21% between yesterday and the time of this writing.

However, it is presently in a retracement because it couldn’t reach the $35,000 level. This rejection could reach about $31,500 but would set it off for a 16% upswing to rise over the 50% Fibonacci retracement levels and reach about $36,000. If the bullish run extends, the price could reach $37,500.

BTC/USDT 4-hour chart. Source: TradingView

Conversely, if the bullish prediction couldn’t be sustained, bitcoin might decline below the $30,000 levels. That would be a 3% retracement, and it might even slide further with more selling pressure from the bears.

Spring Is Here

Most bitcoin analysts have been fixated on the Wyckoff accumulation model since the start of the sell-off last month after noticing that bitcoin had following the Wyckoff pattern for over a month. The tweet below shows that bitcoin has completed phases a, b, and c of the Wyckoff. It is about to enter phase D, where it is expected to go on a new uptrend.

Wyckoff accumulation model analysis. Source: Twitter

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.