Bitcoin (BTC) has always been a central focus in the cryptocurrency market, with investors and market watchers closely examining its price fluctuations.

With Bitcoin surpassing the $67,000 milestone, a crypto analyst has observed that current patterns and past information indicate that Bitcoin’s highest point has yet to be reached. The analyst predicts a significant price surge in the later part of Q3 or early Q4 of this year.

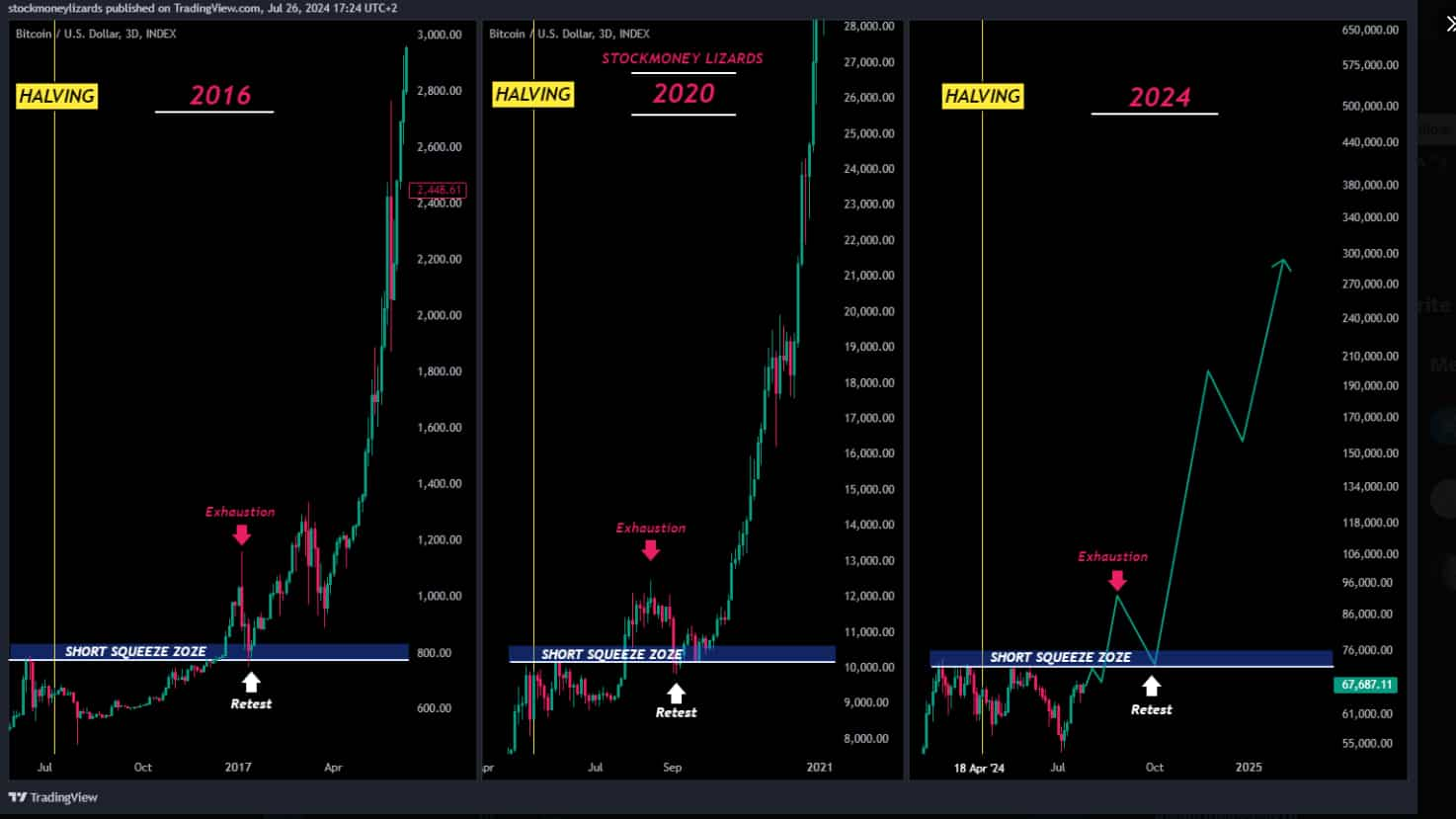

In a recent post on July 20, Stockmoney Lizards discussed three critical factors that contribute to the projected targets and significant support and resistance zones for Bitcoin. These factors include halving events, short-squeeze zones, and institutional accumulation. The analysis justifies the expected substantial surge in Bitcoin’s value.

Correction and Redistribution Following the Halving Event

Bitcoin’s halving events, which decrease the availability of fresh Bitcoins, usually function as an occasion where investors tend to sell their holdings in response to the news. Retail investors frequently jump on the bandwagon, anticipating a significant surge, while major holders, also known as whales, begin to distribute their amassed assets.

After the halving event, it is common for the market to go through a correction phase. This occurs because retail investors who purchased at the peak start selling their assets at a loss.

According to the analyst’s observations, experienced investors or large-scale traders who are aware of these selling pressures take action to repurchase assets at these reduced prices.

This trend was evident in the previous cycles after the 2016 and 2020 halvings when Bitcoin experienced a correction followed by a period of consolidation around critical support levels before embarking on a substantial rally.

The existing support range, recognized as being between $53,000 and $56,000, exhibits a comparable trend of correction and redistribution, suggesting that astute investors are gathering assets in preparation for the upcoming significant shift.

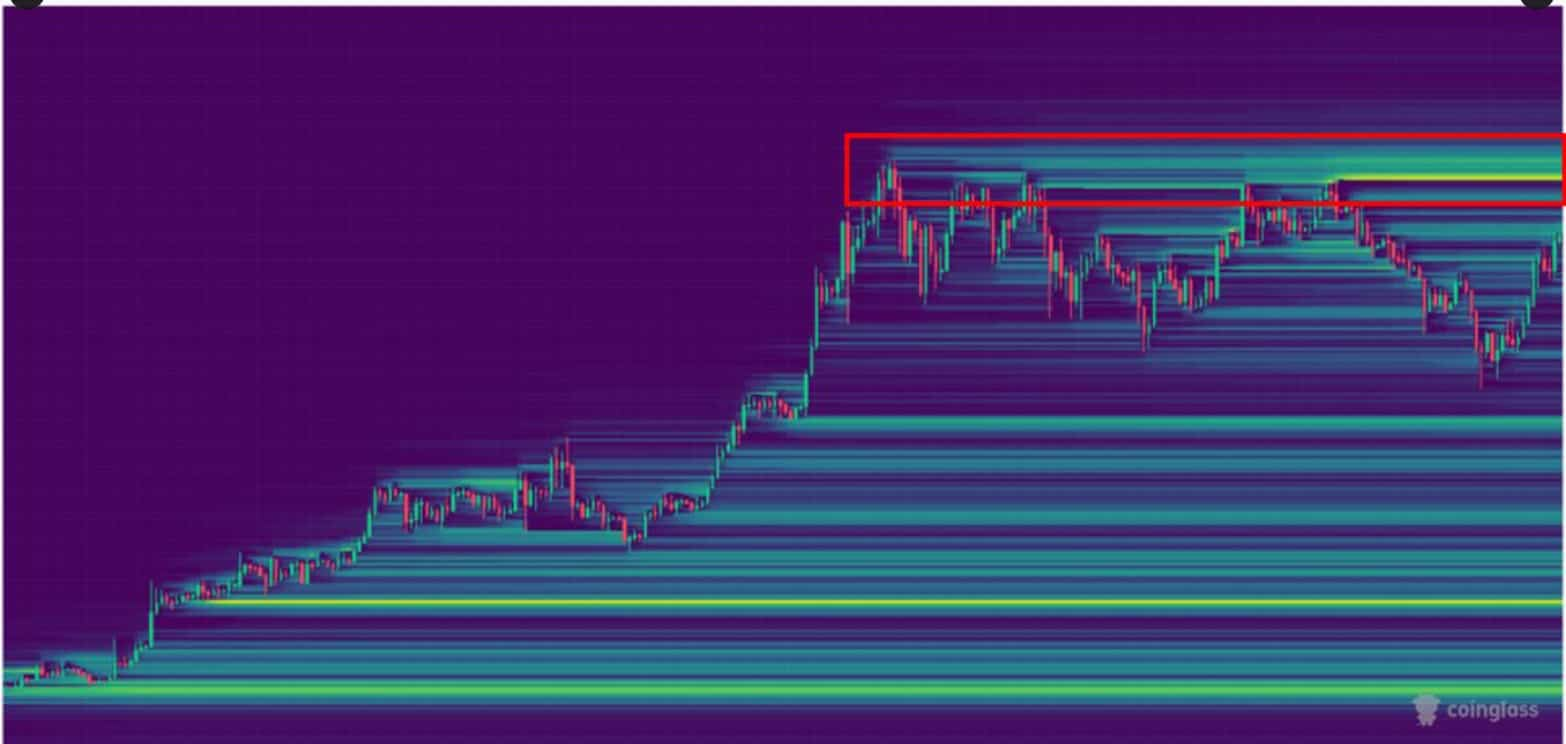

Short-Squeeze Zones: Triggers for Optimistic Reversals

Short-squeeze zones are important regions where a significant amount of liquidation is taking place, which compels bearish traders to exit their positions and results in a bullish breakout.

In both the 2016 and 2020 cycles, these areas were accompanied by deceptive moves and subsequent declines, offering advantageous opportunities for traders to enter. The current location of intense buying pressure, pinpointed at approximately $67,687, is anticipated to result in substantial sell-offs, causing a shift in market sentiment.

This pattern indicates that there may be a false breakout and subsequent decline before the actual rally occurs, providing traders with an ideal opportunity to enter the market.

It is of utmost importance to closely monitor this zone, as it is highly probable to be followed by a substantial price shift. In the past, these areas have played a crucial role in turning around negative trends and sparking positive momentum.

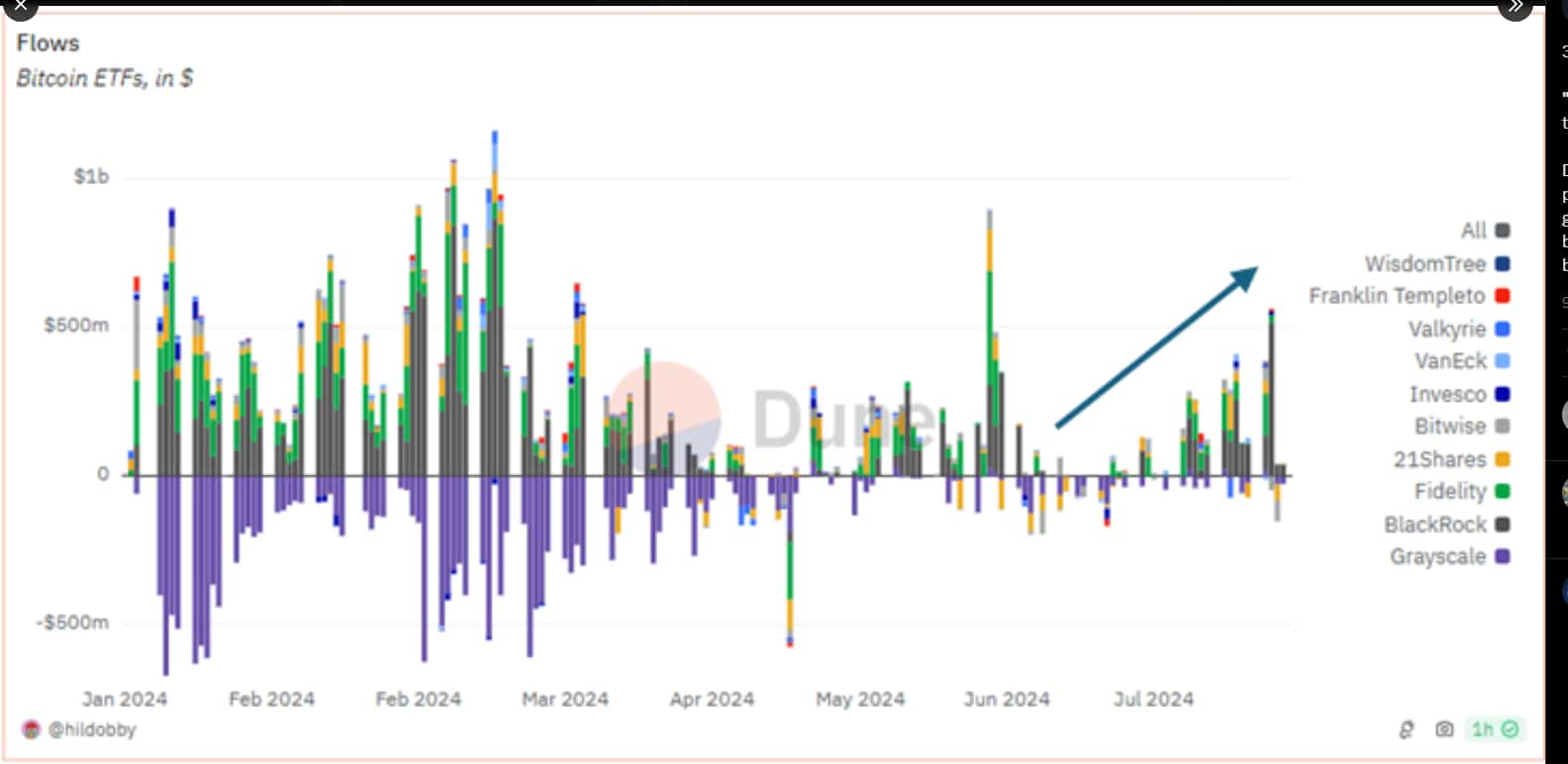

Accumulation by Institutions

New information regarding the flow of funds into Bitcoin exchange-traded funds (ETFs) shows significant investments from prominent institutional investors, including WisdomTree, Franklin Templeton, Valkyrie, and others.

In spite of the recent price drop, these institutions have consistently been amassing Bitcoin, which suggests a high level of confidence in an upcoming price surge.

The surge in ETF inflows during the last couple of months, despite prices staying within a narrow range, indicates a deliberate positioning in anticipation of an upcoming breakout.

This pattern is consistent with historical trends where institutions gather assets before major upward movements, providing additional evidence for the forecast of a substantial surge in Bitcoin. Having faith in institutions is a powerful sign of how investors feel about the market, and it often comes before significant price increases as experienced investors position themselves for big profits.

Anticipated Goals and Key Levels

Given the combination of these factors, Bitcoin appears to be on the verge of a substantial uptrend. The crucial support level of approximately $67,687 is expected to serve as the foundation for the upcoming rally.

Keep a close eye on the support zone between $53,000 and $56,000, as it will play a critical role in potential accumulation and consolidation.

Looking ahead, there are significant barriers at $150,000 and $200,000, and the ultimate objective is set at $300,000.

Experts predict that the highest point will occur in the later part of the third quarter or the beginning of the fourth quarter. This, in turn, aligns with previous instances of price increases following halving events and the current patterns of accumulation.

Analysis of the Price of Bitcoin

As of the time of reporting, Bitcoin was trading at $68,448, showing daily gains of more than 1.8%. During the previous week, there had been an increase of almost 4%.

The convergence of halving events, areas of short-squeeze, and institutional accumulation creates a strong foundation for forecasting a significant upward trend for Bitcoin.

Conclusion

Considering these elements, Bitcoin’s future looks promising, and there is a high expectation for a significant surge in value later this year. Investors and traders should closely observe these critical areas and patterns, as they present substantial prospects for strategic entries and potential profits.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.