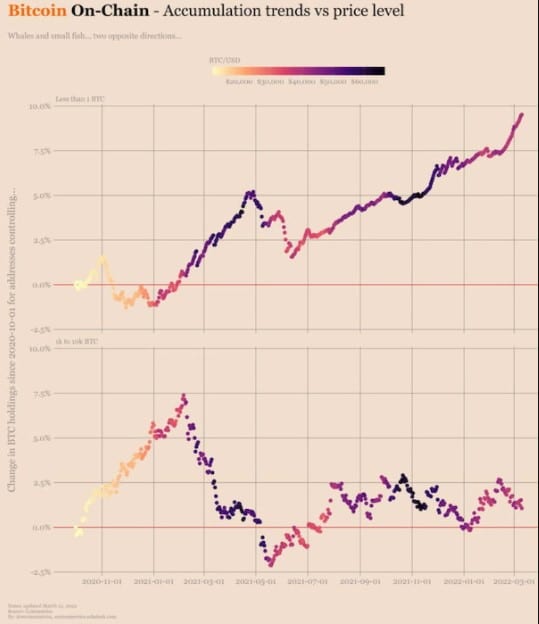

Various analytics showed that more crypto wallets have been acquiring more BTC over the past couple of weeks, with the acquisition reaching new peak levels. But, a comparison between BTC on-chain acquisitions and BTC price showed a considerable disparity between BTC wallets with less than 1 BTC (called small fishes) and those with at least 1K BTC (whales).

New Data Explains The Disparity Between The Two Holders

A March 12 data from an on-chain analytics platform (Ecoinmetrics) showed that there had been a significant rise in the number of small fishes who have increased their BTC holdings. This is in stark contrast to whales who are distributing their holdings.

BTC accumulation between small fishes and whales. Source: Ecoinmetrics

“If the whales aren’t distributing, BTC may likely not sustain an uptrend because there won’t be sufficient momentum,” the report further remarked. The discrepancy proves that the whales’ moves regarding the leading digital asset are responsible for BTC to maintain its uptrend.

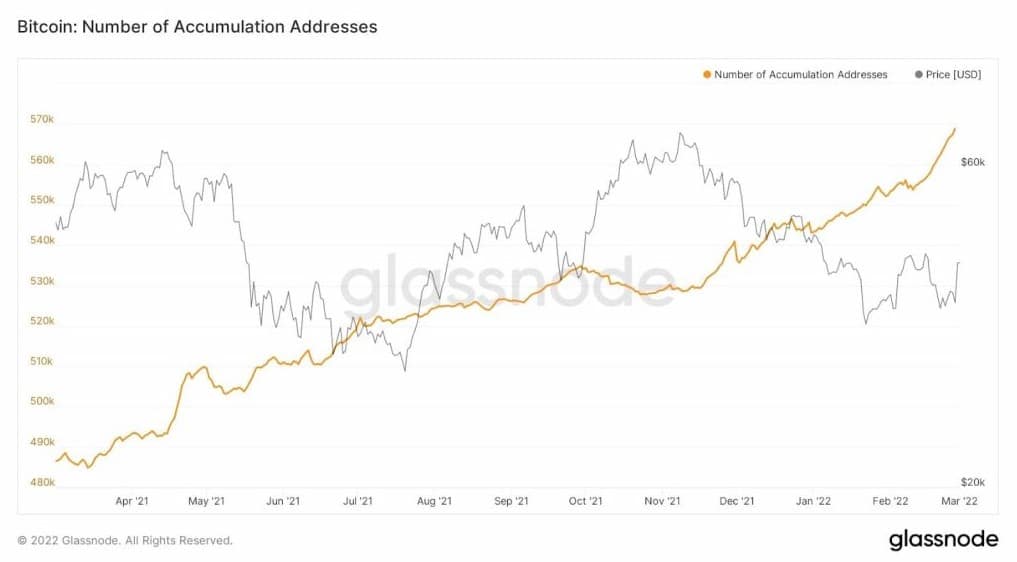

New Peak Levels For Accumulation Wallets

Lex Moskovski, a top crypto analyst on Twitter, predicted on March 1 that the BTC acquisition would reach new peak levels before this month was over. Moskovski based his prediction on data analysis from the famous on-chain analytics firm, Glassnode.

Rising BTC acquisition. Source: Glassnode

Glassnode defines the accumulation of wallets as BTC wallets that have been acquiring BTC since late last month without selling any of them. When there was a sudden rise in BTC price, Glassnode updated their information saying, whales’ BTC acquisitions didn’t cause the sudden rise. Instead, it was caused by the actions of a top wBTC custodian. This custodian created new addresses and transferred reserves into them.

Such moves usually result in a bullish trend for the BTC market as many investors see this action as a buy signal. As of this writing, BTC’s market dominance is nearly 43%, while its market cap is almost $744B.

It’s Time For Gen Z’s To Start Investing In BTC – Peter Brandt

Legendary investor and crypto advocate, Peter Brandt, has claimed that the younger generation must start investing in BTC from henceforth. He further advised these Gen Z’s to get certifications and degrees in blockchain and crypto-related disciplines. This would enable them to get a well-paying job quicker and pay off their student loans in the shortest time if they have one.

Brandt further suggested that regardless of the little belief that the authorities or individuals have in BTC, the Gen Z’s must realize that altcoins (including Ethereum) usually follow its path in price movement and performance.

Many Gen Z’s would do well to listen to Brandt’s advice. He has 40 years of experience in the financial investment sector and rose to prominence for accurately predicting the sharp decline in BTC price four years ago. He has continued to be a BTC advocate, suggesting that the digital asset is a viable investment based on the current financial market conditions. Brandt recently claimed that BTC’s uptrend is about 50% off its peak levels.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.