A brokerage account is a vehicle for buying and selling securities. It can be at your local bank, online or independent firm. All online brokers differ in their features but all provide you with the opportunity to buy and sell stocks, bonds, mutual funds and other investment vehicles. Many brokerages also offer cash management services for those who wish to deposit checks but do not want to actually open a bank account. A brokerage account is essentially the same thing as a checking or savings account at a bank except that it allows you to buy and sell shares, bonds, and other financial instruments.

Today I will review my brokerage but there are a few things I would like to discuss.

What Does A Brokerage Account Bring Along?

The great thing about having a brokerage account is that your money is not tied up in long-term investments or bonds where the market may not move for months or years. We all know how with online brokers you can make quick, short term transactions to invest, say in the stock market, whatever you think is most appropriate at any given time from your wallet on your smartphone or online.

The downside of investing this way is you must spend more time and research on what you are doing because it’s so easy to misjudge when buying and selling. With a bank account, you don’t have as much control over how often you’re investing but money will grow faster if compound interest works out in your favour.

A brokerage account provides a great platform for you to learn about investing and to practice what you’ve learned. Many online brokers provide real-time quotes which are helpful if you trade often and need quick information but some charge extra for it, so shop around! It’s all about leverage. When you use leverage, you are using borrowed money to buy more stock than you can afford and hoping that the stocks will go up so your profits will offset what you’re paying on the loan. Margin rates may vary from firm to firm so again, shop around and read the fine print!

Depending on how much risk you want to take, there are different stages of investment that will require a higher deposit initially. For example, if most of your money is in a savings account then opening an IRA (Individual Retirement Account) would make sense because it’s designed for people with no or low income who still want to invest tax-sheltered for retirement years but not everyone qualifies. Having one option or another may be the difference between making or losing money on your investments!

When opening an account with any of the online brokers remember that they will try hard to get your business because all companies are in competition with each other. You should never feel like there is pressure to sign up immediately as they will give it a few days to work out the kinks before anything goes through. As long as you’re aware of what you are doing then you’ll make money! If you don’t know, then do your homework and ask the right questions. It’s up to you how much money you make or lose from day one so use caution when investing in anything.

How to Start Investing? After deciding if a brokerage account is best for you, it’s time to open an account. Here are the steps:

1) Pick an online broker that fits your needs. When comparing platforms of different brokers look at the fees charged, trading commissions, market data, number of securities and tools available, customer support and the minimum deposit required.

2) Make sure you can trade from your computer or smartphone while on the go. While many platforms now offer mobile access there are still some that do not choose a platform that allows you to buy stocks wherever you are. Also, figure out a schedule for letting money build up in your brokerage account before trading with it – this is called dollar-cost averaging. This will help prevent you from playing any particular dip or peak in the market while providing time to learn how to invest and make good decisions when the time comes. Also, don’t forget about margin accounts if you plan on borrowing money for investments!

3) Understand your goals. What do you hope to accomplish with your investment? How much time can you spend researching companies and tracking the market? Do you want a standard brokerage account or an IRA geared toward retirement accounts?

4) Get started by opening a brokerage account today! After all, the sooner you start learning about investing, the better off your portfolio will be when it’s your turn to retire.

I would like to inform you all through this review, that WinGroup is one of the few leading online brokers that provide investors with access to the financial markets. Their state-of-the-art trading platform can be accessed from anywhere in the world at any time through your computer or smartphone. They offer ETF trades, stock purchases and one of the lowest rates for margin trading.

With account types designed specifically for different sorts of traders, WinGroup has something available for everyone! It was founded by young but experienced professionals who share a common passion: helping as many people as possible reach their full potential by understanding how the market affects everyday life. Their products are superior and customer service is top-notch so let them help you today!

Some Of The Major Pros Are Listed Below:

1- No heavy fee in the name of commission: WinGroup does not charge a lot of commissions on any stock or ETF trade like many online brokers. You can buy stocks, sell off your equity and enjoy all the benefits of trading without ever worrying about paying a commission again. Although this could be brought down to no commissions for beginners because I believe that in an era where the survival of the young lot is hard, well-reputed forums should take measures to help them out.

2- Robust Trading Platform: Their platform can be a great option for seasoned traders and beginners alike with quick access to charts, price quotes and real-time market data. It’s easy to use and has features that most other platforms do not have such as visualizations by volume in each order group, alerts for abnormal activity in your portfolio and over 100 candlestick chart patterns available at your fingertips. This is how all online brokers should work.

3- Lowest Margin Rates Available: If you’re looking to borrow money to invest, then there lies a piece of good news in this review. WinGroup’s low margin rates can help you afford more shares than most of its competitors.

4- Top-Notch Technology: All their platforms are mobile-friendly so you can trade from anywhere at any time. Advanced charting tools include multiple price levels and a unique display that lets you view your positions and technical indicators side-by-side.

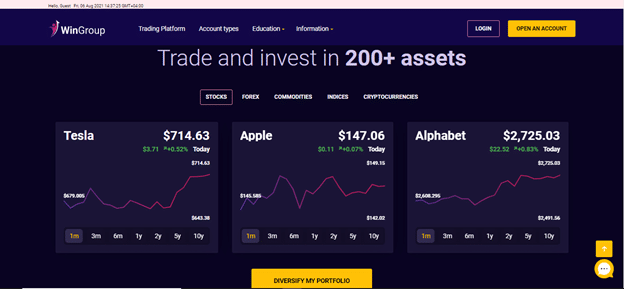

5- Access to a Large Number of Stocks: Whether you’re looking for US-based companies listed on the NYSE, NASDAQ or AMEX exchange or international equities traded in other countries around the world, WinGroup can get you in the markets.

6- No Hidden Fees: I find it important to mention in this review that they do not charge very high to set up your account, maintain it or close out an existing one. They also do not charge higher commissions for buying at the market or selling at a small price difference. I think that transparency should never be compromised for all online brokers because it is the most needed quality for a business to survive in this fast-growing world of technology and finance.

7- Great Customer Service: I have noticed that WinGroup understands the importance of providing a robust customer service experience. They have multiple ways to contact them and are available 24 hours a day, seven days a week, 365 days a year. You never have to worry about calling and not getting help when you need it!

Some Of Their Cons Are Listed Below:

1- Dark Backdrop: I have always felt that the background of their website isn’t very attractive. They should try to beautify it a bit more by installing a new theme because it will be a great attraction for the visitors and the ones who use it on a daily basis. I hope they and all such online brokers take this into account and change it as soon as possible.

2- Payal not allowed: WinGroup doesn’t allow users to make payments using Paypal. Paypal is a popular payment gateway used by many and this can be a great disadvantage for them. We hope that they start accepting Paypal to acquire new clients and retain old ones!

Concluding Remarks

Apart from these cons, I think that their services have good potential to be used. They should try and take some steps if they want to make a mark in the market. As already mentioned, transparency is the most needed quality for an organisation to survive in this era of technology and it can be a game-changer for them. I find it better than many online brokers out there.

I hope they take this review as constructive criticism and make some major changes in order to make it effective. I also believe that their services are worth a shot and can be used in order to gain access to global markets. I hope this will be helpful in making your decisions and this article will be helpful for the ones who want to know more about this company.

Disclaimer: This review is written from the writers experience and their self-knowledge only and this is not a recommendation.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.