Bullish divergence on Bitcoin’s price chart, September rate cut prospects, and increasing M2 supply are some catalysts that might help resume the BTC bull market cycle. Despite Bitcoin price volatility and five-month lows, several major indicators suggest that the bulls might still enjoy the upper hand, hinting at a possible resurgence in the BTC price trajectory.

Bullish Divergence Enhances Bitcoin Rebound Prospects

Bitcoin (BTC) encountered a turbulent start to July, losing over 10.50% to trade near $57,000 as of July 7. At its lowest level, BTC hit $53,550, with its losses powered by fear of a market dump because of Mt. Gox’s ongoing reimbursement of more than 140,000 BTC to its clients and the German government’s BTC liquidations.

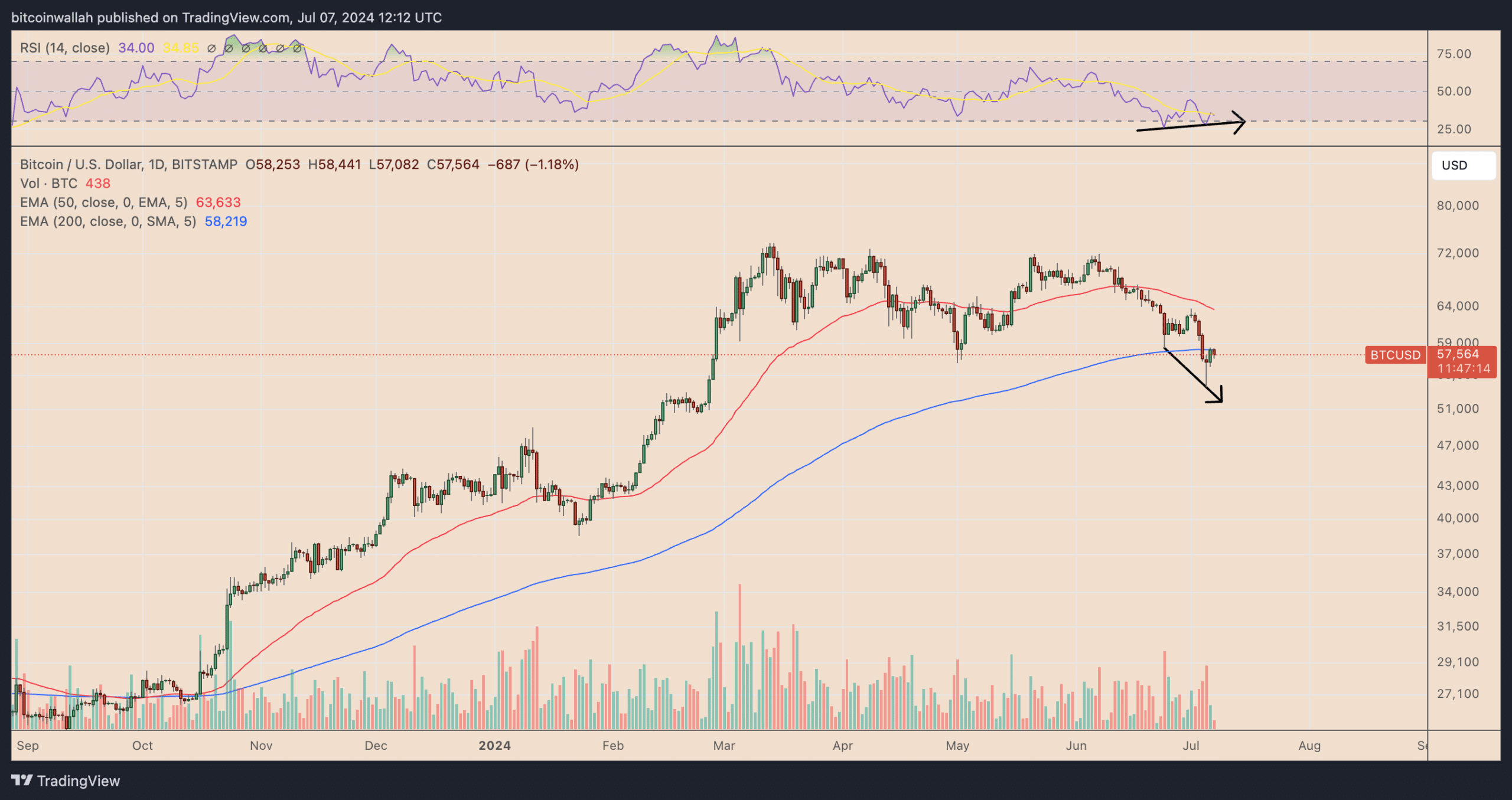

The recent Bitcoin price drop was accompanied by an increasing divergence between dropping prices and the rising relative strength index (RSI). The divergence shows that the selling pressure is slowly weakening, although the price keeps dropping.

Based on technical analysis, the scenario mostly indicates the possibility of a reversal or a slowdown in the current drop, hinting that Bitcoin might soon record a rebound as the market sentiment moves back toward bullishness.

Bullish Hammer, Oversold RSI

Two other classic technical indicators support the bullish reversal scenario. First, Bitcoin formed a bullish hammer candlestick pattern on July 5, featuring a small body at the upper end of the daily candle, with a long lower shadow and little upper shadow. A similar situation happened in May.

Additionally, Bitcoin’s daily RSI reading is oscillating around its oversold threshold of 30, which mostly precedes a recovery or consolidation phase. Analyst Jacob Canfield says the indicator might signal a rebound, with BTC possibly returning to its “former range high” of above $70,000.

Wall Street Bets On September Rate Cut Rise

Bitcoin’s ability to resume its bull run in the coming weeks surges more because of rising interest rate potentials in September.

As of July 7, Wall Street traders saw a 72% potential of the United States Federal Reserve cutting interest rates by 25 basis points, according to data collected by CME. A month ago, the potential of the same was 46.60%.

Expectations for lower interest rates have surged because of a slowdown in hiring in the United States of America.

When the job market gets weaker, the Fed mostly considers cutting interest rates to stimulate economic activity. Lower interest rates are mostly bullish for Bitcoin and other riskier assets since they make traditional safe investments like US Treasury notes less attractive.

Bitcoin ETF Investors Return After July Drop

Another bullish indicator for the Bitcoin market is the resumption of inflows into the US-based spot Bitcoin exchange-traded funds (ETF) after two days of consecutive outflows.

On July 5, when the US reported weak unemployment data, the funds cumulatively attracted $143.10 million worth of BTC, based on data from Farside Investors, indicating a rising risk sentiment among Wall Street investors.

The Fidelity Wise Origin Bitcoin Fund (FBTC) led the inflows with $117 million. On the other hand, the Bitwise Bitcoin ETF (BITB) recorded a net inflow of $30.2 million, and the ARK 21Shares Bitcoin ETF (ARKB), together with the VanEck Bitcoin Trust (HODL), recorded inflows of $11.3 million and $12.8 million.

On the contrary, the Grayscale Bitcoin Trust (GBTC) recorded a net outflow of $28.6 million.

US Money Supply Is Growing Again

More upside signs for Bitcoin come from a recent surge in the US M2 supply, which measures the money supply that consists of checking deposits, cash, and easily convertible near-money, including money market securities, savings deposits, and other time deposits.

As of May 2024, the M2 money supply increased by around 0.82% year-over-year, reducing its aggregate drop from the peak drop of 4.74% in October 2023 to nearly 3.50%.

M2 supply growth is bullish for Bitcoin since it boosts liquidity in the economy. More money available in circulation results in higher investments in riskier assets such as Bitcoin, because traditional investments like bonds and savings offer reduced returns.

Bitcoin Miner Capitulation Hints At Bitcoin Price Bottom

Bitcoin miner capitulation metrics are nearing levels seen in the market bottom after the FTX crash in late 2022, indicating a possible drop for Bitcoin. Miner capitulation happens when miners reduce operations and sell some of their mined Bitcoin and reserves to remain afloat, earn yield, and hedge against Bitcoin exposure.

Market analysts have highlighted multiple signs of capitulation in the past month, during which Bitcoin’s price dropped from $68,791 to as low as $53,550. One major sign is a considerable drop in Bitcoin’s hashrate – the total computational power securing the Bitcoin network.

The hashrate has plunged by 7.7%, hitting a four-month low of 576 exahashes per second after it reached a record high on April 27. This drop indicates that some miners are scaling back operations, reflecting the financial stress within the mining community post-halving.

As weaker miners exit the market or scale back their operations, the more competitive miners will see large profits, possibly helping stabilize their operations and reducing the need to sell BTC. The metrics signal that the Bitcoin market may be approaching its bottom, similar to other cycles where miner sell-offs and operational reductions preceded significant market recoveries.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.