Collins Wu (celebrated Chinese crypto-journalist) has shared CryptoQuant analytics, showing a significant rise in the bitcoin whale ratio across all digital exchanges. Thus, the bitcoin price may soon be on a downward spiral.

Apart from CryptoQuant, Glassnode is another analytics data firm that famous crypto journalists such as Collins Wu and CryptoTwitter often quote when sharing crypto-related news.

Bitcoin Whale Ratio May Be Bearish for Bitcoin

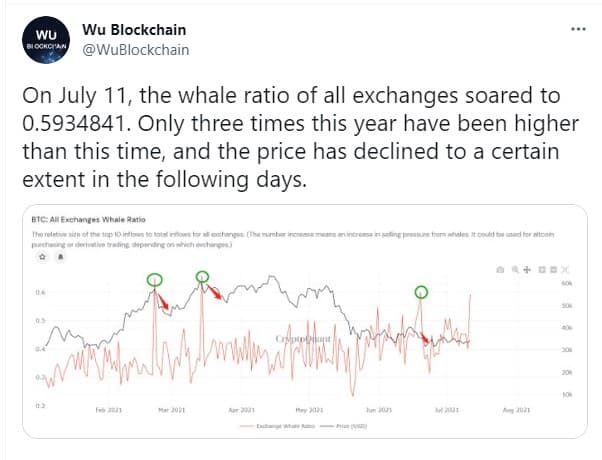

Collins Wu revealed that the bitcoin whale ratio currently stands at approximately 0.6, and there have only been three times before this year that this ratio has been higher. The CryptoQuant chart also reveals an inverse relationship between the bitcoin price and the BTC whale ratio. The higher the index, the lower the bitcoin price and vice versa.

The whale ratio is a measure of the top ten bitcoin inflows and outflows among crypto exchanges. The rise in this ratio indicates that whales are selling massively. Whales are individuals or firms with large amounts of any digital asset. However, Wu revealed that the index rose to almost 0.6 today.

Collins Wu Whale Ratio Tweet. Source: Twitter

However, a bitcoin advocate and trader replied to Wu’s tweet expressing optimism of a bitcoin rally even after the drops. The trader with the Twitter handle (@bit_paschal) stated that bitcoin always rises back sharply after a decline that follows the rise in whale ratio. Hence, he is confident that bitcoin will rise again after this decline.

Significant Decline in Exchanges Bitcoin Inflows

Santiment data analytics have reported that there has been a sharp decline in bitcoin inflows to centralized crypto exchanges, and it’s now at its lowest over the last 50 days. Hence, exchanges now have a significantly low supply of bitcoin.

Coincidentally, bitcoin miners are now accumulating bitcoin after a selling spree that lasted over a month. Also, the bitcoin hashrate is recovering gradually after dropping to a 2-year low. The hashrate has been declining following Chinese authorities‘ continued clampdown on bitcoin miners, with almost all of them looking for safe havens and abandoning operations in the country.

It appears that most miners are settling in their new environments (notably, Europe and North America) and may have been resuming their operations gradually.

Santiment Analysis Tweet. Source: Twitter

Only Four Wallets Hold 3.6% Of All Bitcoin Supply

Meanwhile, a crypto analytics firm, Santiment, has revealed that about 3.6% of the total bitcoin supply in the world is held in four wallets, with the least holding 100,000 BTC and the highest holding 1 million BTC.

Santiment also reveals that these wallets have been holding that amount of bitcoin now for over two years. Furthermore, BitInfoCharts (another reliable crypto analytics firm) shows that only 80 wallets hold 10,000 to 100,000 BTC, representing about 11% of the entire bitcoin supply globally.

Meanwhile, more than 750 crypto traders had contracted a multilingual litigation specialist (Aijia Lejniece) to sue exchange giants, Binance, over the loss of their crypto trading funds when the exchange froze their accounts without prior notice. This is the newest addition to legal woes facing the exchange.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.