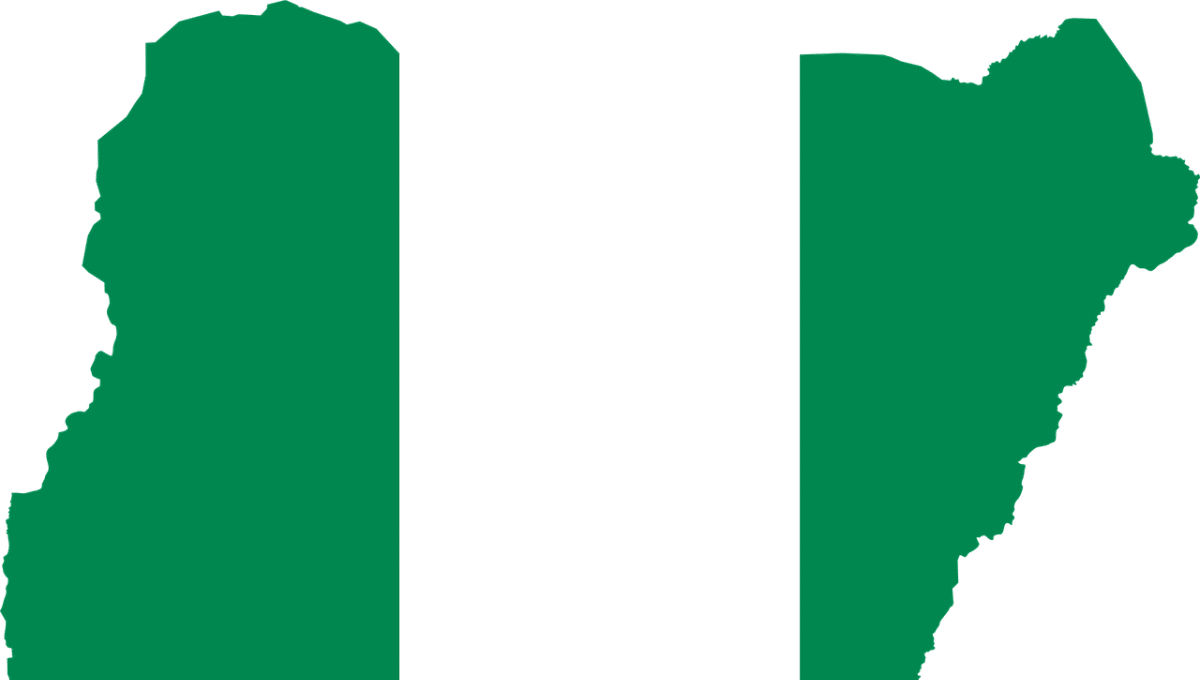

Nigeria’s central bank has revealed plans of creating its central bank digital currency, following the lead of many countries globally. According to the Apex bank, the digital currency will run on Hyperledger Fabric blockchain with preparations starting from October 1. The African country has surprised the crypto community with plans of creating a digital currency due to the government’s outlook on cryptocurrency.

The Nigerian government had banned digital assets some months ago, preventing financial institutions from being involved in payment settlements associated with cryptocurrencies. Nigeria explained that the measure was necessary due to security reasons. Still, many Nigerians have evaded the ban by selling and purchasing digital assets through peer-to-peer. The country leads in the peer-to-peer trading volume in the region.

Nigeria Invests In Blockchain Research And Development

The most populous black nation has invested in researching the technology behind cryptocurrencies to help it launch its digital currency. After months of research, the government has revealed the date for the commencement of its blockchain-based currency and CBDC. Central Bank of Nigeria has chosen October 1 to launch the pilot of “GIANT.” The blockchain-based project has been in existence since three years ago, and it utilizes Hyperledger Fabric. Following plans to launch the pilot phase of the CBDC project, CBN’s Rakiya Mohammed explained that it would likely initiate a proof-of-consent before 2022.

Stakeholders of the Central Bank of Nigeria had a virtual event sometime this week to discuss the growing trends surrounding CBDC in numerous countries. The regulators assured that Nigeria will join in the creation of a Central Bank Digital Currency, especially with the rising number of countries researching and developing their digital currency. The representatives spoke on specific advantages the currency’s creation would bring to the country, citing the project’s use for cross-border trade support, financial inclusion and benefits to business entities within the region. Asides from advantages to private persons, CBD explained that the project could help with remittances and payment settlement, revenue collection other notable benefits to the economy.

Ghana Announces Creation Of CBDC

Nigeria is not the only African country with plans to launch a CBDC as Ghana had earlier revealed moves to create a Central digital currency. The country is one of the first nations to commence the creation of a digital currency in the continent. This could significantly influence other countries into making their virtual currency. Ghana assured that a central bank-created digital currency is much safer than cryptocurrencies. There is a trend pushing the creation of government-issued virtual currency. Regulators have associated many cybercrimes and other illicit acts with the anonymity of cryptocurrencies. This has made some regulators ban the decentralized financial system.

Despite Ghana’s outlook on digital assets, it has been more crypto-friendly than Nigeria. The two countries could pave the way for central bank-issued currencies in the continent if research and development goes as planned. China, being one of the first countries to initiate digital currency, has been the pacesetter. The Asian country has commenced numerous testing since the minting of its digital Yuan.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.